Usw10401 Form

What is the Usw10401

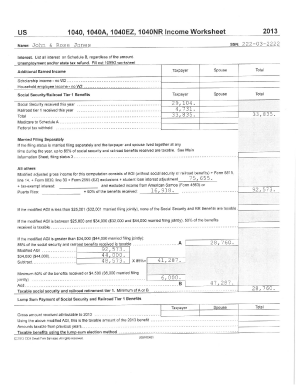

The Usw10401 form, commonly referred to as the A 1040EZ 1040NR income worksheet, is a crucial document used by U.S. taxpayers to report their income and calculate their tax obligations. This form is designed for various taxpayer scenarios, including individuals, families, and non-resident aliens. Understanding the purpose of the Usw10401 is essential for accurate tax filing and compliance with IRS regulations.

How to use the Usw10401

Using the Usw10401 involves several steps that guide taxpayers through the income reporting process. First, gather all necessary documents, such as W-2s, 1099s, and other income statements. Next, follow the instructions on the worksheet to input your income details accurately. The form helps calculate your total income, deductions, and ultimately your tax liability. It is important to review the completed worksheet for accuracy before submitting it to the IRS.

Steps to complete the Usw10401

Completing the Usw10401 requires careful attention to detail. Begin by entering your personal information, including your name and Social Security number. Next, report your income sources, such as wages, dividends, and interest. Follow the worksheet's prompts to deduct eligible expenses and calculate your adjusted gross income. Finally, determine your tax liability and any credits you may qualify for. Ensure all entries are accurate to avoid complications with your tax return.

Legal use of the Usw10401

The Usw10401 form must be completed and submitted in accordance with IRS regulations to be considered legally binding. This includes ensuring that all information is truthful and complete. Taxpayers are responsible for the accuracy of their submissions, and any discrepancies can lead to penalties or audits. Utilizing tools that provide electronic signatures and maintain compliance with eSignature laws can enhance the legal standing of your completed form.

IRS Guidelines

The IRS provides specific guidelines for completing the Usw10401, which include instructions on how to report various types of income and claim deductions. Taxpayers should refer to the IRS website or the instructions accompanying the form for the most up-to-date information. Adhering to these guidelines is crucial for ensuring that your tax return is processed correctly and efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the Usw10401 are typically set for April 15 of each year, although extensions may be available under certain circumstances. It is important to be aware of these dates to avoid penalties for late submissions. Taxpayers should mark their calendars for significant dates related to tax filing, including the start of the tax season and any changes announced by the IRS.

Required Documents

To complete the Usw10401 accurately, taxpayers must gather several key documents. These include W-2 forms from employers, 1099 forms for other income sources, and records of any deductions or credits claimed. Having these documents organized and readily available will streamline the process of filling out the worksheet and ensure that all necessary information is included.

Quick guide on how to complete usw10401

Complete Usw10401 seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, adjust, and eSign your documents swiftly without delays. Manage Usw10401 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Usw10401 effortlessly

- Find Usw10401 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tiresome document searches, or mistakes that require reprinting new document copies. airSlate SignNow accommodates all your document management requirements in just a few clicks from your preferred device. Adjust and eSign Usw10401 and ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the usw10401

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 1040a 1040ez 1040nr income worksheet?

The 1040 1040a 1040ez 1040nr income worksheet is a tax form used by individuals and certain non-residents to report their annual income to the IRS. This worksheet simplifies the process of calculating taxable income, deductions, and credits. By utilizing this worksheet, users can effectively prepare for filing their taxes while ensuring compliance with tax laws.

-

How can airSlate SignNow help with the 1040 1040a 1040ez 1040nr income worksheet?

airSlate SignNow streamlines the process of filling out the 1040 1040a 1040ez 1040nr income worksheet by allowing users to electronically sign and manage documents. Its user-friendly interface and e-signature capabilities enhance the efficiency of tax preparation. This service ensures that important tax documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the 1040 1040a 1040ez 1040nr income worksheet?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. The service provides a cost-effective solution for managing documents, including the 1040 1040a 1040ez 1040nr income worksheet. Users can choose a plan based on their specific needs and budget.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes a variety of features that facilitate efficient tax document management, such as e-signature functionality, document sharing, and cloud storage. It allows users to collaborate on the 1040 1040a 1040ez 1040nr income worksheet easily. Additionally, the platform ensures the security and compliance of sensitive information.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow offers integrations with popular tax preparation software and platforms. This compatibility allows users to seamlessly manage their 1040 1040a 1040ez 1040nr income worksheet alongside their other tax documents. Utilizing integrations can enhance workflow efficiency and accuracy in tax filing.

-

What benefits can I expect from using airSlate SignNow for my 1040 1040a 1040ez 1040nr income worksheet?

Using airSlate SignNow for your 1040 1040a 1040ez 1040nr income worksheet can signNowly reduce the time and effort spent on tax preparation. The platform enhances document accuracy, ensures that all necessary signatures are collected, and maintains a secure, organized archive of your tax documents. This simplicity and reliability make tax season much less stressful.

-

Is airSlate SignNow user-friendly for someone unfamiliar with tax documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with tax documents like the 1040 1040a 1040ez 1040nr income worksheet. The intuitive interface guides users through each step, ensuring that they can effectively manage their tax documents without advanced technical skills.

Get more for Usw10401

Find out other Usw10401

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now