It 2104 Form

What is the IT 2104?

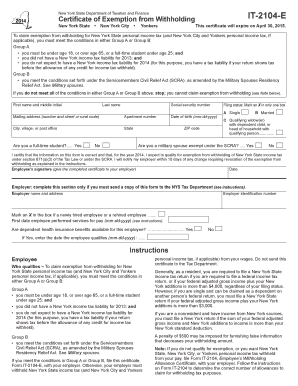

The IT 2104 form is a New York State tax form used to determine the amount of state income tax withholding from an employee's wages. This form is essential for employers to ensure that they are withholding the correct amount of tax based on an employee's filing status and exemptions. It helps in accurately calculating the state tax liability for individuals working in New York.

How to use the IT 2104

To use the IT 2104 form, employees must complete it by providing their personal information, including name, address, and Social Security number. They also need to indicate their filing status and the number of allowances they are claiming. This information helps employers determine the appropriate withholding amount. Once completed, the form should be submitted to the employer, who will use it to adjust the withholding on the employee's paychecks.

Steps to complete the IT 2104

Completing the IT 2104 form involves several straightforward steps:

- Obtain the IT 2104 form from your employer or download it from the New York State Department of Taxation and Finance website.

- Fill in your personal details, including your name, address, and Social Security number.

- Select your filing status, which can be single, married, or head of household.

- Indicate the number of allowances you are claiming based on your tax situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal use of the IT 2104

The IT 2104 form is legally recognized as a valid document for determining state tax withholding. Employers are required to maintain accurate records of the forms submitted by their employees. This ensures compliance with state tax laws and helps avoid potential penalties for under-withholding. The form must be completed accurately to reflect the employee's tax situation, as incorrect information can lead to tax liabilities or refunds at the end of the tax year.

IRS Guidelines

While the IT 2104 is a state-specific form, it is essential to follow IRS guidelines regarding tax withholding. Employees should ensure that their state withholding aligns with federal tax obligations. The IRS provides resources and publications that outline the requirements for federal withholding, which can complement the information provided on the IT 2104 form. Understanding both state and federal guidelines helps individuals manage their tax liabilities effectively.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IT 2104 form. Generally, employees should submit the form to their employer as soon as they start a new job or when their tax situation changes. Employers are responsible for withholding the appropriate amount of state tax based on the information provided. Keeping track of deadlines ensures compliance and helps avoid any issues with tax withholding throughout the year.

Required Documents

To complete the IT 2104 form, employees may need to gather specific documents, including:

- Personal identification, such as a driver's license or Social Security card.

- Previous year’s tax return to determine filing status and allowances.

- Any other relevant financial documents that may impact tax withholding.

Having these documents on hand can facilitate the accurate completion of the IT 2104 form and ensure that the information provided is correct.

Quick guide on how to complete it 2104 129570

Effortlessly Prepare It 2104 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle It 2104 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign It 2104 Seamlessly

- Obtain It 2104 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign It 2104 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 2104 129570

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow IT 2104 and how does it work?

airSlate SignNow IT 2104 is a digital document management tool that allows users to send, eSign, and manage documents with ease. The platform offers a user-friendly interface that enables businesses to streamline their document workflows efficiently. With IT 2104, you can create templates, track document status, and ensure compliance seamlessly.

-

What pricing plans are available for airSlate SignNow IT 2104?

airSlate SignNow IT 2104 offers several pricing tiers to accommodate different business needs. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This flexibility ensures that you find a cost-effective solution that fits your budget.

-

What features does airSlate SignNow IT 2104 provide?

airSlate SignNow IT 2104 includes features such as customizable templates, automatic reminders, and real-time tracking of document progress. Additionally, users benefit from mobile accessibility and the ability to request payments through eSignatures. These robust features make it a comprehensive choice for managing digital documents.

-

How does airSlate SignNow IT 2104 enhance productivity?

By using airSlate SignNow IT 2104, businesses can signNowly enhance productivity by reducing the time spent on document handling and approvals. The platform automates many manual processes, allowing teams to focus on more strategic tasks. This efficiency leads to faster turnaround times and improved overall workflow.

-

Is airSlate SignNow IT 2104 secure for handling sensitive documents?

Yes, airSlate SignNow IT 2104 prioritizes security with advanced encryption technology and multiple authentication methods. This ensures that sensitive documents are protected from unauthorized access and bsignNowes. Businesses can confidently use IT 2104 for their most important documents without compromising security.

-

Can airSlate SignNow IT 2104 integrate with other software applications?

Absolutely, airSlate SignNow IT 2104 is designed to integrate seamlessly with various software applications such as CRMs, project management tools, and payment processors. These integrations enhance functionality and allow you to build a cohesive digital ecosystem for your business operations. This interoperability is a key advantage of using IT 2104.

-

What are the benefits of using airSlate SignNow IT 2104 for remote teams?

airSlate SignNow IT 2104 is particularly beneficial for remote teams as it enables collaboration on documents regardless of physical location. The platform allows team members to eSign documents, provide feedback, and track changes in real-time. This digital functionality signNowly enhances remote work efficiency and communication.

Get more for It 2104

Find out other It 2104

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later