Ohio Lottery Tax Form 2014-2026

What is the Ohio Lottery Tax Form

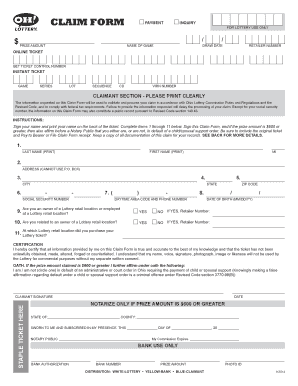

The Ohio Lottery Tax Form is a document required for reporting lottery winnings to the state of Ohio. This form is essential for individuals who have won a substantial amount through the Ohio Lottery, including games like keno and scratch-offs. It ensures compliance with state tax regulations and helps in the accurate reporting of income derived from lottery winnings.

Steps to Complete the Ohio Lottery Tax Form

Completing the Ohio Lottery Tax Form involves several key steps:

- Gather necessary information, including your Social Security number, details of your winnings, and any other relevant financial information.

- Obtain the Ohio Lottery Tax Form from the official Ohio Lottery website or through authorized distribution points.

- Fill out the form accurately, ensuring that all required fields are completed. This includes reporting the total amount won and any taxes withheld.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified filing methods, which may include online submission, mailing, or in-person delivery.

Key Elements of the Ohio Lottery Tax Form

The Ohio Lottery Tax Form includes several critical components that must be accurately filled out:

- Winner Information: This section requires personal details such as name, address, and Social Security number.

- Winnings Details: You must report the total amount of winnings and any taxes that were withheld at the time of payout.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate and complete.

How to Use the Ohio Lottery Tax Form

Using the Ohio Lottery Tax Form is straightforward. Once completed, it serves as an official record of your lottery winnings for tax purposes. It is essential to keep a copy for your personal records. This form can be used when filing your state income tax return, as it provides necessary documentation of your lottery income.

Form Submission Methods

The Ohio Lottery Tax Form can be submitted through various methods:

- Online: Some users may have the option to submit the form electronically through the Ohio Lottery website.

- Mail: You can print the completed form and send it to the designated address provided on the form.

- In-Person: Submitting the form in person at a local lottery office or tax office is also an option.

Legal Use of the Ohio Lottery Tax Form

The Ohio Lottery Tax Form is legally binding when filled out correctly and submitted according to state regulations. It is crucial to ensure that all information is truthful and accurate to avoid any legal repercussions. Compliance with state tax laws helps protect your rights as a lottery winner and ensures proper handling of your tax obligations.

Quick guide on how to complete ohio lottery tax form

Complete Ohio Lottery Tax Form effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage Ohio Lottery Tax Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and electronically sign Ohio Lottery Tax Form without hassle

- Obtain Ohio Lottery Tax Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your preference. Edit and electronically sign Ohio Lottery Tax Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio lottery tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Lottery claim form and how can I access it?

The Ohio Lottery claim form is a document required to claim lottery winnings in Ohio. You can easily access the form online through the official Ohio Lottery website or download it directly from our airSlate SignNow platform for convenience.

-

How do I fill out the Ohio Lottery claim form using airSlate SignNow?

Filling out the Ohio Lottery claim form is simple with airSlate SignNow. You can upload your downloaded claim form, fill it out digitally, and use our eSigning feature to sign it electronically, all within a user-friendly interface.

-

Are there any fees associated with using airSlate SignNow for the Ohio Lottery claim form?

airSlate SignNow offers a cost-effective solution with affordable pricing plans. While there may be a minimal subscription fee for premium features, you can sign and send the Ohio Lottery claim form at no additional cost.

-

Can I track the status of my Ohio Lottery claim form submission?

Yes, with airSlate SignNow, you can track the status of your Ohio Lottery claim form submission. Our platform provides real-time updates and notifications, so you always know where your claim stands.

-

Is airSlate SignNow secure for submitting the Ohio Lottery claim form?

Absolutely! airSlate SignNow is committed to security and compliance. Your Ohio Lottery claim form and all associated data are protected with advanced encryption and security measures, ensuring that your information remains confidential.

-

What features does airSlate SignNow offer for managing the Ohio Lottery claim form?

airSlate SignNow offers a range of features to manage your Ohio Lottery claim form effectively, including document editing, eSigning, and secure storage. These tools enhance your workflow and streamline the claim submission process.

-

Can I integrate airSlate SignNow with other applications for the Ohio Lottery claim form?

Yes, airSlate SignNow supports multiple integrations with popular applications, allowing you to connect with services you already use. This makes it easier to manage the Ohio Lottery claim form and other documents from one central platform.

Get more for Ohio Lottery Tax Form

- Booking form pdf db schenker dbschenker

- Michigan alcoholism screening test form

- Student appeal suffolk county community college sunysuffolk form

- Gender inclusive housing form alma college alma

- Request for course withdrawal jefferson state community form

- Course adddrop form

- Prerequisite evaluationchallenge request form

- Download a donation form pdf 29 3 kb berklee college of music berklee

Find out other Ohio Lottery Tax Form

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile