Dtf 719 Form

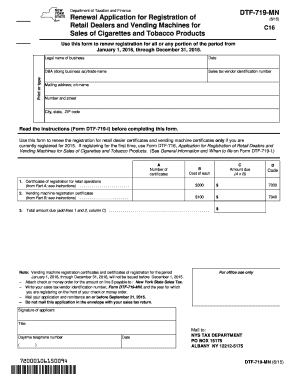

What is the DTF 719?

The DTF 719 is a form used in the state of New York for tax purposes, specifically related to the reporting of certain tax credits and exemptions. This form is essential for individuals and businesses seeking to claim specific tax benefits, ensuring compliance with state tax regulations. Understanding the purpose and requirements of the DTF 719 is crucial for accurate tax reporting and maximizing potential savings.

How to use the DTF 719

Using the DTF 719 involves several key steps. First, gather all necessary documentation that supports your claim for tax credits or exemptions. This may include income statements, previous tax returns, and any relevant financial records. Next, fill out the form accurately, ensuring that all information is complete and truthful. Once completed, submit the form as directed, either electronically or via mail, according to the instructions provided by the New York Department of Taxation and Finance.

Steps to complete the DTF 719

Completing the DTF 719 requires careful attention to detail. Follow these steps for a smooth process:

- Review the eligibility criteria for the specific tax credits you are claiming.

- Gather all required documents to support your claims.

- Fill out the DTF 719 form, ensuring all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the completed form by the specified deadline, either online or through traditional mail.

Legal use of the DTF 719

The DTF 719 must be used in accordance with New York state tax laws. Submitting this form legally binds the filer to the information provided. It is essential to ensure that all claims made on the form are valid and supported by appropriate documentation. Misrepresentation or fraudulent claims can lead to penalties, including fines or legal action.

Filing Deadlines / Important Dates

Filing deadlines for the DTF 719 typically align with the annual tax filing deadlines in New York. It is important to stay informed about specific dates to avoid late submissions. Generally, the deadline for filing personal income tax returns is April fifteenth, while extensions may apply for certain circumstances. Always check the New York Department of Taxation and Finance for the most current deadlines to ensure compliance.

Required Documents

When preparing to submit the DTF 719, certain documents are required to support your claims. These may include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Documentation of any relevant deductions or credits.

- Proof of residency or business location, if applicable.

Who Issues the Form

The DTF 719 is issued by the New York State Department of Taxation and Finance. This department is responsible for overseeing tax compliance and ensuring that taxpayers have access to the necessary forms and resources for accurate tax reporting. For any questions regarding the form, taxpayers can contact the department directly for assistance.

Quick guide on how to complete dtf 719 100665779

Easily Prepare Dtf 719 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the right form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Dtf 719 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Effortlessly Edit and eSign Dtf 719

- Obtain Dtf 719 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Develop your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Dtf 719 and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 719 100665779

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dtf 719 and how is it beneficial for businesses?

DTF 719 is a document transfer format that streamlines the eSigning process for businesses. By utilizing dtf 719, companies can improve their document workflow, enhance collaboration, and reduce turnaround times, making it an invaluable tool in today's fast-paced business environment.

-

How does airSlate SignNow utilize the dtf 719 format?

AirSlate SignNow fully supports the dtf 719 format, allowing users to send, receive, and eSign documents seamlessly. The integration of dtf 719 ensures compatibility across various devices and platforms, making it easier for teams to collaborate in real-time.

-

What pricing plans are available for airSlate SignNow that support dtf 719?

AirSlate SignNow offers a variety of pricing plans tailored to meet different business needs, all of which support the dtf 719 format. These plans range from essential features for startups to advanced functionalities for large enterprises, ensuring flexibility and scalability.

-

Are there any specific features of airSlate SignNow that enhance the use of dtf 719?

Yes, airSlate SignNow includes features like automated workflows, secure cloud storage, and real-time notifications, all of which enhance the dtf 719 experience. These features help users manage documents effortlessly while ensuring data security and compliance.

-

Can I integrate dtf 719 with other software using airSlate SignNow?

Absolutely! AirSlate SignNow provides integrations with various third-party applications that can utilize the dtf 719 format. This enables businesses to synchronize their existing workflows and enhance productivity across platforms.

-

What are the security measures in place for documents using dtf 719 with airSlate SignNow?

AirSlate SignNow employs robust security features for documents using the dtf 719 format, including encryption and multi-factor authentication. These measures ensure that sensitive information remains protected while being shared and signed electronically.

-

Is training provided for using dtf 719 with airSlate SignNow?

Yes, airSlate SignNow offers comprehensive training resources for users looking to maximize their use of dtf 719. From user guides to video tutorials, training materials facilitate a smooth onboarding experience and help users explore all features effectively.

Get more for Dtf 719

- Oil change checklist template form

- Formulaire a 0527 jf

- Smart core waiver form

- Financial assistance application ymca of central stark county ymcastark form

- Meds by mail order form department of veterans

- Dr726 pro se motion form doc butlercountyohio

- Enduring power of attorney qld form 9

- Thermiva consent form 9

Find out other Dtf 719

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile