Printable Colorado Income Tax Form 104

What is the Printable Colorado Income Tax Form 104

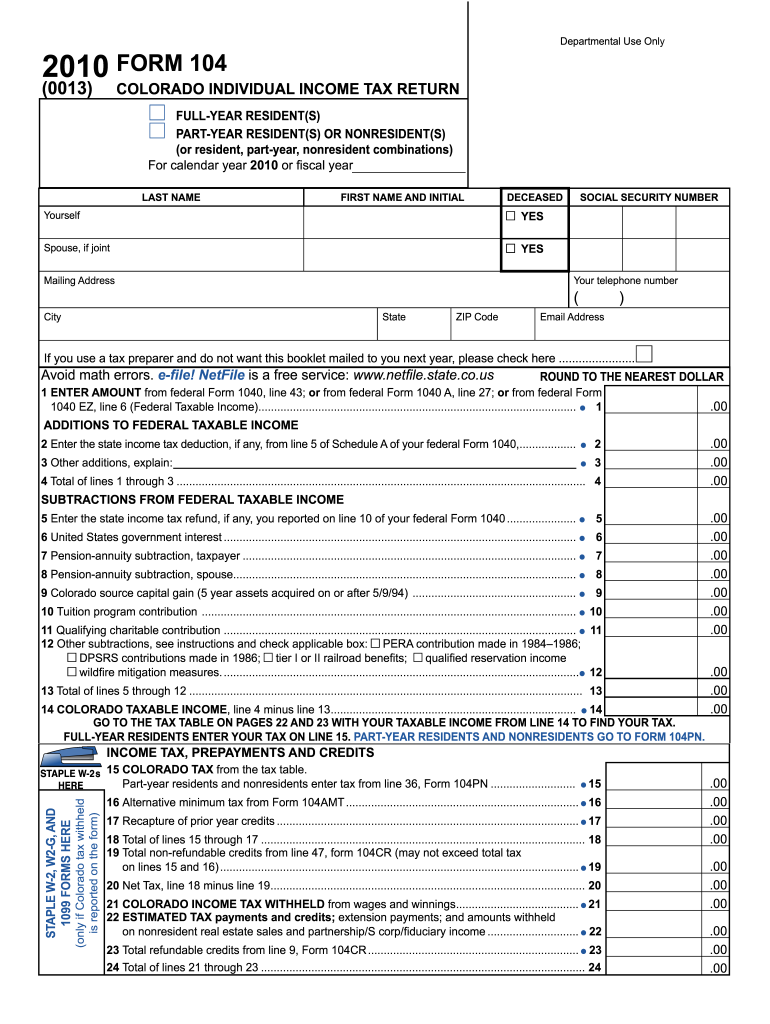

The Colorado Form 104 is the official income tax return form used by residents of Colorado to report their income and calculate their state tax liability. This form is essential for individuals and businesses operating within the state, as it ensures compliance with Colorado tax laws. The form includes various sections where taxpayers can detail their income, deductions, and credits, ultimately determining the amount of tax owed or the refund due. Understanding the purpose and structure of the Colorado Form 104 is crucial for accurate and timely tax filing.

How to Use the Printable Colorado Income Tax Form 104

Using the Colorado Form 104 involves several important steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions or credits. Next, download and print the form from a reliable source, ensuring it is the most current version. Carefully fill out each section, following the instructions provided on the form. It is advisable to double-check all entries for accuracy before submission. Once completed, you can file the form either electronically or by mail, depending on your preference.

Steps to Complete the Printable Colorado Income Tax Form 104

Completing the Colorado Form 104 requires a systematic approach to ensure all information is accurately reported. Begin by entering your personal information, including your name, address, and Social Security number. Next, report your total income, which includes wages, interest, dividends, and any other sources of income. After calculating your total income, proceed to itemize any deductions you may qualify for, such as medical expenses or mortgage interest. Finally, calculate your tax liability and any credits you may claim, leading to the final determination of your tax refund or amount owed.

Legal Use of the Printable Colorado Income Tax Form 104

The Colorado Form 104 is legally binding and must be filled out truthfully and accurately. Submitting false information can lead to penalties, including fines or legal repercussions. When using the form, it is important to comply with all relevant state tax laws and regulations. The form must be signed and dated, affirming that the information provided is correct to the best of your knowledge. Utilizing a reliable digital signing solution can enhance the security and legality of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Form 104 are critical to avoid penalties. Typically, the form must be submitted by April 15 of each year, aligning with federal tax deadlines. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure they file any necessary forms to request additional time. Staying informed about these dates helps ensure compliance and avoids unnecessary fees.

Form Submission Methods (Online / Mail / In-Person)

The Colorado Form 104 can be submitted through various methods, providing flexibility for taxpayers. Electronic filing is the most efficient option, allowing for quick processing and confirmation of receipt. Taxpayers can also choose to mail their completed forms to the appropriate state tax office. For those who prefer a personal touch, in-person submissions are accepted at designated tax offices. Each method has its own guidelines, so it is essential to follow the instructions specific to the chosen submission method.

Quick guide on how to complete printable colorado income tax form 104

Complete Printable Colorado Income Tax Form 104 effortlessly on any device

Managing documents online has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and store it securely online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents rapidly without delays. Handle Printable Colorado Income Tax Form 104 on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Printable Colorado Income Tax Form 104 without hassle

- Locate Printable Colorado Income Tax Form 104 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or conceal sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and electronically sign Printable Colorado Income Tax Form 104 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable colorado income tax form 104

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with colorado income tax documents?

airSlate SignNow is a user-friendly eSignature solution that streamlines the signing process for various documents, including those related to colorado income tax. By utilizing our platform, businesses can easily send, sign, and manage tax documents, ensuring compliance and reducing processing times.

-

How much does airSlate SignNow cost for handling colorado income tax forms?

AirSlate SignNow offers flexible pricing plans that are budget-friendly for businesses managing colorado income tax forms. Depending on your needs, you can choose from monthly or annual subscriptions, with options that include various features and integrations to enhance your workflow.

-

What features does airSlate SignNow provide for colorado income tax-related tasks?

AirSlate SignNow provides a robust set of features tailored to manage colorado income tax-related tasks effectively. Key features include templates for common tax forms, real-time tracking, and automatic reminders, making it easier to keep up with deadlines and ensure all documents are signed promptly.

-

Can airSlate SignNow integrate with accounting software for colorado income tax purposes?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to simplify the management of your colorado income tax needs. This integration allows for easy document sharing and can signNowly reduce data entry errors, enhancing overall efficiency in your tax preparations.

-

Is airSlate SignNow secure for signing colorado income tax documentation?

Absolutely! AirSlate SignNow takes security seriously, employing industry-standard encryption and authentication measures to protect your colorado income tax documentation. Business users can rest assured that their sensitive tax information is safe throughout the signing process.

-

How does airSlate SignNow improve the efficiency of handling colorado income tax filings?

AirSlate SignNow signNowly enhances the efficiency of handling colorado income tax filings by providing a streamlined digital workflow. Users can quickly prepare, send, and sign documents online, reducing the time and hassle traditionally associated with paper forms.

-

What are the advantages of using airSlate SignNow for businesses dealing with colorado income tax?

Using airSlate SignNow offers several advantages for businesses dealing with colorado income tax, such as increased speed and accuracy in document management. Additionally, it allows for easy collaboration and tracking, ensuring that all parties are aligned and reducing the likelihood of missed deadlines.

Get more for Printable Colorado Income Tax Form 104

Find out other Printable Colorado Income Tax Form 104

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document