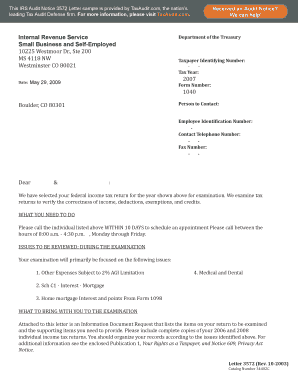

Irs Audit Letter Example 2003

What is the IRS audit letter example?

The IRS audit letter serves as a formal notification from the Internal Revenue Service indicating that an individual or business's tax return is being reviewed or audited. This letter outlines the specific areas of concern that the IRS intends to investigate. Typically, the letter includes instructions on how to respond, what documents may be required, and the timeline for providing this information. Understanding the contents of an IRS audit letter example can help taxpayers prepare adequately and ensure compliance with the IRS's requests.

How to use the IRS audit letter example

Utilizing the IRS audit letter example involves several steps to ensure an effective response. First, read the letter carefully to understand the specific issues raised by the IRS. Next, gather all relevant documentation that supports your tax return, such as receipts, bank statements, and previous correspondence with the IRS. It is also advisable to consult a tax professional for guidance on how to address the concerns raised in the letter. Once you have compiled the necessary information, you can respond to the IRS with a well-organized package that addresses each point mentioned in the audit letter.

Key elements of the IRS audit letter example

An IRS audit letter typically includes several key elements that are crucial for taxpayers to understand. These elements may include:

- The audit type, which could be a correspondence audit or a field audit.

- The specific tax years under review.

- A list of documents or information requested by the IRS.

- The deadline for submitting the requested information.

- Contact information for the IRS agent handling the case.

Familiarity with these components can facilitate a smoother audit process and help ensure that all necessary information is provided in a timely manner.

Steps to complete the IRS audit letter example

Completing the IRS audit letter example involves a systematic approach to ensure compliance with the IRS's requests. Here are the steps to follow:

- Review the audit letter to identify the specific areas under scrutiny.

- Collect all relevant documentation that supports your tax filings for the years mentioned.

- Organize the documents in a clear and logical manner, referencing the points raised in the audit letter.

- Prepare a response letter that addresses each concern, providing explanations and supporting documents as necessary.

- Submit your response by the deadline indicated in the audit letter, ensuring that you keep copies of everything sent.

Following these steps can help you respond effectively and reduce the likelihood of further complications.

Legal use of the IRS audit letter example

The IRS audit letter example is legally significant as it represents the IRS's formal request for information. Responding to this letter is not only a matter of compliance but also a legal obligation. Failure to respond adequately can result in penalties, additional audits, or even legal action. It is essential to maintain accurate records and respond in a timely manner to protect your rights as a taxpayer. Consulting with a tax professional can also ensure that your response aligns with legal requirements and best practices.

Filing deadlines / Important dates

When dealing with an IRS audit letter, it is crucial to be aware of filing deadlines and important dates. The audit letter will specify a deadline by which you must respond, typically within thirty days. Missing this deadline can lead to complications, such as the IRS making adjustments to your tax return without your input. Additionally, if you are required to provide further documentation, be mindful of any additional deadlines communicated by the IRS. Keeping a calendar of these dates can help you stay organized and ensure compliance.

Quick guide on how to complete irs audit letter example

Complete Irs Audit Letter Example effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Irs Audit Letter Example on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

The simplest way to modify and electronically sign Irs Audit Letter Example with ease

- Locate Irs Audit Letter Example and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of your documents or obscure sensitive information with specialized tools provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Irs Audit Letter Example while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs audit letter example

Create this form in 5 minutes!

How to create an eSignature for the irs audit letter example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS audit letter?

An IRS audit letter is an official communication from the Internal Revenue Service notifying taxpayers that their tax returns are being reviewed. Understanding the implications of an IRS audit letter is crucial for individuals and businesses to ensure compliance and address any discrepancies.

-

How can airSlate SignNow assist with IRS audit letters?

airSlate SignNow provides a secure platform for managing and eSigning documents related to IRS audit letters. By using our service, you can easily send and receive essential files, ensuring you maintain comprehensive records during an audit.

-

Does airSlate SignNow offer features to track IRS audit letters?

Yes, airSlate SignNow includes document tracking features that allow users to monitor the status of their IRS audit letters and related documents. This ensures that all communications are accounted for and easily accessible in the event of an audit.

-

Is airSlate SignNow cost-effective for handling IRS audit letters?

Absolutely! airSlate SignNow is a cost-effective solution for businesses managing IRS audit letters, offering various pricing plans that fit different needs. You can simplify document management without breaking the bank while ensuring compliance.

-

What benefits does airSlate SignNow provide for IRS audit letter management?

Using airSlate SignNow improves the efficiency in managing IRS audit letters by streamlining the eSigning process and providing secure storage. This not only saves time but also enhances organization when dealing with critical tax documents.

-

Can airSlate SignNow integrate with other tools for IRS audit letters?

Yes, airSlate SignNow seamlessly integrates with various applications and software that businesses use alongside IRS audit letters. By integrating with your existing tools, we ensure that your workflow remains uninterrupted and efficient.

-

What types of documents related to IRS audit letters can be signed with airSlate SignNow?

With airSlate SignNow, you can eSign various documents related to IRS audit letters, such as responses to IRS inquiries, consent forms, and supporting documentation. Our platform makes it easy to handle all the paperwork efficiently and securely.

Get more for Irs Audit Letter Example

Find out other Irs Audit Letter Example

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed