Multi Parcel Tax Exemption Report Form PC 220A Revenue Wi

What is the Multi Parcel Tax Exemption Report Form PC 220A Revenue WI

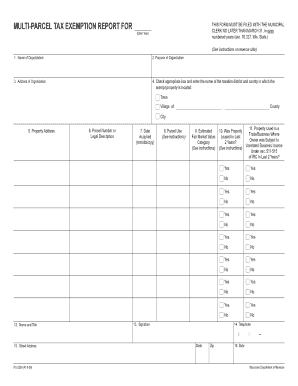

The Multi Parcel Tax Exemption Report Form PC 220A Revenue WI is a crucial document used in Wisconsin for property tax exemption purposes. This form is specifically designed for property owners who wish to report multiple parcels of land that may qualify for tax exemptions. It serves as a means to communicate relevant information about the properties to the local tax authorities, ensuring that they are assessed correctly for tax purposes. Understanding the purpose and requirements of this form is essential for property owners aiming to benefit from available tax exemptions.

Steps to Complete the Multi Parcel Tax Exemption Report Form PC 220A Revenue WI

Completing the Multi Parcel Tax Exemption Report Form PC 220A requires careful attention to detail. Here are the key steps to follow:

- Gather necessary documentation, including property deeds and previous tax statements.

- Fill out the form accurately, ensuring all required fields are completed, such as property descriptions and ownership details.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, ensuring compliance with eSignature regulations.

- Submit the form to the appropriate local tax authority by the specified deadline.

Legal Use of the Multi Parcel Tax Exemption Report Form PC 220A Revenue WI

The legal use of the Multi Parcel Tax Exemption Report Form PC 220A hinges on its compliance with state regulations governing property tax exemptions. To ensure that the form is legally binding, it must be filled out correctly and submitted within the designated time frame. Additionally, electronic signatures must adhere to the requirements set forth by the ESIGN Act and UETA, which validate the authenticity of the signer's identity. Utilizing a reliable eSignature solution can help maintain compliance and ensure the document's legal standing.

State-Specific Rules for the Multi Parcel Tax Exemption Report Form PC 220A Revenue WI

Wisconsin has specific rules and guidelines that govern the use of the Multi Parcel Tax Exemption Report Form PC 220A. These rules include eligibility criteria for property owners, the types of properties that qualify for exemption, and the deadlines for submission. Familiarizing oneself with these state-specific regulations is essential for property owners to maximize their tax benefits and avoid potential penalties. It is advisable to consult local tax authorities or legal resources for the most current information regarding these rules.

How to Obtain the Multi Parcel Tax Exemption Report Form PC 220A Revenue WI

Property owners can obtain the Multi Parcel Tax Exemption Report Form PC 220A through various means. The form is typically available on the official Wisconsin Department of Revenue website, where users can download it in a digital format. Additionally, local tax offices may provide physical copies of the form upon request. Ensuring that you have the most recent version of the form is important, as updates may occur that affect its content and requirements.

Examples of Using the Multi Parcel Tax Exemption Report Form PC 220A Revenue WI

Understanding how to effectively use the Multi Parcel Tax Exemption Report Form PC 220A can be illustrated through various scenarios. For instance, a property owner with multiple rental properties may use the form to report each parcel and apply for tax exemptions based on their usage. Similarly, a nonprofit organization owning several properties may utilize the form to ensure they receive the appropriate tax benefits. These examples highlight the form's versatility in accommodating different property ownership situations.

Quick guide on how to complete multi parcel tax exemption report form pc 220a revenue wi

Complete Multi parcel Tax Exemption Report Form PC 220A Revenue Wi seamlessly on any device

Managing documents online has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Multi parcel Tax Exemption Report Form PC 220A Revenue Wi on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest method to modify and electronically sign Multi parcel Tax Exemption Report Form PC 220A Revenue Wi effortlessly

- Find Multi parcel Tax Exemption Report Form PC 220A Revenue Wi and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize necessary parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Multi parcel Tax Exemption Report Form PC 220A Revenue Wi and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the multi parcel tax exemption report form pc 220a revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PC 220 Wisconsin, and how does it integrate with airSlate SignNow?

The PC 220 Wisconsin is a regulatory framework that governs electronic signatures within the state. airSlate SignNow complies with this framework, ensuring all documents eSigned through our platform are legally binding and compliant with Wisconsin law.

-

How much does airSlate SignNow cost for businesses in Wisconsin?

airSlate SignNow offers flexible pricing plans tailored to businesses in Wisconsin, starting at an affordable monthly rate. Depending on the features and number of users, the cost may vary to fit the needs of your organization while ensuring compliance with PC 220 Wisconsin.

-

What features are included with airSlate SignNow for PC 220 Wisconsin compliance?

airSlate SignNow includes a range of features such as secure eSignature workflows, document templates, and real-time tracking. These features are designed to ensure compliance with PC 220 Wisconsin and enhance the efficiency of your document management.

-

Can airSlate SignNow help businesses in Wisconsin with document storage and retrieval?

Yes, airSlate SignNow provides secure cloud-based document storage, which allows businesses in Wisconsin to easily store, retrieve, and manage their signed documents. By following the guidelines of PC 220 Wisconsin, your documents remain secure and accessible whenever needed.

-

What are the benefits of using airSlate SignNow for businesses in Wisconsin?

Using airSlate SignNow streamlines the signing process, reduces paper waste, and enhances productivity for businesses in Wisconsin. Compliance with PC 220 Wisconsin ensures that all electronic signatures are valid and enforceable, making the transition to digital workflows seamless.

-

Does airSlate SignNow integrate with other software solutions native to Wisconsin?

Absolutely! airSlate SignNow offers integrations with popular software solutions that Wisconsin businesses often use, including CRM systems and cloud storage services. These integrations work smoothly while adhering to the standards set by PC 220 Wisconsin.

-

Is support available for businesses utilizing airSlate SignNow in accordance with PC 220 Wisconsin?

Yes, airSlate SignNow provides dedicated customer support to assist businesses in Wisconsin. Our team is well-versed in the specifications of PC 220 Wisconsin and can help with any questions regarding compliance, features, or troubleshooting.

Get more for Multi parcel Tax Exemption Report Form PC 220A Revenue Wi

- Affidavit of support italy in detroit consdetroit esteri form

- Room change request form

- Nj mvc os ss 87 form

- Individual abuse prevention plan sample form

- Dhs 3163b eng referral to support and collections this form is used by minnesota family investment program diversionary work

- About va form 21 4142aveterans affairs

- Sc dhec division of ems amp trauma state re certification form scdhec

- Circumcisionpenis surgery post operative instructions musc form

Find out other Multi parcel Tax Exemption Report Form PC 220A Revenue Wi

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF