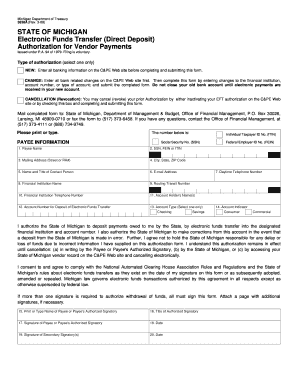

Michigan Dept of Treasury 3636a Form

What is the Michigan Dept Of Treasury 3636a

The Michigan Dept of Treasury 3636a form is a document used for specific tax-related purposes within the state of Michigan. This form is essential for individuals or businesses to report particular financial information to the state treasury. It ensures compliance with state tax regulations and helps facilitate accurate tax assessments. Understanding the purpose of this form is crucial for proper filing and adherence to legal requirements.

How to use the Michigan Dept Of Treasury 3636a

Using the Michigan Dept of Treasury 3636a form involves several steps to ensure accurate completion. First, gather all necessary financial documents and information required for the form. Next, carefully fill out each section, ensuring that all data is accurate and complete. It is important to review the form for any errors or omissions before submission. Once completed, the form can be submitted according to the specified guidelines, whether online or via mail.

Steps to complete the Michigan Dept Of Treasury 3636a

Completing the Michigan Dept of Treasury 3636a form requires a systematic approach:

- Gather relevant financial information, including income statements and tax documents.

- Obtain the latest version of the form from the Michigan Department of Treasury website.

- Fill out the form with accurate details, ensuring to follow any specific instructions provided.

- Double-check all entries for accuracy and completeness.

- Submit the form through the designated method, keeping a copy for your records.

Legal use of the Michigan Dept Of Treasury 3636a

The legal use of the Michigan Dept of Treasury 3636a form is governed by state tax laws. This form must be completed accurately to ensure compliance with legal obligations. Failure to properly use or submit this form can result in penalties or legal repercussions. It is essential to understand the legal context surrounding this form to avoid complications with the state treasury.

Form Submission Methods

The Michigan Dept of Treasury 3636a form can be submitted through various methods, depending on the preferences of the filer. Options typically include:

- Online submission through the Michigan Department of Treasury's e-filing system.

- Mailing the completed form to the appropriate address provided by the department.

- In-person submission at designated state treasury offices.

Required Documents

When completing the Michigan Dept of Treasury 3636a form, certain documents may be required to support the information provided. Commonly needed documents include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Any documentation related to deductions or credits claimed.

Quick guide on how to complete michigan dept of treasury 3636a

Prepare Michigan Dept Of Treasury 3636a effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely archive it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage Michigan Dept Of Treasury 3636a on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign Michigan Dept Of Treasury 3636a with ease

- Find Michigan Dept Of Treasury 3636a and click Get Form to begin.

- Utilize the resources we provide to complete your document.

- Emphasize important parts of the documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks, accessible from any device you prefer. Modify and electronically sign Michigan Dept Of Treasury 3636a and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan dept of treasury 3636a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the michigan dept of treasury 3636a form?

The michigan dept of treasury 3636a form is a required document that facilitates specific transactions with the Michigan Department of Treasury. It ensures compliance with state regulations and allows businesses to properly inform the department of their activities. Completing this form accurately is crucial for avoiding potential penalties or delays in processing.

-

How can airSlate SignNow help with michigan dept of treasury 3636a forms?

airSlate SignNow provides a seamless platform to send and eSign michigan dept of treasury 3636a forms. You can easily upload your document, add necessary fields, and send it out for eSignature in just a few clicks. Our user-friendly interface simplifies form management, ensuring that you can handle your paperwork efficiently.

-

What are the costs associated with using airSlate SignNow for michigan dept of treasury 3636a?

airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. Our affordable plans provide access to all features, including those specifically designed for managing michigan dept of treasury 3636a forms. You can choose the plan that best fits your business needs without breaking the bank.

-

Are there any integration options for airSlate SignNow with the michigan dept of treasury 3636a?

Yes, airSlate SignNow integrates with various apps and tools that can enhance your workflow, including those that interact with the michigan dept of treasury 3636a. This allows you to efficiently manage your document processes and sync information across platforms. Integrations help reduce manual entry and improve overall productivity.

-

What are the benefits of using airSlate SignNow for michigan dept of treasury 3636a processing?

Using airSlate SignNow streamlines the process of managing michigan dept of treasury 3636a forms. You benefit from faster turnaround times, improved compliance, and reduced paperwork. Additionally, the platform's eSignature features provide legal validity, ensuring your documents hold up in any official capacity.

-

Is airSlate SignNow secure for michigan dept of treasury 3636a documents?

Yes, airSlate SignNow prioritizes security, ensuring that your michigan dept of treasury 3636a documents are protected with the highest standards. The platform uses advanced encryption and secure storage solutions to safeguard your sensitive information. You can rest assured that your documents are safe during transmission and while stored.

-

Can I track the status of my michigan dept of treasury 3636a submissions in airSlate SignNow?

Definitely! airSlate SignNow offers real-time tracking for all your michigan dept of treasury 3636a submissions. You can monitor when a document is sent, viewed, and signed, which helps you stay organized and informed throughout the process. This transparency enhances your workflow and ensures nothing falls through the cracks.

Get more for Michigan Dept Of Treasury 3636a

- Prometric hawaii beauty operator fee form

- Country report template form

- Boone county dog license form

- Form it 640 start up ny telecommunication services excise tax credit tax year 772088892

- Electrical service agreement template 787741463 form

- Electronic signature agreement template 787741530 form

- Email agreement template form

- Email marketing agreement template form

Find out other Michigan Dept Of Treasury 3636a

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free