Michigan Form 3862

What is the Michigan Form 5080?

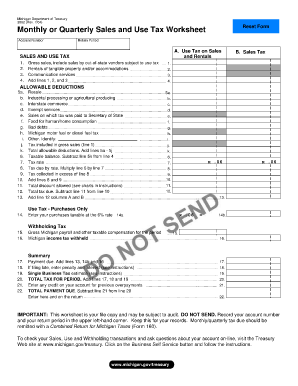

The Michigan Form 5080, also known as the Monthly Sales and Use Tax Worksheet, is a crucial document used by businesses operating in Michigan to report their sales and use tax obligations. This form is essential for businesses to accurately calculate the amount of tax owed to the state based on their sales activities. It is primarily used by retailers and service providers to ensure compliance with Michigan state tax laws.

How to use the Michigan Form 5080

To effectively use the Michigan Form 5080, businesses must gather all relevant sales data for the reporting period. This includes total sales, taxable sales, and any exemptions that may apply. The form requires detailed entries, including the calculation of the total sales tax due. Businesses should ensure they understand the specific categories of sales and any applicable tax rates to complete the form accurately.

Steps to complete the Michigan Form 5080

Completing the Michigan Form 5080 involves several key steps:

- Gather sales records for the reporting period.

- Calculate total sales and identify taxable sales.

- Determine any sales tax exemptions applicable to your business.

- Fill out the form, ensuring all calculations are accurate.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline.

Legal use of the Michigan Form 5080

The legal use of the Michigan Form 5080 is governed by state tax regulations. To be considered valid, the form must be completed accurately and submitted on time. Failure to comply with submission deadlines or to report sales accurately can result in penalties. It is essential for businesses to maintain records that support the information reported on the form to ensure compliance with Michigan tax laws.

Filing Deadlines / Important Dates

Businesses must adhere to specific deadlines when submitting the Michigan Form 5080. The form is typically due on the 20th of each month for the previous month's sales. It is important to stay informed about any changes to filing deadlines, as late submissions can incur penalties and interest on unpaid taxes. Keeping a calendar of important dates can help businesses manage their tax obligations effectively.

Form Submission Methods

The Michigan Form 5080 can be submitted through various methods to accommodate different business needs. Options include:

- Online submission through the Michigan Department of Treasury's eServices portal.

- Mailing a paper copy of the completed form to the appropriate state office.

- In-person submission at designated state tax offices.

Choosing the right submission method can streamline the filing process and ensure timely compliance.

Quick guide on how to complete michigan form 3862

Effortlessly Prepare Michigan Form 3862 on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without any hold-ups. Manage Michigan Form 3862 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Michigan Form 3862 with Ease

- Locate Michigan Form 3862 and select Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with specialized tools provided by airSlate SignNow.

- Generate your eSignature using the Sign feature, which requires just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or save it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document versions. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Michigan Form 3862 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan form 3862

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the michigan form 5080 and how is it used?

The michigan form 5080 is an application form used by Michigan taxpayers to claim a specific tax exemption. It is essential for businesses to understand how this form works in order to accurately file their taxes. Using airSlate SignNow, you can easily complete and eSign the michigan form 5080, simplifying your tax filing process.

-

How can airSlate SignNow help with the michigan form 5080?

airSlate SignNow provides a user-friendly platform to eSign and send the michigan form 5080 digitally. This streamlines the process, reducing the need for paper documents and in-person signatures. By using our solution, you can ensure that your forms are securely signed and submitted in a timely manner.

-

Is there a cost associated with using airSlate SignNow for the michigan form 5080?

Yes, there is a pricing structure for using airSlate SignNow, but it remains cost-effective for businesses. We offer various plans to cater to different needs, allowing you to choose the best option for managing documents like the michigan form 5080. It’s an investment that simplifies document management and can save you time and money in the long run.

-

What features does airSlate SignNow offer for managing the michigan form 5080?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders for important deadlines. These features are particularly useful for managing documents like the michigan form 5080. Additionally, you can store and access your signed documents securely from anywhere.

-

Can I integrate airSlate SignNow with other applications for handling the michigan form 5080?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications including CRM systems and cloud storage solutions. This allows you to manage the michigan form 5080 and other documents more efficiently. By integrating with your existing tools, you can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the michigan form 5080?

Using airSlate SignNow for the michigan form 5080 provides several benefits including enhanced security, convenience of eSigning, and time savings. The platform simplifies the signing process and helps ensure compliance with state regulations. These advantages contribute to a more efficient and less stressful tax filing experience.

-

How secure is the airSlate SignNow platform when dealing with the michigan form 5080?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and stringent access controls to protect your documents, including the michigan form 5080. You can trust that your sensitive information is safe while using our services.

Get more for Michigan Form 3862

- Social anxiety disorder guide test symptoms causes amp treatment form

- How to fill out an application for statement of ownership form

- Tom sawyer multiple choice questions by chapter pdf form

- Immunization record form immunization record form isp hcdsb

- 200910 patient restraint competency check off nurses mc vanderbilt form

- Ctec renewal fillable form

- Tab b 8 change order addendum incomplete construction form

- Pa schedule d sale exchange or disposition of property within pennsylvania pa 20spa 65 d form

Find out other Michigan Form 3862

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT