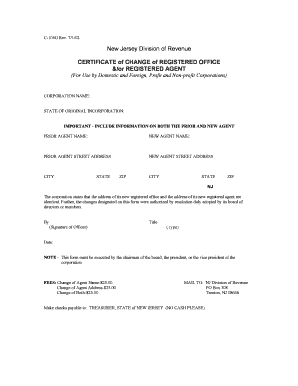

C 104g Form

What is the C 104g Form

The C 104g Form is a specific document used primarily for tax purposes in the United States. It is typically associated with reporting certain financial information to the Internal Revenue Service (IRS). This form is crucial for individuals and businesses alike, as it helps ensure compliance with federal tax regulations. Understanding the purpose and requirements of the C 104g Form is essential for accurate tax reporting and avoiding potential penalties.

How to use the C 104g Form

Using the C 104g Form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all fields are completed with accurate data. It is important to review the form for any errors before submission. Depending on your situation, you may need to attach additional documentation to support the information provided on the form.

Steps to complete the C 104g Form

Completing the C 104g Form requires attention to detail. Follow these steps for effective completion:

- Start by downloading the latest version of the C 104g Form from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income and any deductions or credits applicable to your situation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate your submission.

Legal use of the C 104g Form

The C 104g Form must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to all filing deadlines and accurately reporting all required information. Failure to comply with these regulations can result in penalties, including fines or additional scrutiny from the IRS. It is advisable to consult with a tax professional if you have questions regarding the legal implications of using this form.

Key elements of the C 104g Form

Several key elements are essential to the C 104g Form. These include:

- Taxpayer Information: Accurate identification of the taxpayer is critical.

- Income Reporting: All sources of income must be reported clearly.

- Deductions and Credits: Properly claiming deductions can significantly affect tax liability.

- Signature: A valid signature is necessary to attest to the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the C 104g Form are crucial to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year unless an extension is filed. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS announcements. Marking these dates on your calendar can help ensure timely submission.

Quick guide on how to complete c 104g form

Effortlessly complete C 104g Form on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle C 104g Form on any platform using the airSlate SignNow applications for Android or iOS, and enhance your document-driven processes today.

The simplest method to alter and eSign C 104g Form with ease

- Locate C 104g Form and click on Get Form to initiate the process.

- Make use of the tools we offer to complete your form.

- Emphasize essential sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign C 104g Form to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c 104g form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the C 104g Form and why is it important?

The C 104g Form is a crucial document used in various legal and business processes. It helps ensure compliance with regulations and facilitates smoother transactions. Understanding its significance is essential for businesses looking to operate effectively.

-

How can airSlate SignNow assist with completing the C 104g Form?

airSlate SignNow streamlines the process of completing the C 104g Form by allowing users to fill out, sign, and send the document electronically. Our platform provides an intuitive interface that simplifies form handling and reduces turnaround times. This efficiency can greatly enhance your document workflow.

-

Is there a cost associated with using airSlate SignNow to manage the C 104g Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions ensure that you get the functionality required to manage the C 104g Form efficiently without breaking the bank. You can compare plans on our website to find the best fit for your organization.

-

What features does airSlate SignNow provide for the C 104g Form?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time tracking for the C 104g Form. These features enhance the document management process, ensuring that you can handle your forms accurately and quickly. Furthermore, the platform offers compliance standards to protect your data.

-

Are there any integrations available for the C 104g Form with airSlate SignNow?

Absolutely! airSlate SignNow integrates with numerous third-party applications, making it easy to include the C 104g Form in your existing workflows. Whether you use CRM, document management, or cloud storage systems, we have you covered. This flexibility enhances productivity and streamlines processes.

-

How does airSlate SignNow ensure the security of the C 104g Form?

Security is a top priority for airSlate SignNow. We employ robust encryption methods and comply with industry standards to safeguard your C 104g Form and any associated documents. You can trust that your sensitive information remains protected while utilizing our platform.

-

What are the benefits of using airSlate SignNow for the C 104g Form?

Using airSlate SignNow for the C 104g Form provides numerous benefits, including reduced paperwork, faster processing times, and enhanced collaboration among team members. Our platform’s ease of use and cost-effectiveness make it a preferred choice for businesses of all sizes looking to optimize their document management.

Get more for C 104g Form

- Printable order form delasco

- Central high school transcript request form

- Biennial drug manufacturing license renewal application form

- Blank written pregnancy test form

- Nys it 201 fillable form 702387945

- Accumulation program for part time and limited service keenan form

- Printable fincen form 114

- Group contract template form

Find out other C 104g Form

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure