State of Michigan Forms 2796

What is the State of Michigan Forms 2796

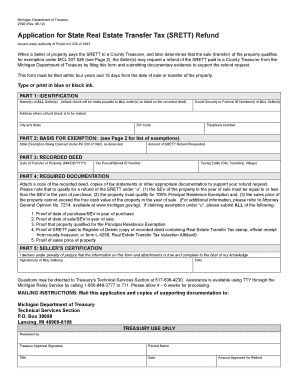

The State of Michigan Forms 2796 is a specific document utilized for various legal and administrative purposes within the state. This form is essential for individuals and businesses to comply with state regulations. It may serve different functions depending on the context, such as tax reporting, legal declarations, or administrative requests. Understanding the purpose of this form is crucial for ensuring proper completion and submission.

How to use the State of Michigan Forms 2796

Using the State of Michigan Forms 2796 involves several steps to ensure accuracy and compliance. First, determine the specific purpose of the form in your situation. Next, gather all necessary information and documentation required to complete the form. It is important to read any accompanying instructions carefully to avoid errors. Once filled out, the form can be submitted electronically or by mail, depending on the guidelines provided for that specific form.

Steps to complete the State of Michigan Forms 2796

Completing the State of Michigan Forms 2796 requires a systematic approach. Follow these steps for effective completion:

- Identify the correct version of the form needed for your specific situation.

- Collect all relevant information, including personal details, financial data, or legal references.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Review the form for any errors or omissions before finalizing it.

- Submit the form according to the specified submission methods, ensuring it meets any deadlines.

Legal use of the State of Michigan Forms 2796

The legal use of the State of Michigan Forms 2796 is governed by specific regulations and requirements. For the form to be considered valid, it must be completed accurately and submitted in accordance with state laws. Compliance with eSignature laws is also essential when submitting the form electronically. Utilizing a reliable eSignature platform ensures that the form is legally binding and meets all necessary legal standards.

Key elements of the State of Michigan Forms 2796

Key elements of the State of Michigan Forms 2796 include the following:

- Identification of the form's purpose and the specific instructions associated with it.

- Accurate completion of all required fields, including signatures where necessary.

- Adherence to submission guidelines, which may include deadlines and acceptable methods of delivery.

- Understanding any legal implications or requirements related to the information provided.

Form Submission Methods

The State of Michigan Forms 2796 can be submitted through various methods, depending on the specific requirements outlined for the form. Common submission methods include:

- Online submission through designated state portals that support electronic filing.

- Mailing the completed form to the appropriate state office or agency.

- In-person submission at designated locations, if applicable.

Quick guide on how to complete state of michigan forms 2796

Complete State Of Michigan Forms 2796 effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage State Of Michigan Forms 2796 on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign State Of Michigan Forms 2796 effortlessly

- Find State Of Michigan Forms 2796 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs within a few clicks from your chosen device. Edit and eSign State Of Michigan Forms 2796 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of michigan forms 2796

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2796 in Michigan used for?

The Form 2796 in Michigan is used for reporting the use of tax-exempt purchases specifically related to certain types of goods and services. Understanding this form is crucial for businesses to comply with state tax regulations and avoid potential penalties. Using airSlate SignNow can streamline the process of managing and eSigning documents related to Form 2796 Michigan.

-

How can airSlate SignNow help with Form 2796 in Michigan?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning Form 2796 Michigan. This easy-to-use solution not only saves time but also enhances compliance by ensuring that all necessary signatures are collected digitally and securely. The platform's features simplify the overall handling of important tax documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, there's a plan tailored for sending and signing Form 2796 Michigan and other essential documents. You can start with a free trial to explore the features before committing to a subscription.

-

Is airSlate SignNow secure for handling Form 2796 Michigan?

Yes, airSlate SignNow ensures robust security protocols for handling confidential documents like Form 2796 Michigan. The platform employs advanced encryption and secure access controls to protect your data throughout the eSigning process. This commitment to security helps businesses maintain compliance and safeguard sensitive information.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow allows for seamless integrations with various applications to facilitate your workflow. By connecting it with your existing tools, you can efficiently manage all documents, including Form 2796 Michigan, and enhance collaboration across your organization.

-

What are the benefits of using airSlate SignNow for Form 2796 Michigan?

Using airSlate SignNow to manage Form 2796 Michigan streamlines your documentation process, reduces manual errors, and saves time. The platform's automation features ensure that the signing process is quick and easy, allowing you to focus more on your business operations. Additionally, the storage and tracking capabilities enhance document management and visibility.

-

How can I start eSigning Form 2796 Michigan with airSlate SignNow?

Getting started with airSlate SignNow for eSigning Form 2796 Michigan is simple. First, you need to create an account and then upload your form to the platform. From there, you can easily add recipients and send the document out for eSignature, making the process quick and efficient.

Get more for State Of Michigan Forms 2796

Find out other State Of Michigan Forms 2796

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template