Capitalization Policy Example Form

What is the Capitalization Policy Example

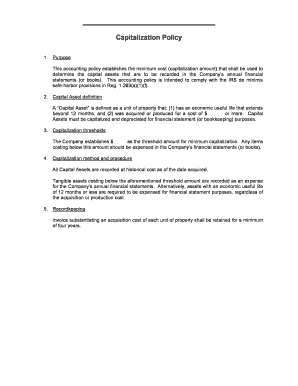

A capitalization policy example outlines the guidelines for recognizing and recording fixed assets on a company's balance sheet. This policy is crucial for ensuring that businesses accurately reflect their financial position and comply with accounting standards. The policy typically specifies the types of assets that should be capitalized, the minimum cost threshold for capitalization, and the useful life of these assets. By establishing clear criteria, organizations can maintain consistency in their financial reporting and asset management.

Key Elements of the Capitalization Policy Example

Several key elements are essential in a capitalization policy example. These include:

- Asset Classification: Defines which types of assets qualify for capitalization, such as property, plant, and equipment.

- Cost Threshold: Establishes the minimum amount that must be spent for an asset to be capitalized, ensuring that minor expenses are expensed rather than capitalized.

- Useful Life: Specifies the estimated lifespan of the asset, which is necessary for calculating depreciation.

- Depreciation Method: Outlines the method used for depreciating capitalized assets, such as straight-line or declining balance.

- Review Process: Details the procedures for reviewing and updating the policy to reflect changes in regulations or business practices.

Steps to Complete the Capitalization Policy Example

Completing a capitalization policy example involves several steps to ensure clarity and compliance. These steps include:

- Identify Assets: Determine which assets the policy will cover, focusing on fixed assets that have a significant impact on financial statements.

- Set Cost Thresholds: Establish clear cost thresholds for capitalization to avoid misclassification of expenses.

- Define Useful Lives: Assign useful lives to each asset category based on industry standards and historical data.

- Choose Depreciation Methods: Select appropriate depreciation methods that align with the organization's financial reporting goals.

- Document the Policy: Write the policy in clear, concise language and ensure it is accessible to relevant stakeholders.

Legal Use of the Capitalization Policy Example

The legal use of a capitalization policy example is vital for compliance with accounting standards and regulations. Organizations must adhere to generally accepted accounting principles (GAAP) and relevant tax laws to avoid penalties. A well-documented policy can serve as a defense during audits, demonstrating that the company follows established guidelines for asset capitalization. Additionally, maintaining compliance with regulations such as the Internal Revenue Code ensures that organizations do not face unexpected tax liabilities.

Examples of Using the Capitalization Policy Example

Examples of applying a capitalization policy example can be found across various industries. For instance:

- A manufacturing company may capitalize machinery purchases over a specific cost threshold, allowing them to spread the expense over the asset's useful life.

- A technology firm might capitalize software development costs once they reach a certain amount, reflecting the investment in long-term assets.

- A retail business could capitalize leasehold improvements made to its store locations, ensuring that these costs are properly accounted for in financial statements.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that influence how businesses should approach capitalization policies. According to IRS regulations, businesses must capitalize certain expenses related to fixed assets, such as improvements that enhance the value or extend the useful life of the asset. Understanding these guidelines is essential for tax compliance and for making informed decisions regarding asset management and reporting.

Quick guide on how to complete capitalization policy example

Prepare Capitalization Policy Example effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your files swiftly without delays. Manage Capitalization Policy Example on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Capitalization Policy Example with ease

- Locate Capitalization Policy Example and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Emphasize pertinent sections of your documents or redact sensitive data with special tools provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searches, or errors necessitating new document copies. airSlate SignNow simplifies your document management needs with just a few clicks from any device you prefer. Edit and eSign Capitalization Policy Example and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the capitalization policy example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a capitalization policy example?

A capitalization policy example is a guideline that businesses utilize to determine which expenditures are to be capitalized as assets. This helps organizations in tracking their fixed assets and ensuring accurate financial reporting. Understanding this example can streamline your accounting processes.

-

How does airSlate SignNow support creating a capitalization policy example?

With airSlate SignNow, businesses can create a capitalization policy example by easily managing and eSigning financial documents related to asset acquisition. The platform offers templates and workflows that can assist you in drafting a well-structured policy. This ensures compliance and enhances operational efficiency.

-

What features does airSlate SignNow offer for managing documents related to a capitalization policy example?

airSlate SignNow includes features like document templates, electronic signing, and real-time collaboration, which are essential for managing capitalization policy examples. These features simplify the process of obtaining necessary approvals and tracking changes in real-time. They ensure a smooth workflow for financial documentation.

-

Is airSlate SignNow affordable for businesses looking to implement a capitalization policy example?

Yes, airSlate SignNow provides a cost-effective solution for businesses seeking to implement a capitalization policy example. With various pricing plans, organizations can find an option that suits their budget while gaining access to powerful features. The platform offers excellent value for enhanced document management and eSigning.

-

Can airSlate SignNow integrate with other accounting software for a capitalization policy example?

AirSlate SignNow seamlessly integrates with various accounting and financial software solutions, facilitating the implementation of a capitalization policy example. This integration allows for better data management and workflow automation, ensuring that your financial documentation aligns with your accounting practices. Streamlining processes helps save time and reduce errors.

-

What benefits does airSlate SignNow provide for creating a capitalization policy example?

The key benefits of using airSlate SignNow for creating a capitalization policy example include ease of use, time-saving features, and enhanced collaboration. Businesses can quickly draft, review, and finalize policies while ensuring compliance with financial regulations. This efficiency can lead to improved accuracy in financial reporting.

-

How can I ensure compliance when using a capitalization policy example in airSlate SignNow?

To ensure compliance with a capitalization policy example when using airSlate SignNow, make use of its customizable templates and approval workflows. These features help enforce standards and maintain documentation integrity throughout the process. Regular audits and following best practices can further safeguard compliance.

Get more for Capitalization Policy Example

- The book thief worksheets pdf form

- List of creditors template form

- Fibromyalgia checklist pdf 45033799 form

- Special education parent survey form

- Wood destroying insect inspection report comcast net home comcast form

- Non disclosure software agreement template form

- Non disclosure when leaving a job agreement template form

- Non disclosure and confidentiality agreement template form

Find out other Capitalization Policy Example

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online