American Funds Rollover Form

What is the American Funds Rollover Form

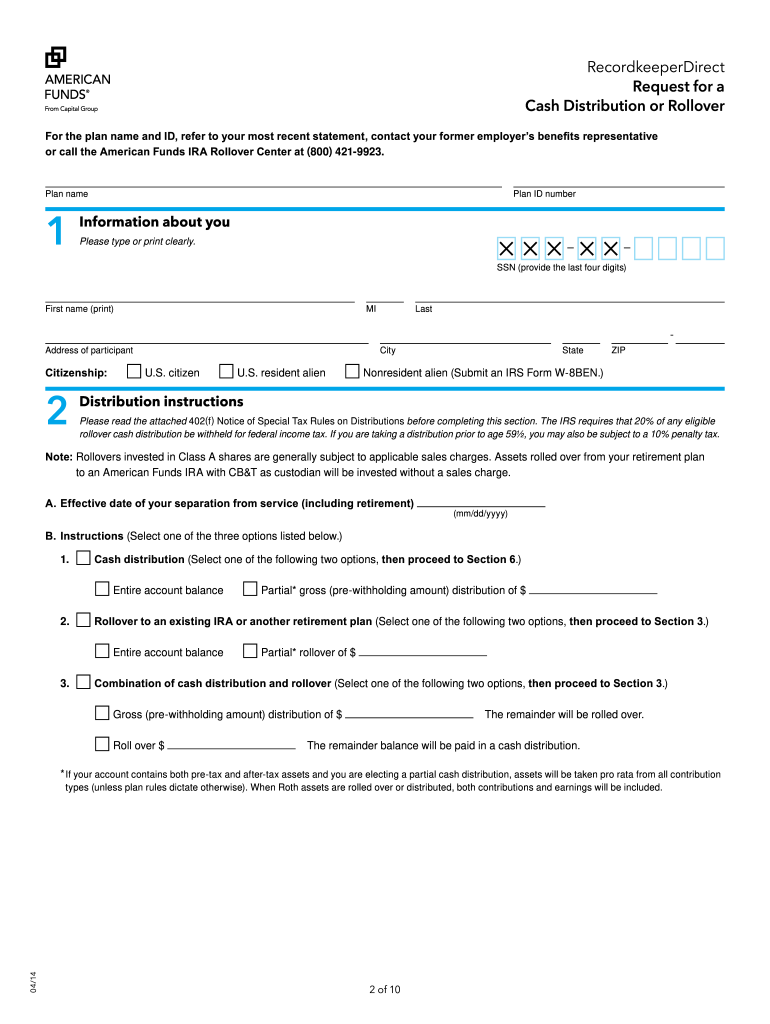

The American Funds 401k rollover form is a crucial document for individuals looking to transfer their retirement savings from a 401k plan into an Individual Retirement Account (IRA) or another qualified retirement plan. This form facilitates the movement of funds, ensuring that the rollover is executed in compliance with IRS regulations. Utilizing this form helps prevent tax penalties that may arise from improper handling of retirement funds.

How to use the American Funds Rollover Form

To effectively use the American Funds 401k rollover form, individuals should first gather all necessary information regarding their current 401k plan and the new retirement account. This includes account numbers, contact details for both financial institutions, and any specific instructions related to the transfer. After completing the form, it should be submitted according to the specified methods, ensuring that all sections are filled out accurately to avoid delays.

Steps to complete the American Funds Rollover Form

Completing the American Funds 401k rollover form involves several key steps:

- Obtain the form from the American Funds website or your financial advisor.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your current 401k plan, including the plan name and account number.

- Indicate the type of rollover you are performing, whether it's a direct or indirect rollover.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, either online, by mail, or in person.

Legal use of the American Funds Rollover Form

The American Funds 401k rollover form is legally binding, provided it meets specific criteria established by the IRS. This includes ensuring that the rollover is executed within the designated time frame and that the funds are transferred directly to prevent tax implications. Utilizing electronic signatures through a compliant platform can also enhance the legal validity of the document.

Required Documents

When filling out the American Funds 401k rollover form, certain documents may be required to facilitate the process. These typically include:

- Your current 401k plan statement.

- Identification documents, such as a driver's license or Social Security card.

- Any additional forms required by the receiving financial institution.

Form Submission Methods

The American Funds 401k rollover form can be submitted through various methods, depending on the preferences of the individual and the requirements of the financial institutions involved. Common submission methods include:

- Online submission through the American Funds website.

- Mailing the completed form to the designated address.

- Delivering the form in person to a local office.

Eligibility Criteria

To utilize the American Funds 401k rollover form, individuals must meet certain eligibility criteria. Generally, this includes being a participant in a qualified 401k plan and having reached a point where they can initiate a rollover, such as upon leaving an employer or reaching retirement age. Additionally, the receiving account must be an eligible retirement plan, such as an IRA or another 401k plan.

Quick guide on how to complete american funds rollover form

Complete American Funds Rollover Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents promptly without interruptions. Manage American Funds Rollover Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign American Funds Rollover Form seamlessly

- Find American Funds Rollover Form and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Decide how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues related to lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign American Funds Rollover Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the american funds rollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an American funds withdrawal request, and how do I create one?

An American funds withdrawal request is a formal process to withdraw funds from your American funds account. You can create one by logging into your account and accessing the withdrawal section, where you can fill out the necessary forms. Using airSlate SignNow, you can eSign your request quickly and ensure it complies with all requirements.

-

How does airSlate SignNow streamline the American funds withdrawal request process?

airSlate SignNow simplifies the American funds withdrawal request process by allowing users to send documents electronically and eSign them in real-time. This eliminates the need for printing, scanning, or mailing, signNowly speeding up the process. Additionally, our platform ensures all documents are securely stored and easy to access.

-

Are there any costs associated with submitting an American funds withdrawal request through airSlate SignNow?

While submitting an American funds withdrawal request through airSlate SignNow may involve fees from your financial institution, our eSignature service operates on a cost-effective subscription model. This means you can efficiently manage and submit multiple documents at a lower overall cost. Always check your specific account terms for potential fees.

-

What features does airSlate SignNow offer for managing American funds withdrawal requests?

airSlate SignNow offers several features that support managing American funds withdrawal requests, including customizable templates, secure eSigning, and document tracking. These features ensure that you have everything you need to complete your requests efficiently. You can also set reminders for important deadlines to stay organized.

-

Can I integrate other software with airSlate SignNow for my American funds withdrawal request?

Yes, airSlate SignNow can be integrated with various software solutions to enhance your American funds withdrawal request process. You can connect it with CRM systems, cloud storage services, and other applications to streamline workflows. This integration helps in maintaining all your documents in one place, making it easier to access and manage.

-

Is airSlate SignNow secure for processing American funds withdrawal requests?

Absolutely! airSlate SignNow employs advanced security measures, including data encryption and secure access protocols, to protect your American funds withdrawal request documents. Your sensitive information is safe during transmission and storage, ensuring that only authorized individuals can access it. Our compliance with industry standards further enhances your confidence in our platform.

-

What benefits can I expect when using airSlate SignNow for American funds withdrawal requests?

Using airSlate SignNow for your American funds withdrawal requests provides numerous benefits, including time savings, enhanced convenience, and reduced paperwork. The platform allows you to eSign and send documents from anywhere, streamlining your workflow and improving efficiency. Additionally, you'll enjoy easy tracking of your requests and access to historical records.

Get more for American Funds Rollover Form

Find out other American Funds Rollover Form

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now