Maryland Tax Forms

What are the Maryland Tax Forms?

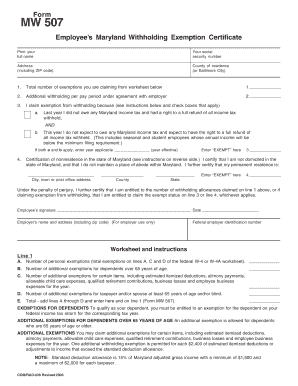

The Maryland tax forms are official documents used by individuals and businesses to report income, calculate taxes owed, and claim deductions or credits. These forms are essential for complying with state tax laws and ensuring accurate tax filings. Various forms cater to different tax situations, including personal income tax, business taxes, and property taxes. Understanding which forms to use is crucial for meeting state requirements and avoiding penalties.

How to Obtain the Maryland Tax Forms

Maryland tax forms can be obtained through several methods. The most straightforward way is to visit the official Maryland Comptroller's website, where you can download the necessary forms in PDF format. Additionally, forms may be available at local tax offices or public libraries. For those who prefer physical copies, you can request forms to be mailed to you by contacting the Maryland Comptroller's office directly.

Steps to Complete the Maryland Tax Forms

Completing the Maryland tax forms involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Choose the appropriate form based on your tax situation, such as the Maryland Resident Income Tax Return (Form 502) or the Non-Resident Income Tax Return (Form 505).

- Fill out the form accurately, ensuring all personal information and income details are correct.

- Calculate your tax liability or refund using the provided instructions.

- Sign and date the form, ensuring compliance with eSignature laws if submitting electronically.

Legal Use of the Maryland Tax Forms

The legal use of Maryland tax forms requires adherence to specific guidelines set by the state. Electronic submissions are valid as long as they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that eSigned documents hold the same legal weight as traditional paper forms. It is essential to use a reliable platform that provides an electronic certificate to validate signatures.

Filing Deadlines / Important Dates

Filing deadlines for Maryland tax forms vary based on the type of form and taxpayer status. Typically, individual income tax returns are due on April 15. If this date falls on a weekend or holiday, the deadline may be extended. Businesses should be aware of different deadlines based on their tax structure, such as corporations or partnerships. Staying informed about these dates is crucial to avoid penalties and ensure timely submissions.

Form Submission Methods

Maryland tax forms can be submitted through various methods, including:

- Online: Many forms can be filed electronically through the Maryland Comptroller's website, providing a quick and efficient way to submit.

- Mail: Completed forms can be mailed to the appropriate address listed on the form. Ensure you use the correct postage and allow sufficient time for delivery.

- In-Person: Taxpayers may also submit forms in person at local tax offices, which can be helpful for those needing assistance or clarification.

Quick guide on how to complete maryland tax forms

Complete Maryland Tax Forms effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Maryland Tax Forms on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to modify and eSign Maryland Tax Forms seamlessly

- Locate Maryland Tax Forms and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize the relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Adjust and eSign Maryland Tax Forms and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Maryland tax forms, and why do I need them?

Maryland tax forms are documents required by the state for filing income, sales, and business taxes. They are essential for ensuring compliance with state tax laws and regulations. Accurate filing can save you from penalties or audits while helping you take advantage of potential tax credits.

-

How can airSlate SignNow help me with Maryland tax forms?

airSlate SignNow provides an efficient way to prepare, sign, and send Maryland tax forms electronically. With features like customizable templates and automated workflows, you can streamline your tax document process. This not only saves time but also enhances accuracy in your filings.

-

Is airSlate SignNow affordable for small businesses needing Maryland tax forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses in need of Maryland tax forms. Our pricing plans cater to various budgets, ensuring that you can access necessary features without breaking the bank. You can focus on your business while we simplify your tax form processes.

-

What features does airSlate SignNow offer for Maryland tax forms?

airSlate SignNow offers several features designed to assist with Maryland tax forms, including eSigning, document storage, and sharing options. You'll also benefit from reminders for important deadlines, which can help you better manage your tax obligations. This comprehensive tool ensures you stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for my Maryland tax forms?

Absolutely! airSlate SignNow integrates with various applications, allowing you to connect your existing software for filing Maryland tax forms. Whether you use accounting software or document storage solutions, seamless integration improves your workflow efficiency. This ensures you're managing your tax documents in one centralized location.

-

Are my Maryland tax forms secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect your Maryland tax forms throughout the signing process. Your sensitive information is stored securely, ensuring peace of mind as you manage your important tax documents.

-

Can airSlate SignNow help me track the status of my Maryland tax forms?

Yes, airSlate SignNow allows you to track the status of your Maryland tax forms in real-time. You will receive notifications when your documents are viewed and signed, ensuring that you stay informed throughout the process. This feature enhances accountability and helps you meet your filing deadlines.

Get more for Maryland Tax Forms

Find out other Maryland Tax Forms

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online