M1PR, Property Tax Refund Return Minnesota Department of Revenue State Mn Form

What is the M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn

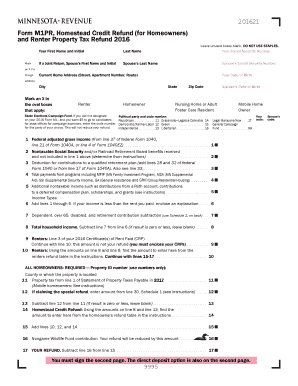

The M1PR form is a crucial document for Minnesota residents seeking a property tax refund. This form is specifically designed to help taxpayers claim refunds based on property taxes paid. The Minnesota Department of Revenue oversees the processing of this form, ensuring that eligible individuals receive the financial relief they deserve. The M1PR is particularly relevant for homeowners and renters who meet specific criteria, allowing them to recover a portion of their property taxes. Understanding this form is essential for maximizing potential refunds.

Steps to complete the M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn

Completing the M1PR form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including proof of income and property tax statements. Next, carefully fill out the form, providing accurate information about your residency, income, and property taxes paid. It is important to double-check all entries to avoid errors that could delay processing. After completing the form, submit it electronically or by mail to the Minnesota Department of Revenue. Keeping a copy of the submitted form for your records is also advisable.

Eligibility Criteria for the M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn

To qualify for a refund using the M1PR form, applicants must meet certain eligibility criteria. Generally, homeowners and renters who have paid property taxes on their primary residence may be eligible. Income limits apply, which vary based on filing status and household size. Additionally, applicants must have lived in Minnesota for at least half of the year for which they are claiming the refund. Familiarizing yourself with these criteria is essential to determine your eligibility before completing the M1PR.

Required Documents for the M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn

When filling out the M1PR form, specific documents are required to support your claim. These typically include your property tax statement, proof of income, and any other relevant financial documents. If you are a renter, you may need a rental agreement or proof of rent payments. Having these documents ready will streamline the process and help ensure that your application is complete and accurate, reducing the chances of delays in processing your refund.

Form Submission Methods for the M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn

The M1PR form can be submitted in several ways to accommodate different preferences. Taxpayers can choose to file electronically through the Minnesota Department of Revenue's online portal, which offers a convenient and secure option. Alternatively, the form can be printed and mailed to the appropriate address provided by the department. In-person submissions may also be possible at designated locations. Understanding these submission methods can help you select the option that best suits your needs.

Legal use of the M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn

The M1PR form is legally binding once submitted, provided it meets all necessary requirements. It is essential to ensure that all information is accurate and truthful, as any discrepancies may lead to penalties or delays in processing. The Minnesota Department of Revenue adheres to strict guidelines to validate the information provided. By using a reliable platform for electronic submission, you can ensure compliance with legal standards while safeguarding your personal information.

Quick guide on how to complete m1pr property tax refund return minnesota department of revenue state mn

Complete M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn on any device using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The easiest way to edit and eSign M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn with ease

- Find M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal weight as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1pr property tax refund return minnesota department of revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the m1pr form and why is it important?

The m1pr form is an essential document for businesses that handle payroll and related taxes. It helps in summarizing employee earnings and tax withholdings, ensuring compliance with state regulations. Understanding the m1pr form can streamline your payroll processes and minimize potential errors.

-

How can airSlate SignNow help with the m1pr form?

airSlate SignNow provides a seamless way to create, send, and eSign the m1pr form digitally. This enhances efficiency, reduces paper usage, and helps track the status of the document in real-time. Utilizing airSlate SignNow ensures that your m1pr form is securely handled and easily accessible.

-

Is airSlate SignNow affordable for small businesses needing the m1pr form?

Yes, airSlate SignNow offers competitive pricing plans suitable for small businesses, making it cost-effective for those needing to manage the m1pr form efficiently. With various features included in the plans, enhancing document workflows becomes more accessible without straining your budget.

-

What features does airSlate SignNow offer for managing the m1pr form?

airSlate SignNow includes features like customizable templates, secure eSignature capturing, and automated reminders specifically designed for documents like the m1pr form. These tools ensure your forms are filled out accurately and submitted on time, improving overall productivity.

-

Can I integrate airSlate SignNow with other tools while managing the m1pr form?

Absolutely! airSlate SignNow provides integrations with popular applications and platforms, allowing seamless workflows as you handle the m1pr form. Whether it's your CRM, HR software, or accounting tools, integration ensures all your business processes stay connected and efficient.

-

What are the security measures for handling the m1pr form with airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling the m1pr form, your documents are protected with encryption, secure cloud storage, and two-factor authentication, ensuring that sensitive information remains confidential and safe from unauthorized access.

-

How does using airSlate SignNow for the m1pr form streamline the signing process?

Using airSlate SignNow for the m1pr form simplifies the signing process by allowing multiple signers to execute documents quickly and remotely. The platform provides intuitive signing options that expedite approvals while providing complete visibility into the signing status.

Get more for M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn

- Apportioned registration form schedule c oregon department odot state or

- Georgia board of nursing georgia state capitol sos ga form

- Riderclaims trustmarkins com 448183596 form

- 4681 form

- Credit union wire transfer form

- Enroll a dependent or change a dependents status form

- Sub lease agreement template form

- Sub lease tenancy agreement template form

Find out other M1PR, Property Tax Refund Return Minnesota Department Of Revenue State Mn

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy