1023 Form

What is the 1023

The 1023 form is an application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. This form is crucial for organizations seeking tax-exempt status, allowing them to operate as nonprofit entities. By completing the 1023, organizations can gain the ability to receive tax-deductible contributions, which can significantly enhance their fundraising capabilities. Understanding the specific requirements and implications of this form is essential for any nonprofit organization in the United States.

Steps to complete the 1023

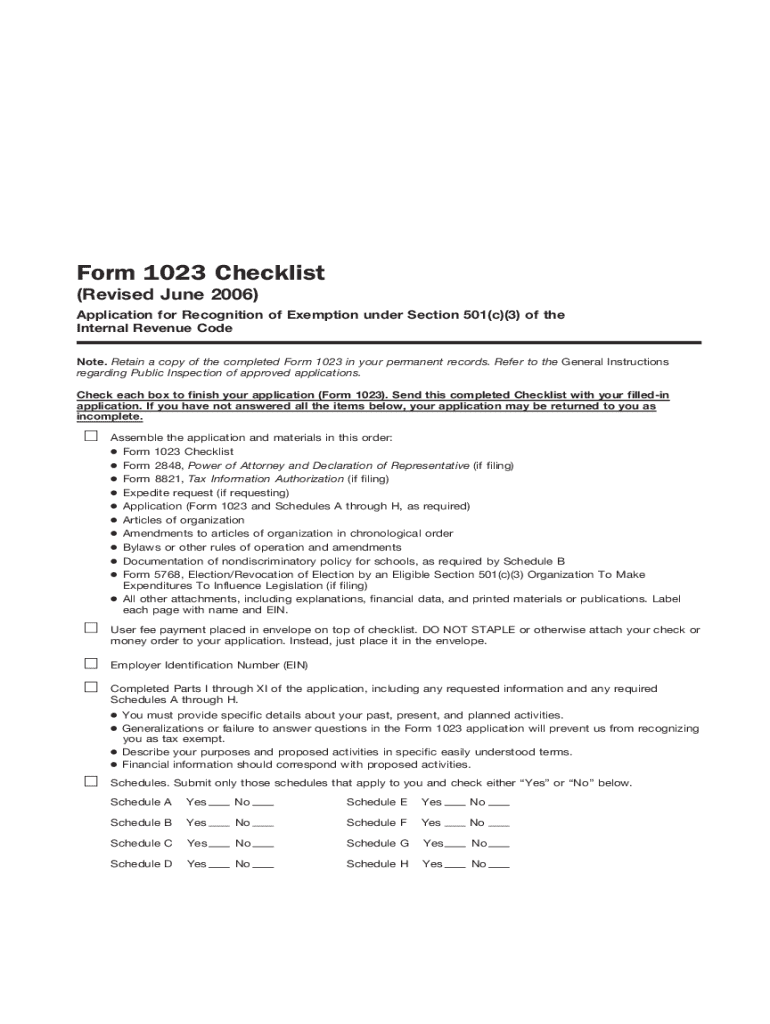

Completing the 1023 form involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather necessary information about your organization, such as its mission, structure, and financial data. Next, carefully fill out the form, paying close attention to each section to provide detailed and truthful information. It is also important to include any required attachments that support your application, such as articles of incorporation and bylaws. Finally, review the completed form for any errors or omissions before submitting it to the IRS.

Legal use of the 1023

The legal use of the 1023 form is governed by specific IRS guidelines. Organizations must ensure that they meet the eligibility criteria for tax-exempt status under Section 501(c)(3). This includes operating exclusively for charitable, educational, or religious purposes. Additionally, organizations must maintain compliance with ongoing reporting requirements to retain their tax-exempt status. Understanding these legal parameters is vital for organizations to avoid penalties and ensure their operations align with federal regulations.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the completion and submission of the 1023 form. These guidelines outline the necessary information required, including the organization's purpose, activities, and financial projections. Organizations must also be aware of the importance of transparency in their operations, as the IRS may request additional documentation to verify the information provided. Adhering to these guidelines not only facilitates a smoother application process but also helps establish credibility with potential donors and stakeholders.

Required Documents

When submitting the 1023 form, several supporting documents are required to substantiate the application. These typically include articles of incorporation, bylaws, a statement of revenue and expenses, and a detailed description of the organization's activities. Additionally, organizations may need to provide information about their board of directors and any fundraising plans. Ensuring that all required documents are included can significantly impact the approval process and timeline.

Filing Deadlines / Important Dates

Organizations must be mindful of filing deadlines associated with the 1023 form to avoid complications. Generally, the form should be submitted within 27 months of the organization's formation date to qualify for retroactive tax-exempt status. If filed after this period, the organization may lose the ability to claim tax-exempt status from its inception. Keeping track of these important dates is essential for maintaining compliance and maximizing the benefits of tax exemption.

Application Process & Approval Time

The application process for the 1023 form can vary in length depending on several factors, including the complexity of the application and the volume of submissions received by the IRS. Typically, organizations can expect a processing time of three to six months. However, it is advisable to prepare for potential delays by submitting a complete and accurate application. Organizations may also follow up with the IRS to check on the status of their application, ensuring they remain informed throughout the process.

Quick guide on how to complete 1023

Complete 1023 effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 1023 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign 1023 with ease

- Find 1023 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and then click on the Done button to preserve your modifications.

- Choose how you would like to submit your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 1023 and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1023

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1023 form, and how can airSlate SignNow help with it?

The 1023 form is an application for tax-exempt status in the United States. airSlate SignNow simplifies the process of sending, signing, and managing this important document electronically, ensuring that you can complete your application quickly and efficiently.

-

How does airSlate SignNow ensure the security of my 1023 document?

airSlate SignNow employs advanced encryption and security protocols to protect your documents, including the 1023 form. You can rest assured knowing that your sensitive information is safeguarded during the signing process.

-

What are the pricing options for airSlate SignNow when handling 1023 forms?

airSlate SignNow offers flexible pricing plans tailored to meet the diverse needs of users managing 1023 forms. Depending on your usage and team size, you can choose from various plans that best suit your budget while providing necessary features.

-

Can I integrate airSlate SignNow with other platforms for managing 1023 forms?

Yes, airSlate SignNow provides seamless integrations with popular applications, allowing you to manage your 1023 forms effortlessly. Connect with CRMs, cloud storage services, and email platforms to streamline your document signing workflow.

-

What features does airSlate SignNow offer for filling out the 1023 application?

airSlate SignNow provides features like templates, form fields, and document sharing specifically designed to assist you in filling out the 1023 application accurately. These tools enhance your efficiency and eliminate manual errors.

-

How can airSlate SignNow benefit non-profits filing a 1023 form?

For non-profits, airSlate SignNow offers a cost-effective solution to expedite the filing of the 1023 form. By reducing the time spent on paperwork, organizations can focus on their mission rather than administrative tasks.

-

Is there a mobile app for airSlate SignNow to handle 1023 forms?

Yes, airSlate SignNow has a mobile app that allows you to manage your 1023 forms on-the-go. This convenience lets you send and sign documents anytime, anywhere, ensuring you never miss a deadline.

Get more for 1023

- Employment application employment application marcs form

- Ecosystem field form pdf ministry of environment env gov bc

- Major revival form

- Revenue nsw audits for foreign person surcharge form

- Search transport canberra and city services act government form

- Activities and trading in thoroughfares and public places form

- Application request for retrospective consideration to be treated as medically unfit under defence personnel regulations form

- Eft payment form

Find out other 1023

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free