Council Tax Fdean Gov Uk Form

Understanding the Council Tax Fdean Gov Uk

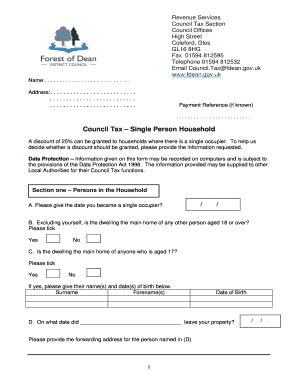

The Council Tax Fdean Gov Uk is a local taxation system that applies to residential properties in the Forest of Dean area. This tax is levied by local councils to fund various public services, including education, waste collection, and emergency services. Each property is assigned a band based on its estimated value, which determines the amount of tax owed. Understanding how this system works is crucial for residents to ensure compliance and to manage their financial obligations effectively.

Steps to Complete the Council Tax Fdean Gov Uk

Completing the Council Tax Fdean Gov Uk form involves several straightforward steps:

- Gather necessary information, including your property details and personal identification.

- Access the online form through the official council website or obtain a paper version if preferred.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for any errors before submission.

- Submit the form electronically or by mail, depending on your chosen method.

Legal Use of the Council Tax Fdean Gov Uk

The legal validity of the Council Tax Fdean Gov Uk form hinges on compliance with specific regulations. Electronic submissions must adhere to the ESIGN Act and UETA, ensuring that signatures are legally binding. It is essential to use a reliable eSignature solution that provides an electronic certificate, confirming the identity of the signer and the integrity of the document. This legal framework protects both the submitter and the council from potential disputes.

Key Elements of the Council Tax Fdean Gov Uk

Several key elements define the Council Tax Fdean Gov Uk:

- Property Banding: Properties are categorized into bands based on their market value, which influences the tax rate.

- Exemptions and Discounts: Certain categories of residents, such as students or those with disabilities, may qualify for discounts or exemptions.

- Payment Options: Residents can choose various payment methods, including monthly installments or a one-time payment.

- Appeals Process: If a resident disagrees with their property banding, there is a formal process to appeal the decision.

Who Issues the Form

The Council Tax Fdean Gov Uk form is issued by the local council, specifically the Forest of Dean District Council. This council is responsible for managing local taxation and ensuring that the funds collected are allocated appropriately to public services. Residents should contact the council for any queries regarding their council tax, including assessments, payments, and potential exemptions.

Penalties for Non-Compliance

Failure to comply with the Council Tax Fdean Gov Uk regulations can result in significant penalties. These may include:

- Additional charges added to the outstanding balance.

- Legal action taken by the council to recover unpaid taxes.

- Potential impact on credit ratings due to unresolved debts.

It is essential for residents to stay informed and ensure timely payments to avoid these consequences.

Quick guide on how to complete council tax fdean gov uk

Complete Council Tax Fdean Gov Uk effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed forms, as you can access the necessary template and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Council Tax Fdean Gov Uk on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Council Tax Fdean Gov Uk effortlessly

- Find Council Tax Fdean Gov Uk and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Council Tax Fdean Gov Uk and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the council tax fdean gov uk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is council tax fdean gov uk?

Council tax fdean gov uk refers to the local tax system applicable in the Forest of Dean district in the UK. It is used to fund local services and is based on the value of your property. To understand your obligations or find specific information, visit the official council tax fdean gov uk website.

-

How can I pay my council tax fdean gov uk?

You can pay your council tax fdean gov uk through various methods including online payments, direct debit, and in-person transactions at designated locations. It’s highly convenient to manage payments online, ensuring timely submission without hassle. For the most accurate payment options, check the council tax fdean gov uk site.

-

What are the discounts available for council tax fdean gov uk?

The council tax fdean gov uk offers various discounts depending on your circumstances. For instance, single occupants can receive a 25% discount, and there are exemptions for certain groups like students and disabled individuals. Detailed eligibility criteria can be found on the council tax fdean gov uk website.

-

What happens if I don't pay my council tax fdean gov uk?

Failing to pay your council tax fdean gov uk can lead to serious consequences, including fines, legal action, or a court summons. The council typically sends reminders before escalating matters, so it’s crucial to communicate any issues with payment as early as possible. For guidance on how to manage payments, refer to the council tax fdean gov uk resources.

-

Can I appeal my council tax band on council tax fdean gov uk?

Yes, you can appeal your council tax band through council tax fdean gov uk if you believe it's assessed incorrectly. This process involves contacting the Valuation Office Agency to review your property’s banding. Be prepared to provide supporting evidence for your claim.

-

What benefits does eSigning with airSlate SignNow offer for handling council tax fdean gov uk documents?

Using airSlate SignNow for eSigning council tax fdean gov uk documents enhances efficiency and security. It allows you to sign and send documentation securely from any device, reducing paper usage and saving time. This digital solution makes managing your council tax documents more streamlined.

-

Are there integration options for airSlate SignNow with council tax fdean gov uk processes?

Absolutely! airSlate SignNow integrations can facilitate smoother workflows with council tax fdean gov uk processes. Whether you need to integrate with accounting software or management systems, our platform ensures simplicity in bridging various applications for effective document management.

Get more for Council Tax Fdean Gov Uk

Find out other Council Tax Fdean Gov Uk

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement