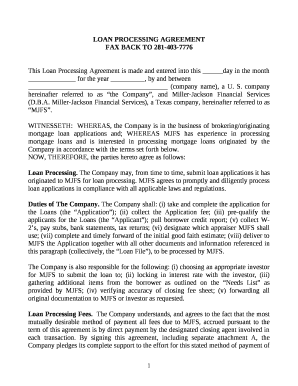

LOAN PROCESSING AGREEMENT Form

What is the contract of loan?

A contract of loan is a legally binding agreement between a lender and a borrower. It outlines the terms under which the borrower receives a specific amount of money from the lender, which must be repaid over a defined period. This agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Understanding the components of this contract is essential for both parties to ensure clarity and compliance with legal standards.

Key elements of the contract of loan

Several key elements must be included in a contract of loan to ensure its validity and enforceability. These elements include:

- Loan Amount: The total sum of money being loaned.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: The schedule outlining when payments are due and the duration of the loan.

- Collateral: Any assets pledged by the borrower to secure the loan, if applicable.

- Default Terms: Conditions under which the lender can take action if the borrower fails to repay.

Steps to complete the contract of loan

Completing a contract of loan involves several important steps to ensure that both parties are protected and that the agreement is legally binding. Here are the steps to follow:

- Gather necessary information, including personal details of both parties and financial information.

- Draft the contract, ensuring all key elements are included and clearly stated.

- Review the contract for accuracy and completeness, making any necessary adjustments.

- Both parties should sign the contract, ideally in the presence of a witness or notary.

- Store the signed contract securely, ensuring both parties have access to a copy.

Legal use of the contract of loan

The legal use of a contract of loan is governed by state and federal laws, which outline the rights and responsibilities of both the lender and borrower. It is essential to comply with these laws to ensure the contract is enforceable in a court of law. Key legal considerations include:

- Adherence to interest rate limits set by state law.

- Compliance with disclosure requirements regarding loan terms.

- Understanding the implications of default and the legal recourse available to lenders.

How to obtain the contract of loan

Obtaining a contract of loan can be done through various channels. Borrowers can find templates online or consult legal professionals to draft a customized agreement. It is important to ensure that any template used complies with relevant laws and includes all necessary elements. Additionally, financial institutions often provide their own loan agreements, which can be utilized when borrowing from them.

Examples of using the contract of loan

Contracts of loan are commonly used in various scenarios, including:

- Personal loans between friends or family members.

- Business loans for startup capital or operational expenses.

- Mortgages for purchasing real estate.

- Student loans for financing education.

Each example highlights the importance of having a clear and enforceable contract to protect the interests of both parties involved.

Quick guide on how to complete loan processing agreement

Effortlessly prepare LOAN PROCESSING AGREEMENT on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle LOAN PROCESSING AGREEMENT on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign LOAN PROCESSING AGREEMENT with ease

- Locate LOAN PROCESSING AGREEMENT and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign LOAN PROCESSING AGREEMENT and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan processing agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a contract of loan?

A contract of loan is a legal agreement between a lender and a borrower, detailing the terms of the loan. This document outlines the amount borrowed, interest rates, repayment schedule, and any collateral involved. It's essential for protecting the interests of both parties.

-

How can airSlate SignNow help with a contract of loan?

airSlate SignNow provides a streamlined solution for creating, signing, and managing a contract of loan. With its user-friendly interface, you can quickly generate templates that include all necessary details. This makes it easy to execute and track loan agreements efficiently.

-

What features does airSlate SignNow offer for managing contracts of loan?

airSlate SignNow offers features such as customizable templates, electronic signatures, and automated reminders for payments related to contracts of loan. You can also integrate it with other software to enhance its functionality and keep all documents organized.

-

Is airSlate SignNow secure for handling contracts of loan?

Yes, airSlate SignNow prioritizes security and employs advanced encryption and authentication methods. Your contract of loan and any related sensitive information will be protected, ensuring that both parties can sign and manage documents with peace of mind.

-

What are the pricing plans for using airSlate SignNow for contracts of loan?

airSlate SignNow offers flexible pricing plans to suit different business needs, including options for individuals and enterprises. By choosing a plan, you can access various features for managing contracts of loan at a cost-effective rate. Review the pricing page for specific details.

-

Can I integrate airSlate SignNow with other applications for contracts of loan?

Absolutely! airSlate SignNow supports integration with numerous applications, allowing you to seamlessly manage your contracts of loan alongside other tools. This integration helps streamline your workflow and ensure that all related tasks are completed efficiently.

-

What are the benefits of using airSlate SignNow for contracts of loan?

Using airSlate SignNow for contracts of loan provides numerous benefits, including faster processing times and reduced paperwork. Electronic signatures expedite the approval process, while templates save time in document creation. Overall, this results in enhanced efficiency for your loan management.

Get more for LOAN PROCESSING AGREEMENT

- Https lifetime formstack com forms sponsoringmemberform

- Sasseta forms la01

- Philippines visa application form

- Stalking no contact order motion to extendmodify illinois legal illinoislegaladvocate form

- Street capital standard gift letter form

- Maryland capitol police id request form

- My culture project form

- Patient financial agreement template 787745539 form

Find out other LOAN PROCESSING AGREEMENT

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement