Income Tax Return Form

What is the Income Tax Return Form

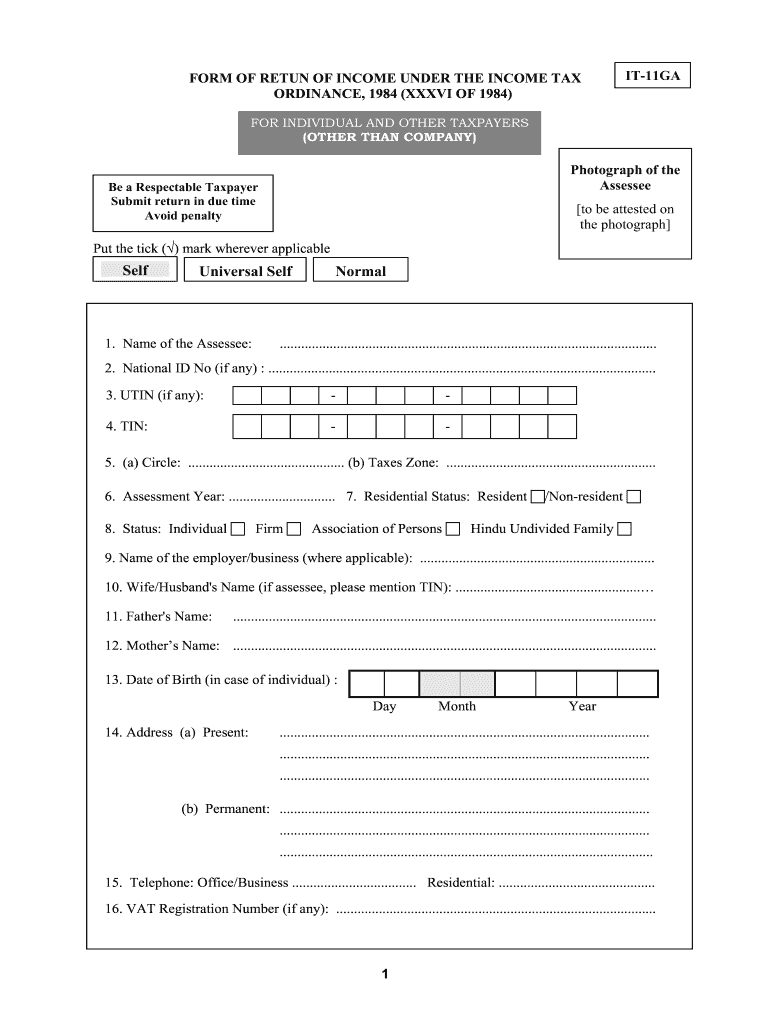

The Income Tax Return Form is an official document used by taxpayers to report their income, calculate their tax liability, and claim any applicable tax credits or deductions. This form is essential for individuals and businesses to ensure compliance with federal and state tax laws. The form captures various financial details, including wages, dividends, interest, and other sources of income, as well as expenses that can reduce taxable income.

Steps to complete the Income Tax Return Form

Completing the Income Tax Return Form involves several key steps to ensure accuracy and compliance:

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductible expenses.

- Choose the correct form variant based on your filing status and income type.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Calculate your total income and determine your tax liability based on current tax rates.

- Claim any eligible deductions and credits to reduce your taxable income.

- Review the completed form for accuracy before submission.

Legal use of the Income Tax Return Form

The Income Tax Return Form serves a critical legal function, as it is required by law for individuals and businesses to report their income and pay taxes owed to the government. Filing this form accurately and on time helps avoid penalties and legal issues. The form must adhere to the regulations set forth by the Internal Revenue Service (IRS) and relevant state tax authorities, ensuring that all information provided is truthful and complete.

Required Documents

To accurately complete the Income Tax Return Form, you will need several documents, including:

- W-2 forms from employers showing annual wages.

- 1099 forms for any freelance or contract work.

- Documentation of other income sources, such as rental income or investments.

- Receipts for deductible expenses, such as medical bills or charitable contributions.

- Previous year's tax return for reference and consistency.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines to avoid penalties. The typical deadline for filing the Income Tax Return Form is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Income Tax Return Form can be submitted through various methods, providing flexibility for taxpayers:

- Online: Many taxpayers choose to file electronically using tax software, which often simplifies the process and speeds up refunds.

- Mail: Taxpayers can print and mail their completed forms to the appropriate IRS address based on their location and filing status.

- In-Person: Some individuals may prefer to file in person at designated IRS offices or through certified tax professionals.

Quick guide on how to complete form of return of income under the income tax ordinance 1984

Uncover how to easily navigate the Income Tax Return Form completion with this simple guide

Submitting and verifying documents digitally is becoming more prevalent and the preferred method for numerous clients. It provides various advantages over outdated printed forms, such as convenience, efficiency, enhanced precision, and safety.

With tools like airSlate SignNow, you can find, modify, sign, enhance, and send your Income Tax Return Form without getting bogged down by endless printing and scanning. Follow this brief guide to get started and complete your form.

Follow these steps to obtain and complete Income Tax Return Form

- Begin by clicking the Get Form button to launch your document in our editor.

- Pay attention to the green marker on the left indicating required fields so you don’t miss them.

- Utilize our advanced features to annotate, modify, sign, secure, and enhance your document.

- Safeguard your file or convert it into a fillable form using the tools available in the right panel.

- Review the document and verify it for errors or inconsistencies.

- Select DONE to complete the editing process.

- Rename your form or keep it as it is.

- Choose the storage option you prefer for your document, send it via USPS, or click the Download Now button to save your form.

If Income Tax Return Form isn’t what you were after, you can explore our extensive collection of pre-uploaded forms that require minimal input to complete. Experience our solution today!

Create this form in 5 minutes or less

FAQs

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How do I fill an income tax return with the 16A form in India?

The applicable Form for filing of your income tax return shall need to examine nature of your income.If you are receiving Form 16A only, then it means you are earning income other than salaries, and therefore possibly you shall need to file Income Tax Return in Form ITR 3 or ITR 4 (depends over the nature of income as already said in above para).You shall need to register your PAN on the website of income tax efiling, thereafter you shall need to link your PAN if you are a resident of India.After successful registration, you may file your income tax return through applicable form. Show your income as being appearing in Form 16A, your bank interest and any other income if you do have.For any assistance/queries related to taxation, you may contact me on pkush39@gmail.com

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

What are the forms of return prescribed under the Income-tax Law?

ITR 1 to ITR 71. ITR 1 (SAHAJ): For SALARIED, RESIDENT individuals having total income up to Rs.50 lakh, one house property, other sources and agricultural income up to Rs.5 k. Not for Director in a company or has invested in unlisted shares.2. ITR 2: For Individuals /HUFs not having income from Business3. ITR 3: For individuals/HUFs having income from BUSINESS4. ITR 4 (SUGAM): For RESIDENT Individuals/ HUFs/Firms (not LLP) having total income up to Rs.50 lakh and having income from business and profession taxable on presumptive basis. Not for an individual who is director or invested in unlisted shares]5. ITR 5: For persons other than- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-76. ITR 6: For Companies not claiming exemption under section 117. ITR 7: For persons required to furnish return under sections 139(4A)- (4D).

Create this form in 5 minutes!

How to create an eSignature for the form of return of income under the income tax ordinance 1984

How to create an electronic signature for the Form Of Return Of Income Under The Income Tax Ordinance 1984 in the online mode

How to make an electronic signature for your Form Of Return Of Income Under The Income Tax Ordinance 1984 in Google Chrome

How to make an eSignature for putting it on the Form Of Return Of Income Under The Income Tax Ordinance 1984 in Gmail

How to generate an electronic signature for the Form Of Return Of Income Under The Income Tax Ordinance 1984 right from your mobile device

How to make an electronic signature for the Form Of Return Of Income Under The Income Tax Ordinance 1984 on iOS

How to make an electronic signature for the Form Of Return Of Income Under The Income Tax Ordinance 1984 on Android OS

People also ask

-

What features does airSlate SignNow offer for nbrfirm users?

airSlate SignNow provides a comprehensive suite of features tailored for nbrfirm users, including user-friendly document templates, e-signature capabilities, and real-time tracking. These tools enhance workflow efficiency, making it easier for businesses to manage their documents securely.

-

How does pricing for airSlate SignNow work for nbrfirm clients?

For nbrfirm clients, airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Each plan includes essential features, ensuring that businesses can select an option that fits their budget while maximizing value.

-

Can airSlate SignNow integrate with my existing tools at nbrfirm?

Yes, airSlate SignNow integrates seamlessly with a wide range of popular applications that nbrfirm businesses may be using. This includes CRM systems, document management software, and cloud storage platforms, allowing for a smooth workflow and data synchronization.

-

What are the benefits of using airSlate SignNow for nbrfirm operations?

The benefits of using airSlate SignNow for nbrfirm operations include increased efficiency, reduced processing time, and enhanced security for document handling. Businesses experience smoother transactions and improved collaboration, leading to better overall productivity.

-

Is airSlate SignNow secure for nbrfirm document management?

Absolutely, airSlate SignNow prioritizes security for nbrfirm document management through advanced encryption and compliance with industry standards. This ensures that all sensitive information is protected during the signing process and stored securely.

-

What customer support options does airSlate SignNow provide for nbrfirm users?

AirSlate SignNow offers robust customer support options for nbrfirm users, including live chat, email support, and extensive online resources. This ensures that businesses have the assistance they need to fully utilize the platform and resolve any issues promptly.

-

How can nbrfirm businesses start using airSlate SignNow?

Nbrfirm businesses can easily start using airSlate SignNow by signing up for a free trial on the website. This allows users to explore all features and see firsthand how it can streamline their document processes before committing to a subscription.

Get more for Income Tax Return Form

- Complete these sixteen sentences to score your knowledge of present simple grammar form

- Dpd schadensmeldung pdf form

- Printable pain diagram form

- Letter to parents about student hygiene form

- Centennial college re admit form

- Tu case id contact information telephone 18006639

- Homeopathy acute consultation intake form

- Global market brandon form

Find out other Income Tax Return Form

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template