Travel Business Expense Report Travel Business Expense Report Form

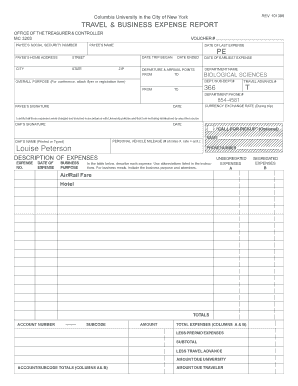

What is the Travel Business Expense Report?

The Travel Business Expense Report is a document used by businesses to track and report expenses incurred during business travel. This report helps organizations manage travel costs, ensuring that all expenditures are accounted for and reimbursed accurately. It typically includes details such as transportation, lodging, meals, and other travel-related expenses. By maintaining a structured report, businesses can streamline their accounting processes and ensure compliance with internal policies and IRS regulations.

How to Use the Travel Business Expense Report

Using the Travel Business Expense Report involves several key steps to ensure accuracy and completeness. First, gather all relevant receipts and documentation related to your travel expenses. Next, fill out the report by categorizing expenses into sections such as transportation, lodging, meals, and incidentals. Be sure to include the date, purpose of the trip, and any other required information. Once completed, submit the report to the appropriate department for review and reimbursement. Keeping a copy for your records is also advisable.

Steps to Complete the Travel Business Expense Report

Completing the Travel Business Expense Report involves a systematic approach:

- Collect all receipts and invoices related to your travel.

- Fill in personal and trip details, including dates and destinations.

- Itemize each expense, specifying the amount and category.

- Attach supporting documents, such as receipts, to validate your claims.

- Review the report for accuracy before submission.

Key Elements of the Travel Business Expense Report

Essential components of the Travel Business Expense Report include:

- Traveler Information: Name, position, and department of the individual submitting the report.

- Trip Details: Dates of travel, destination, and purpose of the trip.

- Expense Categories: Breakdown of costs into categories such as transportation, lodging, meals, and other expenses.

- Receipts: Documentation supporting each claimed expense.

IRS Guidelines

The IRS provides specific guidelines for business travel expenses, which must be adhered to when completing the Travel Business Expense Report. Expenses must be ordinary and necessary for the business, and proper documentation is required for deductions. The IRS also stipulates that expenses should be substantiated with receipts and that any reimbursements must be reported accurately. Familiarizing yourself with these guidelines can help ensure compliance and prevent issues during audits.

Form Submission Methods

The Travel Business Expense Report can typically be submitted through various methods, depending on your organization's policies. Common submission methods include:

- Online Submission: Many companies use digital platforms for submitting expense reports, allowing for quick processing.

- Mail: Some organizations may require physical copies to be mailed to the finance department.

- In-Person: Submitting the report directly to a supervisor or finance representative may also be an option.

Quick guide on how to complete travel business expense report travel business expense report

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only a few seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, exhausting document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign [SKS] to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Travel Business Expense Report Travel Business Expense Report

Create this form in 5 minutes!

How to create an eSignature for the travel business expense report travel business expense report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Travel Business Expense Report?

A Travel Business Expense Report is a document used by businesses to track and manage expenses incurred during business travel. It helps in organizing receipts and justifying travel costs, ensuring that employees are reimbursed accurately and promptly.

-

How can airSlate SignNow help with Travel Business Expense Reports?

airSlate SignNow streamlines the process of creating and managing Travel Business Expense Reports by allowing users to easily eSign and send documents. This simplifies the approval process and ensures that all necessary signatures are collected efficiently.

-

What features does airSlate SignNow offer for Travel Business Expense Reports?

airSlate SignNow offers features such as customizable templates for Travel Business Expense Reports, automated workflows, and secure eSigning. These features enhance productivity and ensure that expense reports are processed quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for Travel Business Expense Reports?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides a cost-effective solution for managing Travel Business Expense Reports, making it accessible for businesses of all sizes.

-

Can airSlate SignNow integrate with other tools for managing Travel Business Expense Reports?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and project management tools, enhancing the management of Travel Business Expense Reports. This integration allows for better tracking and reporting of expenses across platforms.

-

What are the benefits of using airSlate SignNow for Travel Business Expense Reports?

Using airSlate SignNow for Travel Business Expense Reports offers numerous benefits, including increased efficiency, reduced paperwork, and faster reimbursement times. It also enhances compliance and accuracy in expense reporting.

-

How secure is airSlate SignNow when handling Travel Business Expense Reports?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect sensitive information in Travel Business Expense Reports. This ensures that all data is secure and compliant with industry standards.

Get more for Travel Business Expense Report Travel Business Expense Report

- 11 may but the health insurance claim form submitted to interstate brands was signed by a different doctor and listed different

- Form 6765 rev december credit for increasing research activities

- Psa to tx agents there is a new contract mandatory for form

- Complaint form for allegations of discrimination in programs or

- Form 5834 owner out of state title request

- Application for e6 t o o 5 vacancies personnel dat form

- People of the state of california defendant advisement form

- Krn sup crt cr 0415 notice waiver rights request remote form

Find out other Travel Business Expense Report Travel Business Expense Report

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple