Qualified Income Trust Texas Template Form

What is the Qualified Income Trust Texas Template

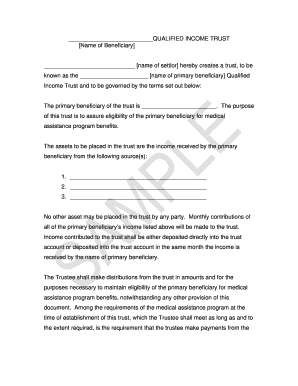

The Qualified Income Trust (QIT) Texas template is a legal document designed to help individuals qualify for Medicaid benefits while managing their income. This template outlines how income is to be deposited into the trust, ensuring that the beneficiary's income does not exceed the Medicaid eligibility limit. The QIT is often referred to as a Miller Trust in Texas, named after a court case that established its use. By utilizing this template, individuals can safeguard their eligibility for essential healthcare services without losing their income to Medicaid's asset limits.

How to use the Qualified Income Trust Texas Template

Using the Qualified Income Trust Texas template involves several key steps. First, individuals must fill out the template with accurate personal information, including the beneficiary's name, address, and income details. Next, the trust must be established by designating a trustee who will manage the funds. Once completed, the document should be signed and dated by the trustee and the beneficiary. It is crucial to ensure that all income is directed into the trust account to maintain compliance with Medicaid regulations. Regular monitoring of the trust account is also necessary to ensure that it remains within the allowable income limits.

Steps to complete the Qualified Income Trust Texas Template

Completing the Qualified Income Trust Texas template requires careful attention to detail. Here are the essential steps:

- Obtain the Qualified Income Trust Texas template from a reliable source.

- Fill in the beneficiary's personal information, including their full name and address.

- Designate a trustee who will manage the trust and ensure compliance with Medicaid requirements.

- Specify the income sources that will be deposited into the trust.

- Sign and date the document in the presence of a notary public to ensure its legal validity.

- Open a trust account at a financial institution to hold the income.

- Regularly deposit income into the trust account and maintain accurate records.

Legal use of the Qualified Income Trust Texas Template

The legal use of the Qualified Income Trust Texas template is essential for individuals seeking Medicaid benefits. This document must comply with state laws and federal regulations governing Medicaid eligibility. It is important to ensure that the trust is irrevocable and that all income is directed to the trust account. Failure to adhere to these legal requirements can result in the loss of Medicaid eligibility. Consulting with a legal professional experienced in elder law or Medicaid planning is advisable to ensure proper use of the template.

Key elements of the Qualified Income Trust Texas Template

The Qualified Income Trust Texas template includes several key elements that are crucial for its effectiveness:

- Beneficiary Information: Detailed personal information about the individual eligible for Medicaid.

- Trustee Designation: Identification of the person responsible for managing the trust.

- Income Sources: Specification of all income that will be deposited into the trust.

- Signatures: Required signatures from both the beneficiary and the trustee, along with notarization.

- Compliance Statements: Clauses ensuring adherence to Medicaid regulations.

Eligibility Criteria

To qualify for a Qualified Income Trust in Texas, certain eligibility criteria must be met. The individual must be applying for Medicaid benefits and have income that exceeds the allowable limit set by the state. Additionally, the individual must be a Texas resident and must not have excess assets beyond the Medicaid limits. The trust must be established specifically for the purpose of qualifying for Medicaid, and all income must be directed into the trust account to maintain eligibility.

Quick guide on how to complete qualified income trust texas template

Complete Qualified Income Trust Texas Template seamlessly on any gadget

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the appropriate form and securely save it on the web. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Qualified Income Trust Texas Template on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Qualified Income Trust Texas Template with ease

- Find Qualified Income Trust Texas Template and then click Get Form to begin.

- Make use of the tools provided to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your adjustments.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Qualified Income Trust Texas Template and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the qualified income trust texas template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a qualified income trust form?

A qualified income trust form is a legal document that allows individuals to qualify for Medicaid while exceeding their income limits. By using this form, applicants can redirect excess income into the trust, ensuring they can still receive essential medical services. It's crucial for anyone looking to manage their income effectively within Medicaid guidelines.

-

How do I complete a qualified income trust form?

Completing a qualified income trust form involves providing detailed information about your income, assets, and beneficiaries. Ensure that all income above the Medicaid limit is accounted for in the trust. For best results, consider seeking guidance from a legal expert familiar with Medicaid regulations.

-

What are the benefits of using a qualified income trust form?

The primary benefit of using a qualified income trust form is that it allows individuals to legally qualify for Medicaid despite having income over the limit. This can provide access to vital health care services and reduce overall medical costs. Additionally, it helps in managing financial resources wisely.

-

Is there a fee associated with the qualified income trust form?

Fees associated with the qualified income trust form can vary depending on your state and the complexity of your situation. Some legal services may charge for assistance in drafting the form, while the form itself is often free to download. It's advisable to consult with a financial adviser to understand the potential costs involved.

-

Can I eSign my qualified income trust form?

Yes, you can eSign your qualified income trust form using airSlate SignNow, which offers secure and efficient eSignature solutions. The platform simplifies the signing process, making it easier to complete your documentation without the need for printing or physical mailing. This is particularly beneficial for time-sensitive submissions.

-

What features does airSlate SignNow offer for managing qualified income trust forms?

airSlate SignNow provides a range of features for managing qualified income trust forms, including customizable templates, secure eSigning, and document tracking. The platform's user-friendly interface allows for streamlined document management, making it easier to store and retrieve your forms as needed. Integration with other software solutions enhances its utility for businesses.

-

How does using a qualified income trust form affect my assets?

Using a qualified income trust form allows you to allocate excess income into the trust without impacting your countable assets for Medicaid eligibility. This means your assets can remain intact while you qualify for necessary medical assistance. It’s essential to understand how the trust operates to safeguard your financial future.

Get more for Qualified Income Trust Texas Template

- Measuring trees gizmo answer key form

- Employee credit card agreement pdf form

- Social security card template photoshop form

- Account for incapacitated adult form

- Blank psychiatric document form

- 2024form mo1120corporation income tax return gener

- Profit interest agreement template form

- Profit participating loan agreement template form

Find out other Qualified Income Trust Texas Template

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document