Payroll Report Sample Form

What is the Payroll Report Sample

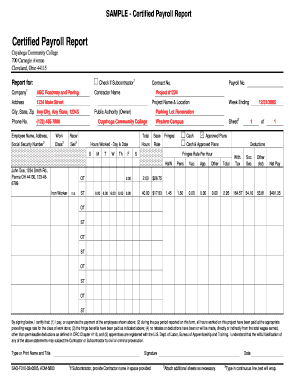

A payroll report sample is a structured document that outlines the earnings, deductions, and net pay for employees over a specific period. This report is essential for businesses to maintain accurate records of employee compensation and ensure compliance with federal and state regulations. It typically includes details such as employee names, hours worked, pay rates, and any applicable taxes or benefits. By using a payroll report template, organizations can streamline their payroll processes and reduce the likelihood of errors.

How to Use the Payroll Report Sample

To effectively use a payroll report sample, begin by gathering all necessary employee data, including hours worked and pay rates. Next, input this information into the template, ensuring that each section is filled out accurately. It is important to double-check calculations for gross pay, deductions, and net pay to maintain accuracy. Once completed, the payroll report can be distributed to employees for their records and used for internal audits or compliance checks. Utilizing a digital solution can enhance this process by allowing for easy updates and secure storage.

Steps to Complete the Payroll Report Sample

Completing a payroll report sample involves several key steps:

- Collect employee information, including names, identification numbers, and pay rates.

- Track hours worked for each employee during the pay period.

- Calculate gross pay by multiplying hours worked by the pay rate.

- Determine deductions, such as federal and state taxes, Social Security, and benefits.

- Calculate net pay by subtracting total deductions from gross pay.

- Review the completed payroll report for accuracy and compliance with legal requirements.

- Distribute the report to employees and retain a copy for company records.

Key Elements of the Payroll Report Sample

Essential elements of a payroll report sample include:

- Employee Information: Names, identification numbers, and job titles.

- Pay Period: Start and end dates of the payroll cycle.

- Hours Worked: Total hours each employee worked during the pay period.

- Gross Pay: Total earnings before deductions.

- Deductions: Itemized list of all deductions, including taxes and benefits.

- Net Pay: Final amount each employee receives after deductions.

Legal Use of the Payroll Report Sample

The legal use of a payroll report sample is crucial for compliance with federal and state labor laws. Employers are required to maintain accurate payroll records to ensure proper tax reporting and employee compensation. The payroll report serves as a legal document that can be referenced in case of disputes or audits. To ensure its legal validity, it is essential to adhere to regulations set forth by the IRS and relevant state agencies, including maintaining confidentiality and security of employee information.

Examples of Using the Payroll Report Sample

Payroll report samples can be utilized in various scenarios, including:

- Monthly payroll processing to ensure timely employee payments.

- Year-end reporting for tax purposes, summarizing total earnings and deductions.

- Internal audits to verify compliance with payroll regulations.

- Providing documentation for employee benefits enrollment or changes.

Quick guide on how to complete payroll report sample

Complete Payroll Report Sample effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Payroll Report Sample on any platform with airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and eSign Payroll Report Sample with ease

- Find Payroll Report Sample and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Payroll Report Sample and ensure effective communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll report sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll report template?

A payroll report template is a standardized document that helps businesses efficiently track and manage employee payroll information. It typically includes sections for employee details, hours worked, wages, taxes, and deductions. Using a payroll report template can streamline your payroll process, ensuring accuracy and compliance.

-

How can airSlate SignNow help with payroll report templates?

airSlate SignNow provides a user-friendly platform that allows businesses to create, customize, and eSign payroll report templates easily. With this solution, you can automate the workflow, enabling quicker processing and approvals. This saves time and reduces errors in payroll management.

-

Is there a cost associated with using airSlate SignNow for payroll report templates?

Yes, airSlate SignNow offers different pricing plans depending on the features you need, including the efficient management of payroll report templates. The platform is cost-effective, providing a variety of tools that can fit within most budgets. You can choose a plan that best meets your business requirements.

-

What features are included in the payroll report template with airSlate SignNow?

airSlate SignNow's payroll report template includes features such as customizable fields, electronic signature capabilities, and workflow automation. These tools ensure that your payroll processes are streamlined and that documents are securely signed and stored. Additionally, you can easily share templates with your team for collaboration.

-

Can I integrate payroll report templates with other software?

Absolutely! airSlate SignNow allows for seamless integrations with various HR and accounting software, making it easier to manage your payroll report templates. This integration ensures all your systems are connected, providing real-time data access and enhancing overall efficiency in payroll processing.

-

What are the benefits of using a payroll report template?

Using a payroll report template simplifies the payroll process by providing a consistent format for tracking employee earnings and deductions. It reduces the risk of errors and ensures compliance with tax regulations. Additionally, having a payroll report template enhances transparency and makes reporting more straightforward for audits.

-

How can I customize my payroll report template in airSlate SignNow?

With airSlate SignNow, you can easily customize your payroll report template by adding or removing fields and choosing the layout that best fits your business needs. This flexibility allows you to tailor the template for different employee classifications or reporting requirements. Customization enhances the usability of the payroll report template.

Get more for Payroll Report Sample

- Fillable defendant answer eviction form

- Clinical info form nassau county police department police co nassau ny

- Learn english kids form

- Sr04 form

- Best undertaking application status form

- Residence remittance basis etc use the sa109 supplementary pages to declare your residence and domicile status and claim form

- Ssa 222 security awareness form pdf

- Rev 1605 form

Find out other Payroll Report Sample

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT