Rev 1605 Form

What is the Rev 1605

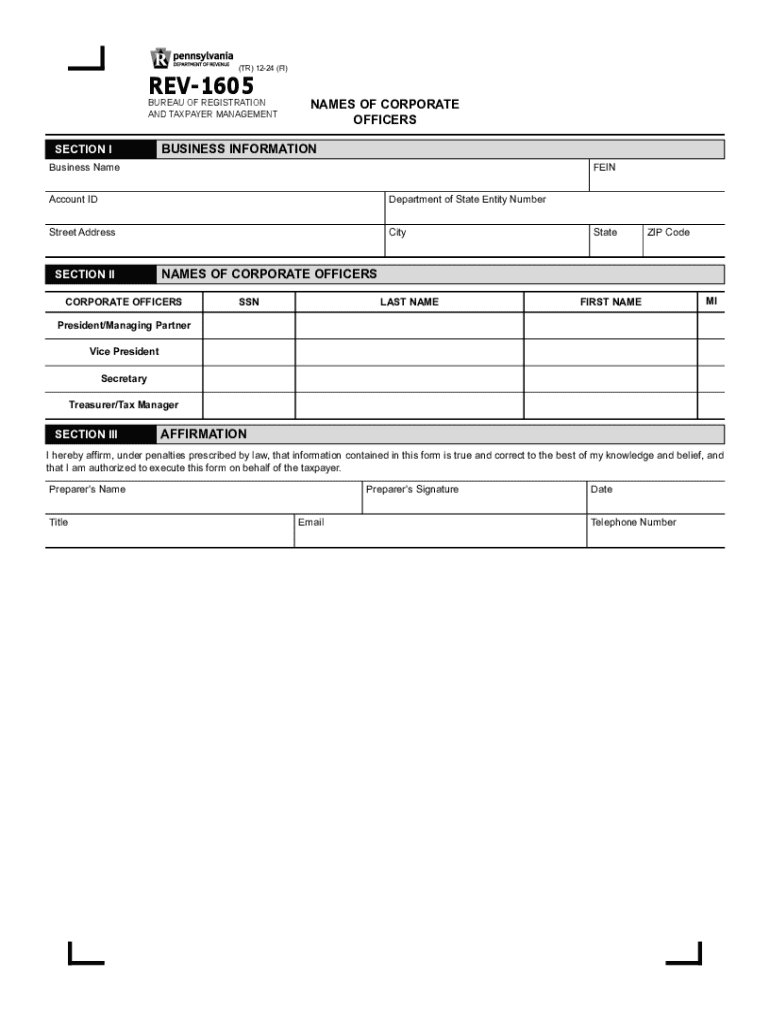

The Rev 1605 form, also known as the Pennsylvania Corporate Officers form, is a document used by businesses in Pennsylvania to report the names and addresses of their corporate officers. This form is essential for maintaining accurate records with the Pennsylvania Department of State. It ensures that the state has up-to-date information regarding the individuals who are responsible for the management of the corporation.

How to use the Rev 1605

The Rev 1605 form is primarily used by corporations in Pennsylvania to disclose their corporate officers. To use this form effectively, businesses should gather the required information about each officer, including their full name, title, and business address. Once completed, the form must be submitted to the appropriate state agency to ensure compliance with state regulations.

Steps to complete the Rev 1605

Completing the Rev 1605 form involves several key steps:

- Gather information about all corporate officers, including names, titles, and addresses.

- Obtain the latest version of the Rev 1605 form from the Pennsylvania Department of State.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Pennsylvania Department of State either online or by mail.

Legal use of the Rev 1605

The Rev 1605 form is legally required for corporations operating in Pennsylvania. Filing this form helps maintain transparency and accountability within the corporate structure. Failure to file or inaccuracies in the information provided can lead to penalties or complications with corporate status.

Filing Deadlines / Important Dates

Corporations must file the Rev 1605 form annually, with specific deadlines that may vary based on the corporation's fiscal year. It is crucial for businesses to be aware of these dates to avoid penalties. Typically, the form should be submitted by the end of the month following the close of the corporation's fiscal year.

Required Documents

To complete the Rev 1605 form, businesses need to provide certain documents, including:

- Identification details of all corporate officers.

- Proof of the corporation's existence, such as the Articles of Incorporation.

- Any previous filings that may be relevant to the current submission.

Form Submission Methods (Online / Mail / In-Person)

The Rev 1605 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Pennsylvania Department of State's website.

- Mailing the completed form to the designated state office.

- In-person submission at local state offices, if preferred.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 1605

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rev 1605 form and how is it used?

The rev 1605 form is a document used for specific tax purposes, often related to the reporting of income or deductions. Businesses can utilize airSlate SignNow to easily send and eSign the rev 1605 form, ensuring compliance and accuracy in their submissions.

-

How can airSlate SignNow help with the rev 1605 form?

airSlate SignNow streamlines the process of completing and signing the rev 1605 form by providing an intuitive platform for document management. Users can quickly fill out the form, add signatures, and send it securely, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the rev 1605 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution allows users to manage the rev 1605 form and other documents without breaking the bank, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer for the rev 1605 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for the rev 1605 form. These tools enhance efficiency and ensure that all necessary steps are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other software for the rev 1605 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to seamlessly manage the rev 1605 form alongside their existing tools. This integration capability enhances workflow efficiency and data management.

-

What are the benefits of using airSlate SignNow for the rev 1605 form?

Using airSlate SignNow for the rev 1605 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are handled professionally and securely, giving you peace of mind.

-

Is airSlate SignNow user-friendly for completing the rev 1605 form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the rev 1605 form. The intuitive interface allows users to navigate the platform effortlessly, even if they have limited technical skills.

Get more for Rev 1605

Find out other Rev 1605

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now