Texas Form 05 102 Instructions

What is the Texas Form 05 102 Instructions

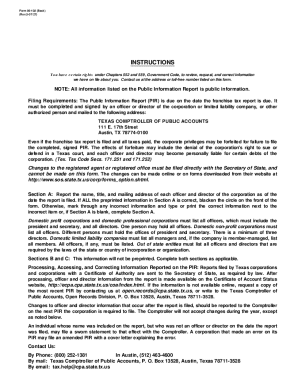

The Texas Form 05 102 instructions provide essential guidance for completing the Public Information Report. This form is crucial for businesses in Texas, as it outlines the necessary information required to comply with state franchise tax regulations. Understanding the instructions ensures that all required details are accurately reported, helping to avoid potential penalties or issues with compliance.

Steps to complete the Texas Form 05 102 Instructions

Completing the Texas Form 05 102 involves several key steps:

- Gather necessary information about your business, including entity type, financial data, and ownership details.

- Review the specific sections outlined in the instructions to understand what information is required.

- Fill out the form carefully, ensuring that all fields are completed accurately.

- Double-check your entries for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid any late fees or penalties.

Legal use of the Texas Form 05 102 Instructions

The Texas Form 05 102 instructions are designed to ensure compliance with state laws regarding franchise taxes. Proper adherence to these instructions is legally required for businesses operating in Texas. An accurate submission not only fulfills legal obligations but also protects businesses from potential audits and fines.

Form Submission Methods (Online / Mail / In-Person)

The Texas Form 05 102 can be submitted through various methods, providing flexibility for businesses:

- Online: Many businesses prefer to file electronically, which can streamline the process and provide immediate confirmation of receipt.

- Mail: If preferred, businesses can print the completed form and mail it to the appropriate state agency.

- In-Person: Submitting the form in person at designated state offices is also an option for those who require direct assistance.

Required Documents

When completing the Texas Form 05 102, several documents may be required to support your submission:

- Financial statements for the reporting period.

- Documentation of ownership and management structure.

- Any prior tax filings that may be relevant to the current report.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Texas Form 05 102 to avoid penalties. Typically, the form must be submitted annually, with specific dates varying based on the business entity type. Businesses should mark their calendars to ensure timely compliance.

Quick guide on how to complete texas form 05 102 instructions 100019913

Effortlessly Prepare Texas Form 05 102 Instructions on Any Device

Digital document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the correct form and securely store it online. airSlate SignNow offers all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Texas Form 05 102 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and Electronically Sign Texas Form 05 102 Instructions with Ease

- Find Texas Form 05 102 Instructions and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight key sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Texas Form 05 102 Instructions and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas form 05 102 instructions 100019913

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the 05 102 instructions offered by airSlate SignNow?

The airSlate SignNow 05 102 instructions include essential features such as document eSigning, customizable templates, and secure cloud storage. These features streamline the signing process, making it efficient and user-friendly. Additionally, the platform ensures that your documents are safely stored and easily accessible.

-

How does airSlate SignNow facilitate compliance with the 05 102 instructions?

airSlate SignNow is designed to help users comply with the 05 102 instructions by providing an intuitive platform that automates workflows and maintains accurate records. This compliance is further ensured by the advanced security measures and legally binding signatures that the service integrates. You can confidently manage your documents while adhering to industry standards.

-

What pricing plans are available for the 05 102 instructions on airSlate SignNow?

airSlate SignNow offers competitive pricing plans for its 05 102 instructions, including options for small businesses and enterprises. Each plan is designed to cater to different business needs, ensuring teams can choose the most cost-effective solution. Incredibly, airSlate SignNow also offers a free trial to help potential customers evaluate the platform.

-

Can airSlate SignNow integrate with other applications for managing 05 102 instructions?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing the management of 05 102 instructions. Popular integrations include Google Workspace, Salesforce, and Microsoft Office. These integrations allow users to streamline their document workflows without needing to switch between different platforms.

-

What benefits do businesses gain by using airSlate SignNow for 05 102 instructions?

By using airSlate SignNow for 05 102 instructions, businesses improve efficiency by reducing the time spent on document processing. The platform also enhances collaboration among team members with real-time updates and visual document tracking. This results in faster turnaround times and improved customer satisfaction.

-

Is airSlate SignNow suitable for all types of businesses for managing 05 102 instructions?

Absolutely! airSlate SignNow is suitable for businesses of all sizes looking to manage 05 102 instructions effectively. Its user-friendly interface and robust features cater to the diverse needs of industries ranging from education to healthcare. Flexibility and scalability make it a great choice for any organization.

-

How secure is airSlate SignNow in handling 05 102 instructions?

Security is a priority for airSlate SignNow, especially concerning the handling of 05 102 instructions. The platform utilizes state-of-the-art encryption methods to protect sensitive information. Additionally, features like two-factor authentication and audit trails help ensure that your documents remain confidential and secure.

Get more for Texas Form 05 102 Instructions

- Form abs app 10

- Interactive logic model template evaluation support scotland evaluationsupportscotland org form

- Rajib signature style form

- Make up cooking lab form ocfsdorg

- Bhel haridwar pay slip form

- Infrared sauna consent form thinique

- S3 050048ims security extentions 3gpp 3gpp form

- Property transfer agreement template form

Find out other Texas Form 05 102 Instructions

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template