Form G 45 PDF

What is the Form G-45?

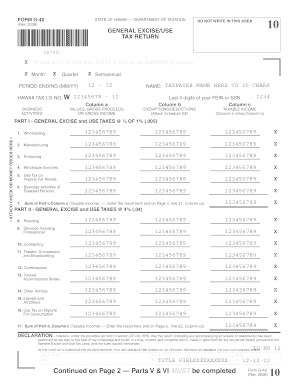

The Form G-45 is a tax document used in the State of Hawaii for reporting general excise tax. This form is essential for businesses that engage in activities subject to general excise tax, allowing them to report their income and calculate the tax owed to the state. The G-45 tax return must be filed periodically, typically on a quarterly basis, depending on the taxpayer's filing frequency. Understanding the purpose and requirements of the G-45 is crucial for compliance with state tax laws.

Steps to Complete the Form G-45

Completing the Form G-45 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and expense documentation. Next, accurately report your gross income from business activities in the appropriate sections of the form. After calculating your general excise tax liability based on the reported income, ensure that all figures are correctly totaled. Finally, review the completed form for any errors before submission to avoid penalties.

Legal Use of the Form G-45

The legal use of the Form G-45 is governed by Hawaii state tax regulations. Filing this form is mandatory for businesses that earn income subject to general excise tax. It is crucial to adhere to the filing deadlines and accurately report all income to maintain compliance with state laws. Failure to submit the G-45 or inaccuracies in reporting can lead to penalties, interest on unpaid taxes, and potential legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Form G-45 vary based on the taxpayer's reporting period. Generally, the form must be submitted quarterly, with specific due dates falling on the last day of the month following the end of each quarter. For example, the deadline for the first quarter (January to March) is April 20. It is important to stay informed about these dates to avoid late fees and maintain good standing with the Hawaii Department of Taxation.

Form Submission Methods

The Form G-45 can be submitted through various methods to accommodate different preferences. Taxpayers may file the form online through the Hawaii Department of Taxation's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Required Documents

When completing the Form G-45, certain documents are required to ensure accurate reporting. These include records of all sales and income generated during the reporting period, receipts for any allowable deductions, and previous tax returns if applicable. Keeping organized financial records will facilitate the completion of the G-45 and support the accuracy of reported figures, which is essential for compliance with tax regulations.

Examples of Using the Form G-45

The Form G-45 is utilized by various types of businesses in Hawaii, including retail shops, restaurants, and service providers. For instance, a small retail store must report its total sales and calculate the general excise tax owed based on its gross income. Similarly, a restaurant would report its sales from food and beverage services on the G-45. These examples illustrate the form's importance in ensuring that businesses fulfill their tax obligations while contributing to state revenue.

Quick guide on how to complete form g 45 pdf 33897587

Easily Prepare Form G 45 Pdf on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle Form G 45 Pdf on any device using the airSlate SignNow apps for Android or iOS, and streamline your document-related tasks today.

The Simplest Way to Modify and Electronically Sign Form G 45 Pdf

- Locate Form G 45 Pdf and click Get Form to begin.

- Make use of the provided tools to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form G 45 Pdf and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form g 45 pdf 33897587

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a g45 form, and why is it important?

The g45 form is a crucial document used for various official purposes, including tax filings and administrative processes. Understanding the g45 form is essential to ensure compliance and avoid potential penalties. Using airSlate SignNow, you can easily prepare, send, and eSign your g45 form securely.

-

How much does using airSlate SignNow for g45 form transactions cost?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it a cost-effective solution for managing your g45 form processes. Pricing varies based on the features you select and the number of users. Visit our pricing page for detailed information on the best plan for your needs.

-

What features does airSlate SignNow offer for managing the g45 form?

airSlate SignNow provides a range of features to streamline the management of the g45 form, including customizable templates, automated workflows, and secure eSigning. These features help you save time and reduce errors during the document completion process. The user-friendly interface also simplifies the entire experience.

-

Can I integrate airSlate SignNow with other tools for g45 form submissions?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems to facilitate g45 form submissions. This allows you to connect your existing workflows and enhance efficiency. Simply set up your integrations through our easy-to-use dashboard.

-

Is airSlate SignNow suitable for teams working with g45 forms?

Absolutely! airSlate SignNow is designed for teams of all sizes, providing collaborative features that enable multiple users to work on g45 forms together. Team members can review, edit, and sign documents in real-time, signNowly improving productivity and communication within your organization.

-

How secure is airSlate SignNow when handling g45 forms?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents like the g45 form. We implement industry-standard encryption, secure access controls, and compliance with regulations such as GDPR and HIPAA. Rest assured that your g45 forms are protected throughout their lifecycle.

-

What benefits can I expect when using airSlate SignNow for g45 forms?

Using airSlate SignNow for your g45 forms offers numerous benefits, including reduced turnaround times, enhanced accuracy, and improved compliance. The platform simplifies document management, allowing you to focus on your core business activities rather than paperwork. Additionally, eSigning enhances the efficiency of getting approvals.

Get more for Form G 45 Pdf

- Living will arkansas form

- Optimum business name change form 100754339

- Medical term detectives worksheet answers form

- Play google comstorebooksvariations in chemical character of water in the englishtown form

- Canada pension plan death benefit application form

- Editable homeschool high school transcript template form

- Occupational rent agreement template form

- Occupancy agreement template form

Find out other Form G 45 Pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors