Nys it 201 Fillable Form 2023-2026

What is the NYS IT 201 Fillable Form

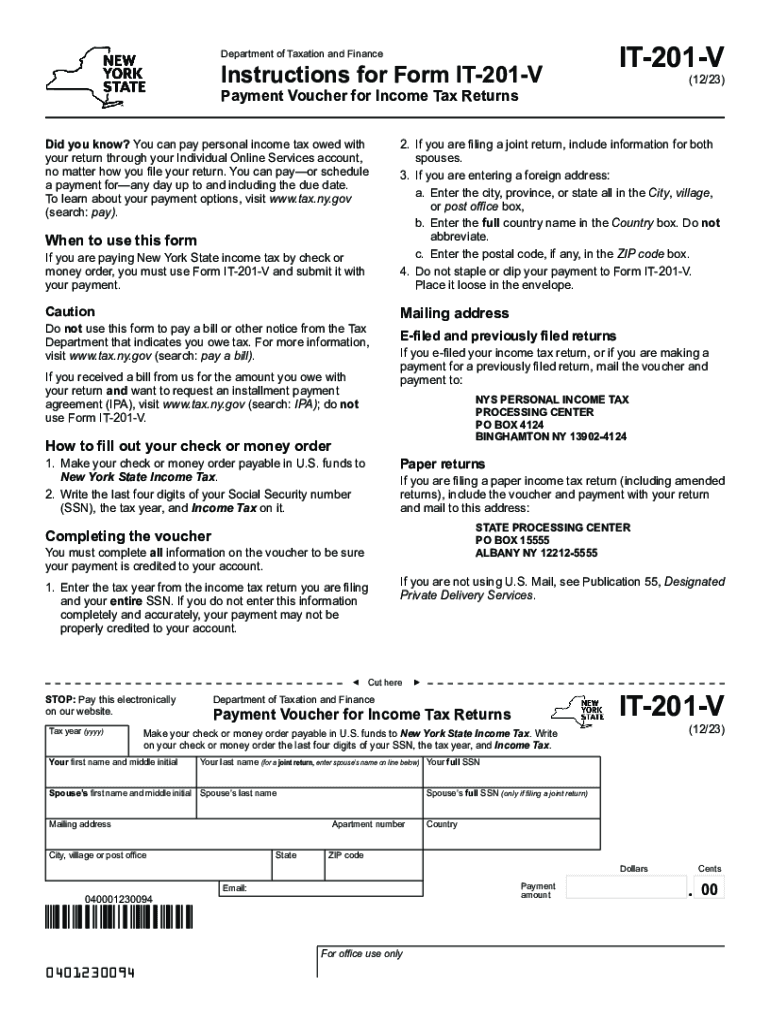

The NYS IT 201 fillable form is a tax document used by residents of New York State to report their income and calculate their tax liability. This form is specifically designed for individual taxpayers who need to file their annual state income tax returns. The IT 201 form captures various income sources, deductions, and credits, allowing taxpayers to determine their total tax owed or refund due. It is essential for accurately reporting income and ensuring compliance with state tax laws.

How to Use the NYS IT 201 Fillable Form

Using the NYS IT 201 fillable form involves several steps. First, download the form from the New York State Department of Taxation and Finance website or access it through a tax preparation software that supports NYS forms. Fill out the form by entering your personal information, income details, and any applicable deductions or credits. Ensure that all entries are accurate to avoid delays in processing. Once completed, you can submit the form electronically or print it for mailing. Always keep a copy for your records.

Steps to Complete the NYS IT 201 Fillable Form

Completing the NYS IT 201 fillable form requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources in the designated sections.

- Claim any deductions or credits you qualify for, such as the standard deduction or itemized deductions.

- Calculate your total tax liability and determine if you owe taxes or are due a refund.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the NYS IT 201 fillable form. Typically, the deadline for submitting your state income tax return is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you are unable to file by the deadline, you may request an extension, but any taxes owed must still be paid by the original due date to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The NYS IT 201 fillable form can be submitted through various methods to accommodate taxpayer preferences. You can file your return electronically using approved tax software, which often provides a faster processing time and quicker refunds. Alternatively, you may print the completed form and mail it to the appropriate address specified in the instructions. In-person filing is also an option at designated tax offices, but it is advisable to check for any specific requirements or appointments needed for in-person submissions.

Required Documents

When completing the NYS IT 201 fillable form, certain documents are essential to ensure accurate reporting of income and deductions. Required documents typically include:

- W-2 forms from employers showing your earnings and withheld taxes.

- 1099 forms for any freelance work or other income sources.

- Records of any other income, such as rental or investment income.

- Documentation for deductions, including mortgage interest statements and property tax receipts.

- Any relevant receipts or documents that support credits claimed.

Quick guide on how to complete nys it 201 fillable form 702387945

Complete Nys It 201 Fillable Form effortlessly on any device

Digital document management has become signNowly more prevalent among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Nys It 201 Fillable Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Nys It 201 Fillable Form effortlessly

- Obtain Nys It 201 Fillable Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your requirements in document management in just a few clicks from any device you choose. Alter and eSign Nys It 201 Fillable Form and ensure great communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys it 201 fillable form 702387945

Create this form in 5 minutes!

How to create an eSignature for the nys it 201 fillable form 702387945

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 201 v. and how does it benefit my business?

It 201 v. is an innovative electronic signature solution designed to streamline document management processes. By utilizing it 201 v., businesses can efficiently send, sign, and manage documents digitally, reducing paperwork and enhancing productivity.

-

How much does it 201 v. cost?

The pricing for it 201 v. is competitive and tailored to fit various business needs. We offer flexible subscription plans that range from basic to premium options, providing excellent value for organizations of any size.

-

What features does it 201 v. include?

It 201 v. comes packed with features such as template creation, real-time tracking, and compliance with eSignature laws. These functionalities enable businesses to customize their document workflows and ensure secure, legally binding signatures.

-

Is it 201 v. easy to integrate with other applications?

Absolutely! It 201 v. seamlessly integrates with various third-party applications, including CRM systems and cloud storage solutions. This allows businesses to enhance their existing systems and workflows without disruption.

-

Can I use it 201 v. for international transactions?

Yes, it 201 v. is designed to accommodate international transactions by adhering to eSignature laws globally. This means you can confidently send and sign documents with clients, partners, or employees around the world.

-

What kind of customer support is available for it 201 v. users?

Users of it 201 v. have access to dedicated customer support via various channels, including email, live chat, and phone. We're committed to ensuring that all your questions are answered promptly to help you maximize the benefits of our service.

-

Are there security features included in it 201 v.?

Yes, it 201 v. incorporates advanced security features such as encryption, multi-factor authentication, and secure cloud storage. These measures are in place to protect your sensitive documents and maintain the integrity of your transactions.

Get more for Nys It 201 Fillable Form

- Stonington harbor waiting list application form town of stonington stonington ct

- Name address dear sir affin bank berhad form

- Amendments in nic amp asicc2000 form

- Example of ca tax certificate form

- Mtsu flight lab request form

- The mughal empire in india answer key form

- Cal poly safety inspection checklist laboratory afd cal poly form

- Transcript request form purchase college purchase

Find out other Nys It 201 Fillable Form

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile