How to Fill the Nebraska Net Book Value Personal Property Schedule 1 Form

Understanding the Nebraska Net Book Value Personal Property Schedule 1 Form

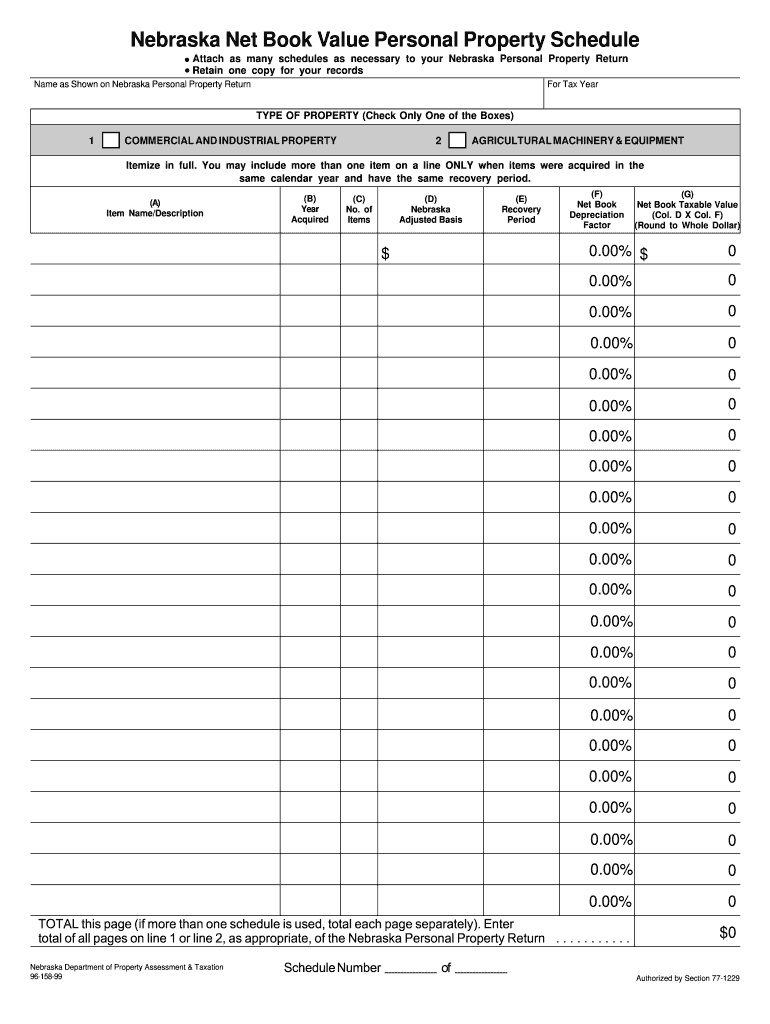

The Nebraska Net Book Value Personal Property Schedule 1 Form is essential for reporting the net book value of personal property owned by individuals or businesses in Nebraska. This form is designed to help taxpayers accurately declare their assets for tax purposes, ensuring compliance with state regulations. The net book value reflects the value of assets after accounting for depreciation, which is crucial for determining property taxes owed.

Steps to Complete the Nebraska Net Book Value Personal Property Schedule 1 Form

Completing the Nebraska Net Book Value Personal Property Schedule 1 Form involves several key steps:

- Gather necessary information about your personal property, including purchase dates, original costs, and any accumulated depreciation.

- Fill in the form with accurate details, ensuring that all required fields are completed. This includes listing each asset and its corresponding net book value.

- Review the form for accuracy before submission, as errors can lead to delays or penalties.

- Submit the completed form by the designated deadline, either electronically or via mail, depending on your preference.

Legal Use of the Nebraska Net Book Value Personal Property Schedule 1 Form

The legal use of the Nebraska Net Book Value Personal Property Schedule 1 Form is to ensure that taxpayers report their personal property accurately for tax assessment purposes. This form must be completed in accordance with Nebraska state laws, and failure to do so may result in penalties. It is important to understand that the information provided on this form can be subject to verification by tax authorities.

Filing Deadlines for the Nebraska Net Book Value Personal Property Schedule 1 Form

Filing deadlines for the Nebraska Net Book Value Personal Property Schedule 1 Form are typically set by the Nebraska Department of Revenue. Taxpayers must submit this form by May first of each year to avoid potential penalties. It is advisable to check for any updates or changes to deadlines annually, as they can vary based on specific circumstances or legislative changes.

Form Submission Methods for the Nebraska Net Book Value Personal Property Schedule 1 Form

Taxpayers have multiple options for submitting the Nebraska Net Book Value Personal Property Schedule 1 Form. The available methods include:

- Online submission through the Nebraska Department of Revenue's website, which allows for quick processing.

- Mailing a physical copy of the form to the appropriate tax office.

- In-person submission at designated tax offices, which can provide immediate confirmation of receipt.

Key Elements of the Nebraska Net Book Value Personal Property Schedule 1 Form

Key elements of the Nebraska Net Book Value Personal Property Schedule 1 Form include:

- Identification of the taxpayer, including name and address.

- A detailed list of personal property assets, including descriptions and values.

- Calculation of the net book value for each asset, accounting for depreciation.

- A certification statement affirming the accuracy of the information provided.

Quick guide on how to complete how to fill the nebraska net book value personal property schedule 1 form

Your assistance manual on how to prepare your How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form

If you’re curious about how to finalize and submit your How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form, here are some straightforward instructions on making tax filing easier.

To begin, you simply need to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and complete your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and go back to amend answers as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to complete your How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form swiftly:

- Create your account and begin working on PDFs in moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting in written form can lead to return errors and delay refunds. Of course, prior to e-filing your taxes, verify the IRS website for declaration rules applicable in your state.

Create this form in 5 minutes or less

FAQs

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do I store form values to a JSON file after filling the HTML form and submitting it using Node.js?

//on submit you can do like this

Create this form in 5 minutes!

How to create an eSignature for the how to fill the nebraska net book value personal property schedule 1 form

How to generate an eSignature for the How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form online

How to generate an eSignature for the How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form in Google Chrome

How to make an electronic signature for putting it on the How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form in Gmail

How to generate an eSignature for the How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form from your mobile device

How to generate an eSignature for the How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form on iOS devices

How to generate an electronic signature for the How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form on Android

People also ask

-

What is net book value and how does it relate to airSlate SignNow?

Net book value refers to the value of a company's assets after accounting for depreciation. With airSlate SignNow, businesses can effectively manage their documents, ensuring that their financial valuations, like the net book value of assets, are accurately represented and easily accessible.

-

How does airSlate SignNow's pricing structure affect the net book value of my business?

Using airSlate SignNow is a cost-effective solution that can signNowly reduce operational costs. By saving on paper and printing expenses, these savings positively influence your company's net book value over time.

-

What features does airSlate SignNow offer that are beneficial for calculating net book value?

airSlate SignNow includes features such as customizable templates and detailed audit trails that aid in accurate documentation of asset values. These features ensure that your net book value is consistently updated and reflected in all business transactions.

-

Can I integrate airSlate SignNow with other financial software to track net book value?

Yes, airSlate SignNow integrates seamlessly with various financial and accounting software. This allows for an efficient workflow that streamlines updates to net book value and keeps all financial records in sync.

-

How does airSlate SignNow enhance the accuracy of net book value calculations?

By utilizing airSlate SignNow's digital document management features, you can minimize human error and ensure that all relevant data is captured accurately. This enhancement in documentation aids in calculating the net book value with precision.

-

What are the benefits of using airSlate SignNow in relation to maintaining net book value?

airSlate SignNow offers a secure and efficient way to manage contracts and financial documents, which are crucial for maintaining accurate net book value. By reducing the risk of lost or mismanaged documents, businesses can ensure their asset valuations are up-to-date.

-

How can airSlate SignNow assist in improving the reporting of net book value?

With features like automated reminders and eSignature capabilities, airSlate SignNow ensures timely updates on asset transactions. This is essential for improving the reporting process of net book value in financial statements or audits.

Get more for How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form

- Dfa 3775 form

- Missouri charge code manual form

- Natural selection worksheet form

- Application form for dubai visa

- Annual return form download

- Wv class q hunting license form

- Vfw application form

- Burnaby south secondary school and the bc provincial school for the deaf term 1 physical activity log due on november 30th goal form

Find out other How To Fill The Nebraska Net Book Value Personal Property Schedule 1 Form

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure