Mississippi Farm Tax Affidavit Form

What is the Mississippi Farm Tax Affidavit

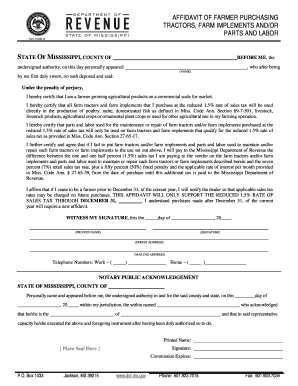

The Mississippi Farm Tax Affidavit is a legal document that allows qualifying farmers to claim tax exemptions on certain agricultural purchases. This affidavit serves as proof that the individual or entity is engaged in farming activities, which can lead to significant savings on sales tax for items used directly in agricultural production. The form must be completed accurately to ensure compliance with state regulations and to avoid any potential tax liabilities.

Steps to Complete the Mississippi Farm Tax Affidavit

Completing the Mississippi Farm Tax Affidavit involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your farming operation details and any relevant identification numbers. Next, fill out the form with precise information regarding your farming activities and the items for which you are seeking tax exemption. Once completed, review the affidavit for any errors or omissions. Finally, sign and date the form to validate it before submission.

Eligibility Criteria

To qualify for the Mississippi Farm Tax Affidavit, applicants must meet specific eligibility criteria set by the state. Generally, the individual or business must be actively engaged in farming operations, which includes cultivating crops, raising livestock, or producing agricultural products. Additionally, the items purchased must be directly related to the farming activities to qualify for the tax exemption. It is essential to verify that all criteria are met before submitting the affidavit to avoid any complications.

Required Documents

When applying for the Mississippi Farm Tax Affidavit, certain documents may be required to support your application. These typically include proof of farming activities, such as receipts for agricultural purchases, business licenses, and any relevant tax identification numbers. Having these documents ready can streamline the process and help ensure that your affidavit is processed without delays.

Legal Use of the Mississippi Farm Tax Affidavit

The Mississippi Farm Tax Affidavit is legally binding and must be used in accordance with state tax laws. It is essential to understand that submitting this affidavit falsely or with incorrect information can result in penalties, including fines or loss of tax exemption status. Therefore, it is crucial to ensure that all information provided is accurate and truthful to maintain compliance with legal requirements.

Form Submission Methods

The Mississippi Farm Tax Affidavit can be submitted through various methods to accommodate different preferences. Farmers may choose to submit the form online, which can expedite the processing time. Alternatively, the affidavit can be mailed to the appropriate tax authority or delivered in person at designated offices. Each method has its own advantages, so it is important to select the one that best fits your needs.

Examples of Using the Mississippi Farm Tax Affidavit

Farmers can utilize the Mississippi Farm Tax Affidavit in several scenarios to benefit from tax exemptions. For instance, a farmer purchasing seeds, fertilizers, or equipment specifically for agricultural use can submit this affidavit to avoid sales tax on those purchases. Additionally, livestock farmers may use the affidavit when buying feed or veterinary supplies, ensuring they do not incur unnecessary tax expenses on essential items for their operations.

Quick guide on how to complete mississippi farm tax affidavit 100980966

Effortlessly Prepare Mississippi Farm Tax Affidavit on Any Gadget

Digital document management has become increasingly favored among both businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Manage Mississippi Farm Tax Affidavit from any gadget using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Edit and Electronically Sign Mississippi Farm Tax Affidavit with Ease

- Obtain Mississippi Farm Tax Affidavit and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to preserve your modifications.

- Select how you want to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, cumbersome form navigation, or errors that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Mississippi Farm Tax Affidavit and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mississippi farm tax affidavit 100980966

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mississippi farm tax exemption form?

The Mississippi farm tax exemption form is a document that allows qualifying farmers to claim tax exemptions on certain agricultural purchases. By submitting this form, eligible farmers can reduce their tax liabilities related to farming activities. Understanding how to properly fill out this form is crucial for maximizing savings.

-

How can airSlate SignNow help with the Mississippi farm tax exemption form?

airSlate SignNow provides a seamless way to create, send, and eSign the Mississippi farm tax exemption form digitally. Our platform simplifies the process, enabling farmers to complete their forms quickly and easily. With airSlate SignNow, you can ensure that your forms are legally binding and securely stored.

-

Is there a cost associated with using airSlate SignNow for the Mississippi farm tax exemption form?

airSlate SignNow offers flexible pricing plans based on your needs, starting with a free trial. This allows you to explore the features available for managing the Mississippi farm tax exemption form without any initial cost. Depending on the plan you choose, you can benefit from additional features to streamline your document management.

-

What features does airSlate SignNow offer for the Mississippi farm tax exemption form?

airSlate SignNow offers features such as customizable templates, easy eSigning, and efficient document tracking for the Mississippi farm tax exemption form. These functionalities enhance the user experience by making it simple to fill out and send forms to the necessary parties. Additionally, you can automate reminders and notifications for better workflow management.

-

Can I integrate airSlate SignNow with other tools for managing the Mississippi farm tax exemption form?

Yes, airSlate SignNow supports integrations with various tools and platforms to optimize your workflow. You can connect it with popular applications like Google Drive, Dropbox, and CRM systems to manage the Mississippi farm tax exemption form efficiently. These integrations help streamline the process and keep your documents organized.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including the Mississippi farm tax exemption form, offers benefits like enhanced security, faster processing times, and reduced paper waste. Digital signatures are legally recognized, ensuring compliance and security. Additionally, you can access your documents anytime, making it easier to manage your tax-related paperwork.

-

Is airSlate SignNow compliant with Mississippi regulations for tax exemption forms?

Absolutely! airSlate SignNow is designed to comply with legal standards, including those specific to Mississippi tax exemption forms. This ensures that your completed Mississippi farm tax exemption form meets all regulatory requirements, giving you peace of mind while submitting your documentation.

Get more for Mississippi Farm Tax Affidavit

- Verification of residency form eng sweetwater union high rdm sweetwaterschools

- Af form 125

- Slip trip and fall hazards assessment checklist form

- How does merger form look like

- Cacfp infant meals parent preference letter kids town child form

- Form 3533 change of address for individuals form 3533 change of address for individuals

- Vermont tax form co 411 dana and rahman tukan

- California schedule ca 540nr unable to fill out part ii form

Find out other Mississippi Farm Tax Affidavit

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT