Ohio Commercial Activity Tax Return Form

What is the Ohio Commercial Activity Tax Return Form

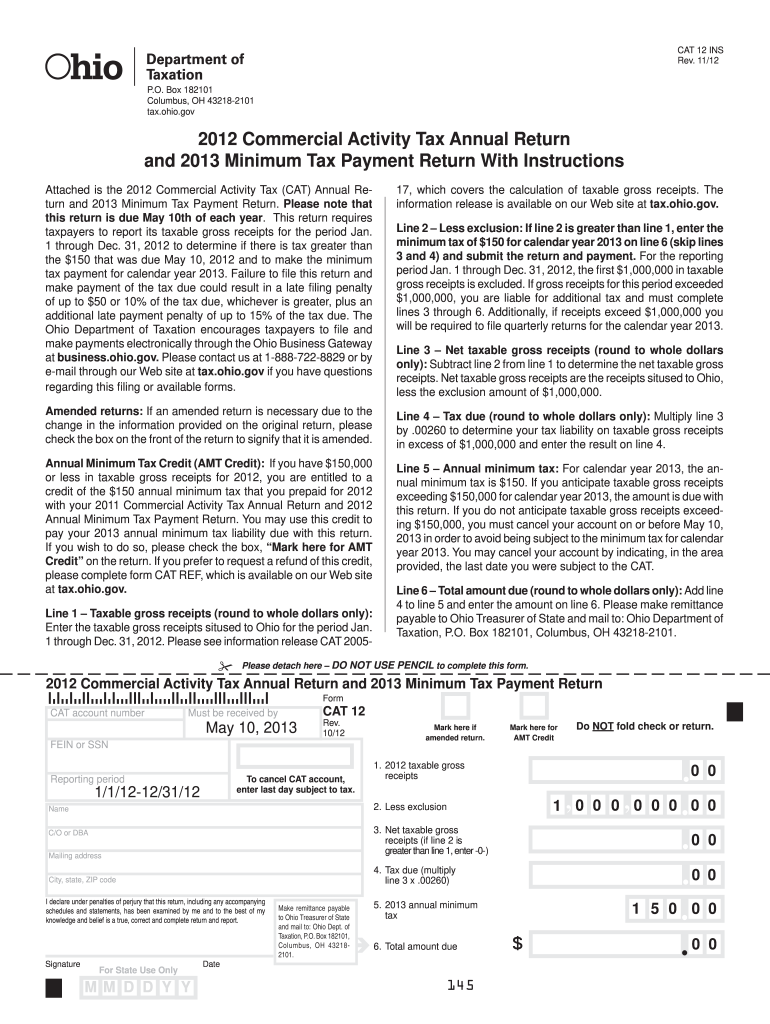

The Ohio Commercial Activity Tax Return Form is a document used by businesses operating in Ohio to report their gross receipts and calculate their tax liability under the state's commercial activity tax (CAT). This tax applies to businesses with gross receipts exceeding one million dollars annually. The form requires detailed information about the business's revenue, deductions, and any applicable credits. Proper completion of this form is essential for compliance with Ohio tax laws.

Steps to complete the Ohio Commercial Activity Tax Return Form

Completing the Ohio Commercial Activity Tax Return Form involves several key steps:

- Gather necessary financial documents, including revenue statements and expense reports.

- Calculate total gross receipts for the reporting period.

- Determine any available deductions, such as those for certain types of sales or receipts.

- Fill out the form accurately, entering all required information in the designated fields.

- Review the completed form for errors or omissions before submission.

How to use the Ohio Commercial Activity Tax Return Form

The Ohio Commercial Activity Tax Return Form is used to report and pay the commercial activity tax. Businesses must fill out the form with accurate financial data and submit it to the Ohio Department of Taxation. The form can be completed electronically or on paper, depending on the preference of the business. It is important to follow the specific instructions provided with the form to ensure compliance and avoid penalties.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines for the Ohio Commercial Activity Tax Return Form to avoid late penalties. The tax is typically due on an annual basis, with specific dates varying based on the business's fiscal year. It is advisable to check the Ohio Department of Taxation's official schedule for the most current deadlines and ensure timely submission of the form.

Required Documents

To complete the Ohio Commercial Activity Tax Return Form, businesses need to gather several key documents, including:

- Financial statements detailing gross receipts.

- Records of any deductions claimed.

- Previous tax returns for reference.

- Any correspondence from the Ohio Department of Taxation related to the CAT.

Legal use of the Ohio Commercial Activity Tax Return Form

The Ohio Commercial Activity Tax Return Form must be used in accordance with Ohio tax laws. This includes ensuring that all information provided is accurate and complete. The form serves as a legal document, and any inaccuracies can lead to penalties or audits. Businesses should maintain records of their submissions and any supporting documentation for verification by tax authorities.

Quick guide on how to complete 2013 commercial activity tax annual return form

Effortlessly Complete Ohio Commercial Activity Tax Return Form on Any Device

Managing documents online has become increasingly popular with both businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle Ohio Commercial Activity Tax Return Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to Edit and eSign Ohio Commercial Activity Tax Return Form with Ease

- Find Ohio Commercial Activity Tax Return Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form - via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, frustrating form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Ohio Commercial Activity Tax Return Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

Can anyone share a link on how to fill out the GST and GST annual return?

The deadline for filing GST Return for the year 17–18 is fast approaching .To file the GST annual return you need to reconcile the data appearing in your returns with the data in your financial books.You can watch the below video to have a basic idea about filing GST annual returnEnglish :Hindi :

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

Create this form in 5 minutes!

How to create an eSignature for the 2013 commercial activity tax annual return form

How to make an eSignature for the 2013 Commercial Activity Tax Annual Return Form online

How to make an electronic signature for the 2013 Commercial Activity Tax Annual Return Form in Google Chrome

How to generate an eSignature for putting it on the 2013 Commercial Activity Tax Annual Return Form in Gmail

How to make an electronic signature for the 2013 Commercial Activity Tax Annual Return Form from your smart phone

How to generate an eSignature for the 2013 Commercial Activity Tax Annual Return Form on iOS devices

How to create an eSignature for the 2013 Commercial Activity Tax Annual Return Form on Android

People also ask

-

What are the ohio commercial activity tax instructions for businesses?

The ohio commercial activity tax instructions provide a comprehensive guide for businesses to comply with tax regulations in Ohio. These instructions outline the necessary steps for registration, filing, and payment processes to ensure that your business meets all requirements. Following these guidelines helps avoid penalties and ensures smooth operations.

-

How can airSlate SignNow help with ohio commercial activity tax instructions?

airSlate SignNow facilitates the signing and management of documents related to the ohio commercial activity tax instructions. With our platform, you can easily store, send, and eSign important tax-related documents securely and efficiently. This streamlines your compliance process and reduces the administrative burden.

-

What features does airSlate SignNow offer to support ohio commercial activity tax instructions?

airSlate SignNow offers features like customizable templates, audit trails, and real-time notifications, all of which are beneficial when following ohio commercial activity tax instructions. These tools help ensure that your document management aligns with tax deadlines and legal requirements. Additionally, you can track who has signed documents to maintain compliance.

-

Are there any costs associated with following ohio commercial activity tax instructions using airSlate SignNow?

Using airSlate SignNow for managing your documents related to the ohio commercial activity tax instructions is cost-effective. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you only pay for the features you need. This investment can ultimately save your business time and resources in the long run.

-

Can airSlate SignNow integrate with other tools for ohio commercial activity tax instructions?

Yes, airSlate SignNow can seamlessly integrate with various business tools that help you manage your finances more effectively while following the ohio commercial activity tax instructions. Integrations with platforms such as accounting software enhance your workflow and ensure all your tax documents are efficiently managed. This compatibility allows for greater flexibility and ease of use.

-

What are the benefits of using airSlate SignNow for ohio commercial activity tax instructions?

Using airSlate SignNow for ohio commercial activity tax instructions offers numerous benefits, including increased efficiency and reduced paperwork. Our digital solution eliminates the need for physical signatures and allows for quicker processing times, ensuring that you stay compliant. This also enhances security by safeguarding your sensitive tax documents.

-

How do I get started with airSlate SignNow for ohio commercial activity tax instructions?

Getting started with airSlate SignNow for ohio commercial activity tax instructions is simple. Sign up for our platform, and you can easily begin creating, sending, and signing documents related to your tax compliance needs. Our user-friendly interface makes it easy for anyone to navigate the process and start managing their documents effectively.

Get more for Ohio Commercial Activity Tax Return Form

- Withdrawal form for school

- Fsrp0023 form

- Rcmp form 6388

- Backflow test report city of seguin seguintexas form

- How to get old maybank statement form

- Federal mortgage bank of nigeria individual registration form

- Application for body craft studio permit dekalb county board of form

- Ethics consultation form

Find out other Ohio Commercial Activity Tax Return Form

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement