Fcps Tax Forms

What is the FCPS Tax Forms

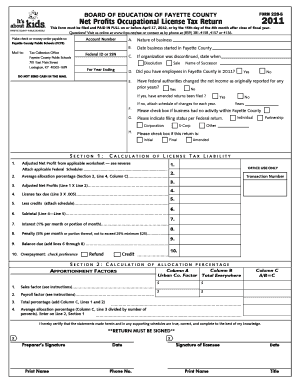

The FCPS tax forms are essential documents used for reporting net profits and occupational taxes for businesses operating within Fayette County, Kentucky. These forms include specific information required by the Board of Education of Fayette County, such as the FCPS net profits tax and the occupational license tax. The forms are designed to ensure compliance with local tax regulations and provide transparency in financial reporting.

How to Use the FCPS Tax Forms

Using the FCPS tax forms involves accurately filling out the required information regarding your business's financial performance. This includes reporting your gross receipts, allowable deductions, and calculating your net profits. It is crucial to follow the instructions provided with the forms to ensure that all necessary details are included. Proper use of these forms helps avoid penalties and ensures compliance with local tax laws.

Steps to Complete the FCPS Tax Forms

Completing the FCPS tax forms involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Identify the correct form for your business type, such as the board of education of Fayette County form 228 S.

- Fill out the form, ensuring that all sections are completed accurately.

- Calculate your net profits and any applicable taxes owed.

- Review the form for accuracy and completeness before submission.

Legal Use of the FCPS Tax Forms

The FCPS tax forms are legally binding documents that must be filled out in accordance with local tax laws. They serve as official records of your business's financial activities and tax obligations. Compliance with the legal requirements surrounding these forms is essential to avoid potential audits and penalties. Understanding the legal implications of these forms can help ensure that your business operates within the law.

Filing Deadlines / Important Dates

Filing deadlines for the FCPS tax forms are crucial for compliance. Typically, these forms must be submitted by a specified date each year, often coinciding with the end of the fiscal year. It is important to stay informed about these deadlines to avoid late fees or penalties. Keeping a calendar of important dates related to tax filings can help ensure timely submissions.

Required Documents

When completing the FCPS tax forms, several documents are required to support your claims and calculations. These may include:

- Income statements detailing gross receipts.

- Expense reports outlining allowable deductions.

- Previous tax returns for reference.

- Any additional documentation requested by the Board of Education of Fayette County.

Form Submission Methods

The FCPS tax forms can be submitted through various methods to accommodate different preferences. Common submission methods include:

- Online submission through the designated portal.

- Mailing the completed forms to the appropriate office.

- In-person submission at the Board of Education of Fayette County office.

Quick guide on how to complete fcps tax forms

Complete Fcps Tax Forms effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your files swiftly without delays. Manage Fcps Tax Forms on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to alter and eSign Fcps Tax Forms effortlessly

- Find Fcps Tax Forms and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to share your form, through email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Fcps Tax Forms and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fcps tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FCPS W2 reissue form, and why might I need it?

The FCPS W2 reissue form is a document you can submit to request a new copy of your W2 from FCPS. You might need it if your original form was lost, damaged, or if there was incorrect information. Having an accurate W2 is essential for tax filing and ensuring compliance with financial regulations.

-

How do I complete the FCPS W2 reissue form?

To complete the FCPS W2 reissue form, you'll need to provide your personal information such as your name, Social Security number, and address. Ensure all information is accurate to avoid delays. Once completed, submit it through the proper channels indicated by FCPS for processing.

-

Is there a fee associated with the FCPS W2 reissue form?

Typically, there is no fee to request an FCPS W2 reissue form, but it’s best to check with the FCPS payroll department for any potential charges. If your request falls within certain guidelines, you might be able to receive it free of charge. Be sure to clarify any costs before submitting your request.

-

How long does it take to receive my new W2 after submitting the FCPS W2 reissue form?

The processing time for the FCPS W2 reissue form can vary, but generally, expect to wait a few weeks for your new W2 to be issued. Factors such as the time of year and FCPS’s volume of requests can affect this duration. It's wise to submit your request early to avoid delays during tax season.

-

Can I request multiple copies of my W2 using the FCPS W2 reissue form?

Yes, you can request multiple copies of your W2 using the FCPS W2 reissue form if you need them for different purposes. Specify the number of copies you require when you submit the form. Ensure you check with FCPS for any specific regulations regarding multiple copies.

-

What should I do if my FCPS W2 reissue form is denied?

If your FCPS W2 reissue form is denied, you will typically receive a notice explaining the reason. Common causes include incomplete information or submission past the deadline. Review the information you provided and contact the FCPS payroll department for assistance in resolving the issue.

-

Are there any online options for submitting the FCPS W2 reissue form?

Many organizations, including FCPS, are moving towards digital solutions, and you may have the option to submit your FCPS W2 reissue form online. Check the official FCPS website or contact their payroll department for specific online submission procedures. This can streamline the process and help you receive your new W2 faster.

Get more for Fcps Tax Forms

Find out other Fcps Tax Forms

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document