Form Sc8453

What is the Form SC8453

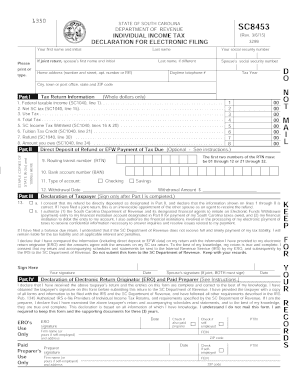

The South Carolina Form SC8453 is an individual income tax declaration for electronic filing. This form is essential for taxpayers who choose to file their state income tax returns electronically. It serves as a declaration that the taxpayer has authorized their electronic filing and provides necessary information for the South Carolina Department of Revenue to process the return accurately. The SC8453 form ensures that the taxpayer's identity is verified and that the submission complies with state regulations.

How to use the Form SC8453

To use the Form SC8453, taxpayers must first complete their electronic tax return using approved tax software. Once the return is prepared, the SC8453 form must be printed, signed, and submitted to the South Carolina Department of Revenue. This form acts as a cover sheet for the electronic submission, confirming that the taxpayer has reviewed the return and authorizes its filing. It is important to ensure that all information on the form is accurate and matches the electronic return to avoid processing delays.

Steps to complete the Form SC8453

Completing the Form SC8453 involves several key steps:

- Prepare your electronic tax return using compatible tax software.

- Print the Form SC8453 once your return is finalized.

- Sign the form in the designated area to validate your authorization.

- Ensure all personal information, including your Social Security number and address, is correctly filled out.

- Submit the signed form to the South Carolina Department of Revenue as instructed by your tax software.

Legal use of the Form SC8453

The legal use of the Form SC8453 is governed by state regulations regarding electronic filing. By signing this form, taxpayers affirm that they are authorized to file the return electronically and that the information provided is true and correct to the best of their knowledge. The form must be submitted in conjunction with the electronic filing to ensure compliance with the South Carolina Department of Revenue's requirements. Failure to properly complete or submit the SC8453 can result in delays in processing or potential penalties.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form SC8453. Typically, individual income tax returns are due by April fifteenth each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to submit the SC8453 form along with the electronic return by this deadline to avoid late filing penalties. Taxpayers may also consider filing for an extension if they need additional time, but they must still pay any taxes owed by the original due date.

Form Submission Methods (Online / Mail / In-Person)

The Form SC8453 must be submitted in conjunction with an electronic tax return. Taxpayers typically submit the SC8453 via electronic means, as part of the e-filing process. However, if necessary, the signed form can also be mailed to the South Carolina Department of Revenue. It is not typically required to submit the form in person, but taxpayers should check for any specific instructions from the Department of Revenue regarding submission methods. Ensuring that the form is submitted according to the guidelines helps maintain compliance and facilitates quicker processing.

Quick guide on how to complete form sc8453

Prepare Form Sc8453 with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form Sc8453 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to alter and electronically sign Form Sc8453 effortlessly

- Obtain Form Sc8453 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign function, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form Sc8453 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form sc8453

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to print South Carolina state tax form SC8453 using airSlate SignNow?

To print South Carolina state tax form SC8453 using airSlate SignNow, simply upload your completed form to our platform. After eSigning your document, you can download it directly in a printable format. This makes it easy to ensure your tax form is ready for submission.

-

Are there any costs associated with printing South Carolina state tax form SC8453 using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans, including a free trial. While printing the South Carolina state tax form SC8453 is included in most of our subscriptions, be sure to review the specific plan details to understand any associated costs.

-

What features does airSlate SignNow offer for managing South Carolina state tax form SC8453?

With airSlate SignNow, you can easily upload, sign, and print South Carolina state tax form SC8453. The platform also enables teams to collaborate in real time, track signatures, and securely store documents, ensuring a smooth tax filing process.

-

Can I integrate airSlate SignNow with other applications to manage my tax forms?

Yes, airSlate SignNow integrates seamlessly with various applications, including Google Drive and Microsoft Office. This allows you to streamline your workflow and efficiently manage your South Carolina state tax form SC8453, along with other important documents.

-

Is airSlate SignNow compliant with IRS regulations for submitting the South Carolina state tax form SC8453?

Absolutely, airSlate SignNow complies with IRS regulations for electronic signatures and document management. When you print South Carolina state tax form SC8453 using our platform, you can be confident it's prepared according to federal and state guidelines.

-

How secure is my data when printing South Carolina state tax form SC8453 with airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods to protect your documents and personal information when you print South Carolina state tax form SC8453 to ensure that your data is always safe and secure.

-

What support options are available if I have trouble printing my South Carolina state tax form SC8453?

If you encounter any issues while printing your South Carolina state tax form SC8453, airSlate SignNow offers dedicated customer support. You can access our help center, chat with support representatives, or consult our comprehensive FAQs for quick assistance.

Get more for Form Sc8453

- Virginia junior angler awards program virginia marine resources mrc virginia form

- Marathon training schedule novice 30 week x 5 day plan form

- Proof of service by mail 021 california judicial council court forms

- Boxing federal id form

- Skv 4632 form

- Deed agreement template form

- Deed of loan agreement template form

- Deed of sale agreement template form

Find out other Form Sc8453

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney