E 595e Form

What is the E 595e

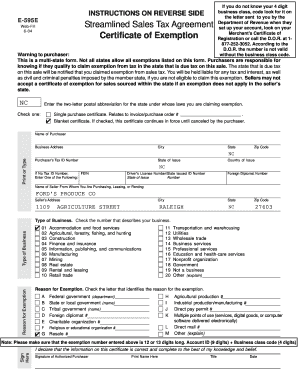

The E 595e is a specific form used in the United States for tax-exempt purchases by certain organizations. This form allows qualifying entities, such as non-profits and government agencies, to make purchases without incurring sales tax. The E 595e serves as a declaration of the buyer's tax-exempt status and provides necessary information to vendors to validate the exemption. Understanding the purpose and function of the E 595e is essential for organizations looking to manage their tax liabilities effectively.

How to use the E 595e

Using the E 595e involves several steps to ensure compliance with tax regulations. First, the organization must complete the form accurately, providing all required information, including the name, address, and tax-exempt status. Once filled out, the E 595e should be presented to the vendor at the time of purchase. It is crucial to retain a copy of the form for the organization's records, as it may be needed for audits or verification purposes. Proper use of the E 595e can help streamline the purchasing process and avoid unnecessary tax expenses.

Steps to complete the E 595e

Completing the E 595e requires careful attention to detail. Here are the steps to follow:

- Obtain the E 595e form from the appropriate source.

- Fill in the organization’s name, address, and tax identification number.

- Indicate the type of organization that qualifies for tax exemption.

- Sign and date the form to certify its accuracy.

- Provide the completed form to the vendor during the transaction.

Following these steps ensures that the E 595e is completed correctly, allowing for valid tax-exempt purchases.

Legal use of the E 595e

The legal use of the E 595e is governed by state tax laws, which outline who qualifies for tax exemption and under what circumstances. Organizations must ensure that they meet the eligibility criteria set forth by the state in which they operate. Misuse of the E 595e, such as using it for non-qualifying purchases, can result in penalties and loss of tax-exempt status. It is important for organizations to stay informed about legal requirements to maintain compliance and avoid legal issues.

Required Documents

To complete the E 595e, certain documents may be necessary. These typically include:

- A copy of the organization’s tax-exempt certificate.

- Proof of the organization’s status, such as incorporation papers or IRS determination letters.

- Any additional documentation required by the vendor to validate the exemption.

Having these documents on hand can facilitate the completion of the E 595e and support the organization’s claims for tax exemption.

Form Submission Methods

The E 595e can be submitted in various ways, depending on the vendor's requirements. Typically, the form is presented at the point of sale, either in person or electronically. Some vendors may accept a scanned copy of the form via email, while others may require a physical copy. It is important to confirm the submission method accepted by the vendor to ensure that the tax exemption is honored.

Quick guide on how to complete e 595e 37550342

Effortlessly Prepare E 595e on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents since you can easily locate the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage E 595e on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

The simplest way to edit and electronically sign E 595e without any hassle

- Locate E 595e and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or mask sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Produce your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Edit and electronically sign E 595e and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e 595e 37550342

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the e595e form and how is it used?

The e595e form is a vital document used for tax exemption purposes in certain transactions. Businesses utilize this form to assert their eligibility for sales tax exemption under specific regulations. Understanding the e595e form can help organizations streamline their compliance processes and reduce unnecessary expenses.

-

How can airSlate SignNow assist with e595e form management?

airSlate SignNow provides a seamless solution for managing the e595e form by allowing users to create, send, and sign documents electronically. The platform simplifies the process of obtaining necessary signatures and ensures that the e595e form is processed efficiently. With our user-friendly interface, managing the e595e form becomes hassle-free.

-

Is there a pricing structure for using airSlate SignNow for the e595e form?

Yes, airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Each plan provides access to features that make managing documents like the e595e form easy and efficient. By choosing airSlate SignNow, businesses can find a cost-effective solution that maximizes their resources.

-

What are the key features of airSlate SignNow related to the e595e form?

AirSlate SignNow includes several key features that aid in the management of the e595e form, including customizable templates, secure e-signatures, and document tracking. These features enhance user experience and ensure that documents are handled securely and efficiently. Ultimately, airSlate SignNow makes working with the e595e form straightforward and effective.

-

What benefits do users gain from using airSlate SignNow for the e595e form?

Using airSlate SignNow for the e595e form offers multiple benefits, such as increased efficiency, cost savings, and reduced paper usage. The electronic signing process ensures faster turnaround times and eliminates the delays often associated with traditional paperwork. Additionally, these benefits contribute to better overall organizational efficiency.

-

Can airSlate SignNow integrate with other applications for managing the e595e form?

Absolutely! AirSlate SignNow boasts seamless integrations with popular applications, making it easier to manage the e595e form alongside other business processes. These integrations ensure that users can streamline their workflows and enhance productivity by connecting airSlate SignNow with tools they already use.

-

Is the e595e form secure when processed through airSlate SignNow?

Yes, the security of the e595e form is a top priority at airSlate SignNow. The platform employs robust encryption and authentication measures to ensure that all documents are protected from unauthorized access. Users can trust that their e595e form and related information remain safe throughout the signing process.

Get more for E 595e

- Grc 172243 vehicle access form chicago department of aviation

- Rational drug therapy phone number form

- Mw507 calculator form

- Mental health law online forms

- Ending chronic homelessness through employment and housing form

- Notice of appeal use this form to appeal a small claims decision to the court of queens bench

- Inquiries toll 1 form

- Alberta health services personal information form

Find out other E 595e

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe