W 9 Withholding Form

What is the W-9 Withholding

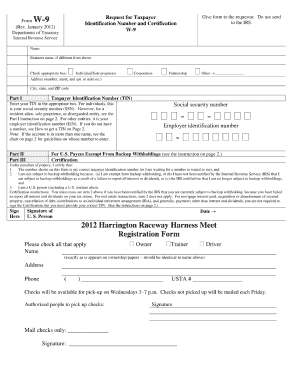

The W-9 withholding form is a tax document used in the United States by individuals and businesses to provide their taxpayer identification information to a requester. This form is essential for reporting income to the Internal Revenue Service (IRS). Typically, it is used by freelancers, contractors, and vendors who receive payments from businesses. The information collected on the W-9 includes the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

Steps to Complete the W-9 Withholding

Completing the W-9 withholding form involves several straightforward steps:

- Provide your name as it appears on your tax return.

- If applicable, enter your business name.

- Fill in your address, including street, city, state, and ZIP code.

- Indicate your taxpayer identification number (SSN or EIN).

- Sign and date the form to certify that the information provided is accurate.

Ensure that all information is correct to avoid any issues with tax reporting.

Legal Use of the W-9 Withholding

The W-9 withholding form serves a legal purpose by ensuring that the requester has the necessary taxpayer information to report payments to the IRS accurately. It is crucial for compliance with tax laws, as failure to provide a completed form may result in backup withholding, where the requester must withhold a percentage of payments for tax purposes. The form must be filled out truthfully, as providing false information can lead to penalties.

How to Obtain the W-9 Withholding

The W-9 withholding form can be easily obtained from the IRS website or through various tax preparation software. It is also commonly provided by businesses requesting the form from their contractors or vendors. To ensure you have the most current version, always refer to the IRS official site when downloading the form.

Examples of Using the W-9 Withholding

Common scenarios for using the W-9 withholding form include:

- A freelance graphic designer providing services to a corporation.

- A contractor performing home repairs for a homeowner.

- A consultant offering business advice to a firm.

In each case, the requester needs the W-9 to report payments made to the individual or business to the IRS.

Filing Deadlines / Important Dates

While the W-9 withholding form itself does not have a submission deadline, it is important to submit it promptly when requested. The requester typically needs the completed form before making payments to ensure compliance with IRS regulations. Additionally, businesses must file forms such as the 1099-MISC or 1099-NEC by specific deadlines, which depend on the type of payment and filing method.

Quick guide on how to complete w 9 withholding

Effortlessly Prepare W 9 Withholding on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a fantastic environmentally-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle W 9 Withholding on any device using the airSlate SignNow Android or iOS apps and improve any document-centric process today.

The Easiest Way to Edit and Electronically Sign W 9 Withholding with Ease

- Obtain W 9 Withholding and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign W 9 Withholding and ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 9 withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is W 9 Withholding?

W 9 Withholding refers to the IRS form that provides your taxpayer identification number to those who need to report income or other payments made to you. It's essential for ensuring the correct amount of withholding tax is applied. Properly completing this form can help you avoid issues with the IRS and maintain compliance.

-

How does airSlate SignNow support W 9 Withholding documentation?

airSlate SignNow offers a seamless platform for sending and eSigning W 9 Withholding forms. You can easily create, send, and manage these documents electronically, ensuring you have all necessary approvals and signatures in one place. This streamlines your tax documentation process and enhances compliance.

-

What are the pricing plans for using airSlate SignNow for W 9 Withholding?

airSlate SignNow offers flexible pricing plans designed to meet various business needs. These plans provide access to essential features for managing W 9 Withholding forms, such as unlimited document signing and cloud storage. You can choose a plan that fits your budget and usage requirements.

-

What features does airSlate SignNow provide for managing W 9 Withholding forms?

airSlate SignNow includes features like automated reminders, customizable templates, and secure eSignature options for W 9 Withholding forms. These tools help you streamline the process and ensure timely compliance with IRS regulations. Additionally, you can track document status and manage approvals easily.

-

Can I integrate airSlate SignNow with other software for W 9 Withholding processes?

Yes, airSlate SignNow offers integrations with popular software such as CRMs and accounting tools, making it easier to manage your W 9 Withholding processes. These integrations help you sync data and automate workflows, ensuring efficient handling of tax documentation. This enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for W 9 Withholding?

Using airSlate SignNow for W 9 Withholding offers numerous benefits, including improved accuracy, faster processing times, and enhanced compliance. The electronic nature of the platform reduces paperwork and minimizes the risk of errors. This leads to a more efficient workflow for your tax documentation.

-

Is it safe to use airSlate SignNow for sensitive W 9 Withholding information?

Absolutely! airSlate SignNow prioritizes the security of your sensitive W 9 Withholding information. The platform employs advanced encryption and compliance with industry standards to protect your data. You can trust that your tax-related documents are securely handled.

Get more for W 9 Withholding

- Institutional verification form

- Staffmasters application form

- Property repair estimate sheet pdf 463486561 form

- Wisewoman life style intervention reporting form scdhec

- Rita net profit tax return form

- Non exclusive music license agreement template form

- Non exclusive distribution agreement template form

- Music artist book contract template form

Find out other W 9 Withholding

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple