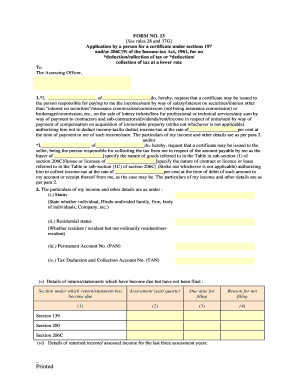

13 See Rules 28 and 37G Application by a Person for a Certificate under Sections 197 Andor 206C9 of the Income Tax Act, 1961, Fo Form

Understanding the 13 See Rules 28 And 37G Application

The 13 See Rules 28 And 37G Application by a person for a certificate under Sections 197 and/or 206C(9) of the Income Tax Act, 1961, is a crucial document for individuals and entities seeking to avoid or reduce tax deductions at source. This application allows taxpayers to request the assessing officer to issue a certificate for no deduction or a lower rate of tax deduction. It is particularly relevant for those who may not have a tax liability or who are eligible for lower tax rates based on specific criteria.

Steps to Complete the Application

Completing the 13 See Rules 28 And 37G Application requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including proof of income and tax liability.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach supporting documents that validate your request for no deduction or lower tax rates.

- Review the application for any errors or missing information before submission.

- Submit the application to the appropriate assessing officer, either electronically or by mail.

Legal Use of the Application

The application for a certificate under Sections 197 and/or 206C(9) is legally binding when completed correctly. It is essential to comply with all relevant tax laws and regulations to ensure the application is accepted. The document must be signed by the applicant, and it should reflect accurate information to avoid penalties or legal issues.

Required Documents for Submission

When applying for the 13 See Rules 28 And 37G certificate, specific documents are required to support your application. These typically include:

- Proof of identity, such as a driver's license or passport.

- Tax returns from previous years to demonstrate tax compliance.

- Financial statements or income proof to justify the request for a lower deduction rate.

Eligibility Criteria for the Application

To qualify for the 13 See Rules 28 And 37G Application, applicants must meet certain eligibility criteria. Generally, this includes:

- Being a resident taxpayer under the Income Tax Act.

- Having a valid reason for requesting no deduction or a lower rate.

- Providing sufficient documentation to support the application.

Application Process and Approval Time

The application process for the 13 See Rules 28 And 37G certificate involves submitting the completed form along with the required documentation to the assessing officer. The approval time can vary, but applicants should expect a response within a few weeks. It is advisable to follow up if there are delays to ensure timely processing.

Quick guide on how to complete 13 see rules 28 and 37g application by a person for a certificate under sections 197 andor 206c9 of the income tax act 1961 for

Prepare 13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 Andor 206C9 Of The Income tax Act, 1961, Fo effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the desired form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without hassles. Manage 13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 Andor 206C9 Of The Income tax Act, 1961, Fo on any device with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

How to alter and eSign 13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 Andor 206C9 Of The Income tax Act, 1961, Fo with ease

- Obtain 13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 Andor 206C9 Of The Income tax Act, 1961, Fo and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign 13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 Andor 206C9 Of The Income tax Act, 1961, Fo and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 13 see rules 28 and 37g application by a person for a certificate under sections 197 andor 206c9 of the income tax act 1961 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the '13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 Andor 206C9 Of The Income Tax Act, 1961'?

The '13 See Rules 28 And 37G Application' refers to a process that allows individuals and entities to apply for a certificate under Sections 197 and 206C(9) of the Income Tax Act, 1961. This certificate is essential for obtaining no tax deduction or a lower tax deduction when making payments to the Assessing Officer.

-

How does airSlate SignNow facilitate the application for these tax certificates?

airSlate SignNow streamlines the process of submitting the '13 See Rules 28 And 37G Application' by allowing users to prepare and eSign their applications online. This user-friendly platform ensures that businesses can quickly navigate the requirements without getting bogged down in paperwork.

-

Are there any costs associated with using airSlate SignNow for tax certificate applications?

airSlate SignNow offers a cost-effective solution to handle documentation related to the '13 See Rules 28 And 37G Application.' Pricing plans vary based on the features chosen, but they are designed to fit different business needs without sacrificing accessibility.

-

What features does airSlate SignNow offer that are relevant to tax compliance?

In addition to facilitating the '13 See Rules 28 And 37G Application,' airSlate SignNow provides features such as document templates, robust security measures, and customizable workflows. These features help ensure that businesses maintain compliance while streamlining their operations.

-

Can airSlate SignNow integrate with other financial software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various financial software systems, allowing users to link the '13 See Rules 28 And 37G Application' process with their existing financial workflows. This integration simplifies data management and enhances overall efficiency.

-

What benefits can businesses expect from using airSlate SignNow for tax certificate applications?

Using airSlate SignNow for submitting the '13 See Rules 28 And 37G Application' can signNowly reduce processing time and minimize errors. The platform empowers businesses to focus on their core activities while ensuring timely compliance with tax regulations.

-

Is there support available for users who have questions about the application process?

Absolutely! airSlate SignNow offers customer support to assist users with any queries related to the '13 See Rules 28 And 37G Application or other functionalities. Their knowledgeable team is available to help guide clients through the application and eSigning process.

Get more for 13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 Andor 206C9 Of The Income tax Act, 1961, Fo

- Warranty deed with life estate 3441588 form

- Income sensitive repayment plan form aspire resources inc

- Dpscs dcd 50 2 form

- Match the following words form

- E verify trademark license uscis uscis form

- Summer food service program sd department of education form

- Doj 488 tax waiver form

- Standard consulting agreement template form

Find out other 13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 Andor 206C9 Of The Income tax Act, 1961, Fo

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement