Oregon Form W4p

What is the Oregon Form W-4P

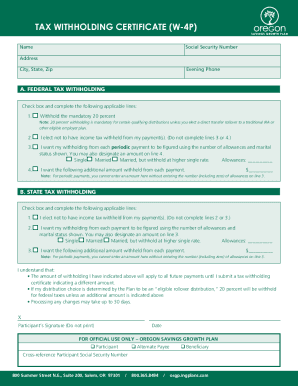

The Oregon Form W-4P is a state-specific tax form used by individuals to indicate their withholding preferences for pension and annuity payments. This form is essential for taxpayers receiving retirement benefits, as it helps determine the amount of state income tax to be withheld from these payments. By completing the Oregon Form W-4P, taxpayers can ensure that the correct amount of taxes is withheld, which can help avoid underpayment penalties during tax season.

How to use the Oregon Form W-4P

Using the Oregon Form W-4P involves several straightforward steps. First, taxpayers should obtain the form, which can typically be downloaded from the Oregon Department of Revenue website. Next, individuals need to fill out their personal information, including their name, address, and Social Security number. The form also requires taxpayers to specify their withholding preferences by indicating the amount or percentage they wish to have withheld from their pension or annuity payments. Once completed, the form should be submitted to the payer of the pension or annuity, ensuring that the withholding preferences are properly implemented.

Steps to complete the Oregon Form W-4P

Completing the Oregon Form W-4P involves a series of clear steps:

- Download the form from the Oregon Department of Revenue website.

- Provide your personal details, including your name, address, and Social Security number.

- Indicate your withholding preferences by selecting the appropriate options for federal and state tax withholding.

- Review the completed form for accuracy.

- Submit the form to the payer of your pension or annuity payments.

Following these steps ensures that your withholding preferences are accurately reflected in your income tax withholdings.

Legal use of the Oregon Form W-4P

The Oregon Form W-4P is legally binding when completed accurately and submitted to the appropriate payer. It complies with state tax laws, allowing individuals to control their tax withholding on pension and annuity payments. To ensure legal compliance, it is important to keep a copy of the submitted form for personal records and to review it periodically, especially if there are changes in income or tax situations.

Key elements of the Oregon Form W-4P

The Oregon Form W-4P includes several key elements that taxpayers need to be aware of:

- Personal Information: Name, address, and Social Security number.

- Withholding Preferences: Options to specify the amount or percentage of tax to withhold.

- Signature: Required to validate the form and confirm the accuracy of the information provided.

Understanding these elements is crucial for ensuring that the form is filled out correctly and meets all legal requirements.

Form Submission Methods

The Oregon Form W-4P can be submitted in several ways, depending on the payer's preferences. Common submission methods include:

- Online Submission: Some payers may allow electronic submission of the form through their websites.

- Mail: The completed form can be mailed directly to the payer's address.

- In-Person: Taxpayers may also choose to deliver the form in person at the payer's office.

Choosing the appropriate submission method can help ensure timely processing of the withholding preferences.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Oregon Form W-4P. Generally, taxpayers should submit the form before the start of the tax year to ensure that the correct amount of tax is withheld from the first pension or annuity payment of the year. Additionally, if there are changes in personal circumstances, such as retirement or changes in income, the form should be updated promptly to reflect these changes.

Quick guide on how to complete oregon form w4p

Easily Prepare Oregon Form W4p on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Oregon Form W4p on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Oregon Form W4p

- Find Oregon Form W4p and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and electronically sign Oregon Form W4p and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon form w4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon W 4P form and why is it important?

The Oregon W 4P form is a state-specific withholding form that allows employees to specify their tax withholding preferences in Oregon. It's important because accurate completion ensures that the correct amount of state income tax is withheld from an employee's paycheck, preventing overpayment or underpayment of taxes.

-

How can airSlate SignNow simplify the process of completing the Oregon W 4P?

airSlate SignNow streamlines the process of completing the Oregon W 4P by providing an intuitive platform for electronic signing and document management. Users can fill out and eSign the form securely online, reducing the likelihood of errors and enhancing efficiency.

-

Are there any costs associated with using airSlate SignNow for the Oregon W 4P?

While airSlate SignNow offers a free trial, there are subscription plans available that vary in price based on features and usage. These plans provide an affordable way for businesses to handle the Oregon W 4P along with other document signing needs.

-

What features does airSlate SignNow offer for managing the Oregon W 4P?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage all tailored for forms like the Oregon W 4P. These functionalities help ensure that businesses can manage their tax forms efficiently and maintain compliance.

-

Can airSlate SignNow integrate with other software for handling the Oregon W 4P?

Yes, airSlate SignNow offers integrations with various software systems, enhancing its functionality for managing the Oregon W 4P. This allows users to seamlessly connect their existing HR or payroll systems, improving overall workflow and data accuracy.

-

How does airSlate SignNow ensure the security of the Oregon W 4P data?

airSlate SignNow prioritizes security by utilizing end-to-end encryption and complying with industry standards, ensuring that Oregon W 4P data is protected. This gives users peace of mind knowing their sensitive information is handled securely.

-

Is customer support available for issues related to the Oregon W 4P on airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support for users needing assistance with the Oregon W 4P. Their support team is available to help with any questions or issues, ensuring a smooth experience for all users.

Get more for Oregon Form W4p

- Financial guarantee for a student visa georgia tech blorraineb lorraine gatech form

- Change of address iwa forest industry pension plan form

- Eyesight report form 54985499

- Behavior styles rating form pdf public rcas

- Dd form 2842

- Reconciliation agreement template form

- Recording agreement template form

- Recording studio agreement template form

Find out other Oregon Form W4p

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship