Form 438

What is the Form 438

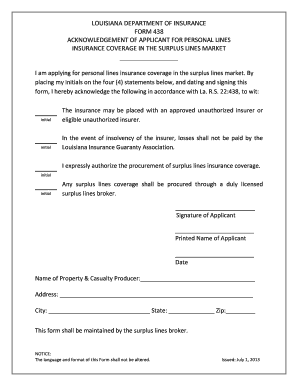

The Form 438, also known as the Louisiana Department of Insurance Form 438, is a crucial document used in the insurance sector within Louisiana. This form is primarily utilized for reporting specific information related to insurance policies and claims. It is essential for ensuring compliance with state regulations and for maintaining accurate records within the Louisiana Department of Insurance.

How to use the Form 438

Using the Form 438 involves several key steps to ensure accurate completion and submission. First, gather all necessary information regarding the insurance policy or claim that pertains to the form. This may include policy numbers, claimant details, and any relevant documentation. Once you have all the required information, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submission to the Louisiana Department of Insurance.

Steps to complete the Form 438

Completing the Form 438 requires a systematic approach to ensure accuracy. Follow these steps:

- Gather necessary documentation and information related to the insurance policy or claim.

- Carefully fill out each section of the form, ensuring all required fields are completed.

- Double-check the information for accuracy, including names, dates, and policy numbers.

- Sign and date the form where required.

- Submit the completed form to the Louisiana Department of Insurance via the preferred submission method.

Legal use of the Form 438

The Form 438 must be used in accordance with Louisiana state laws and regulations governing insurance practices. To be legally binding, the form must be completed accurately and submitted within the specified timeframes. Compliance with eSignature laws is also essential if the form is submitted electronically, ensuring that it meets the legal standards set by the ESIGN and UETA acts.

Key elements of the Form 438

Understanding the key elements of the Form 438 is vital for effective completion. Important components include:

- Policy Information: Details regarding the insurance policy, including policy number and type.

- Claimant Information: Personal details of the individual filing the claim or report.

- Signature Section: A designated area for the signer to validate the form.

- Date of Submission: The date on which the form is completed and submitted.

Form Submission Methods

The Form 438 can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Completing and submitting the form electronically via the Louisiana Department of Insurance website.

- Mail: Sending a printed version of the form to the appropriate department address.

- In-Person: Delivering the completed form directly to a local office of the Louisiana Department of Insurance.

Quick guide on how to complete form 438

Complete Form 438 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Form 438 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form 438 effortlessly

- Locate Form 438 and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or the need to print new document copies due to errors. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 438 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 438

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 438 and how does it work?

Form 438 is a vital document used in various business processes that require signatures and approvals. With airSlate SignNow, you can easily create, fill out, and eSign Form 438, streamlining your workflow and ensuring compliance. Our platform simplifies the management of such forms, making it efficient for users to handle paperwork digitally.

-

How much does it cost to use airSlate SignNow for Form 438?

Pricing for using airSlate SignNow varies depending on the plan you choose. We offer flexible pricing options that accommodate the needs of businesses of all sizes looking to manage Form 438 and other documents efficiently. For precise details about the costs, you can visit our pricing page or contact our sales team.

-

What features does airSlate SignNow offer for handling Form 438?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure electronic signatures tailored for Form 438. These features not only enhance usability but also ensure that your documents are processed quickly and securely, saving you time and reducing paperwork.

-

Is airSlate SignNow compliant with legal standards for Form 438?

Yes, airSlate SignNow complies with all relevant legal standards for electronic signatures, ensuring that your use of Form 438 is legally binding and secure. Our platform adheres to industry regulations such as ESIGN and UETA, giving you confidence in the validity of your signed documents.

-

Can I integrate airSlate SignNow with other tools for Form 438 management?

Absolutely! airSlate SignNow offers seamless integration with various tools and applications, enhancing how you manage Form 438. Whether it's CRM systems, cloud storage, or project management software, our platform works well with numerous third-party services to facilitate a smooth workflow.

-

What are the benefits of using airSlate SignNow for Form 438?

Using airSlate SignNow for Form 438 brings numerous benefits, including improved efficiency, reduced processing time, and enhanced security. Businesses can quickly prepare and sign documents while minimizing delays associated with traditional paper methods. Additionally, it allows for better tracking and management of your documents.

-

How can I get started with airSlate SignNow for Form 438?

Getting started with airSlate SignNow for Form 438 is easy! Simply sign up for an account on our website, choose a plan that fits your needs, and start uploading or creating your forms. Our user-friendly interface and helpful resources ensure that you're set up quickly and can begin utilizing our features right away.

Get more for Form 438

Find out other Form 438

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe