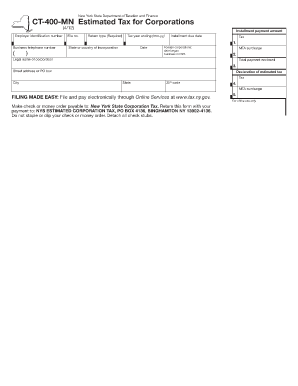

Ct 400 Mn Form

What is the CT 400 MN?

The CT 400 MN is a tax form used in Minnesota for reporting income and calculating taxes owed for businesses. This form is essential for various business entities, including corporations and partnerships, to ensure compliance with state tax regulations. The CT 400 MN provides a structured way for businesses to report their income, deductions, and credits, ultimately determining their tax liability. Understanding this form is crucial for any business operating in Minnesota, as it helps maintain transparency and accountability in financial reporting.

Steps to Complete the CT 400 MN

Completing the CT 400 MN involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and any applicable tax credits. Next, accurately fill out the form, ensuring all sections are completed, including income, deductions, and tax calculations. It's important to double-check the figures for any errors before submission. Finally, sign and date the form, and choose your preferred submission method, whether online, by mail, or in person.

Filing Deadlines / Important Dates

Filing deadlines for the CT 400 MN are crucial for businesses to avoid penalties. Typically, the form must be submitted by the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. It's essential to be aware of any changes to these dates, as they can vary based on state regulations or specific circumstances. Keeping a calendar of important tax dates can help ensure timely filing.

Legal Use of the CT 400 MN

The CT 400 MN is legally binding when completed and submitted in accordance with Minnesota tax laws. To ensure its legal validity, businesses must adhere to specific guidelines, including accurate reporting of income and expenses. The form must be signed by an authorized representative of the business, and any supporting documentation should be retained for future reference. Compliance with state tax regulations is vital to avoid legal repercussions and maintain good standing with the Minnesota Department of Revenue.

Required Documents

To complete the CT 400 MN, several documents are required. These typically include:

- Income statements detailing revenue generated during the tax year.

- Expense reports to document all business-related costs.

- Any applicable tax credit documentation to support claims for deductions.

- Previous year’s tax returns for reference and consistency.

Having these documents ready will streamline the completion process and help ensure accuracy in reporting.

Form Submission Methods

The CT 400 MN can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Minnesota Department of Revenue website, which is often the quickest method.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Choosing the right submission method can depend on the business's needs and preferences, as well as any specific requirements from the state.

Quick guide on how to complete ct 400 mn

Effortlessly Prepare Ct 400 Mn on Any Device

Digital document organization has become increasingly favored by businesses and individuals. It serves as an ideal eco-conscious replacement for conventional printed and signed documents, enabling you to locate the correct form and safely store it online. airSlate SignNow supplies all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Ct 400 Mn on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Ct 400 Mn with Ease

- Obtain Ct 400 Mn and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Ct 400 Mn and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 400 mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 400 mn taxation and how does it affect businesses?

400 mn taxation refers to the tax implications and regulations that businesses must comply with when earning a revenue of 400 million or more. Understanding 400 mn taxation is crucial for businesses to ensure compliance and avoid penalties while optimizing their tax liabilities.

-

How does airSlate SignNow streamline document management related to 400 mn taxation?

airSlate SignNow simplifies document management by allowing businesses to easily send, receive, and eSign documents pertaining to 400 mn taxation. This solution helps ensure that all necessary tax documents are efficiently managed and securely stored, reducing the risk of errors and misfiling.

-

What are the pricing options for airSlate SignNow services related to 400 mn taxation?

airSlate SignNow offers various pricing plans to cater to businesses of all sizes involved in 400 mn taxation. These plans are designed to be cost-effective, ensuring that companies can choose the best option that fits their budget while benefiting from essential features for document handling.

-

What features does airSlate SignNow provide to assist with 400 mn taxation compliance?

Key features of airSlate SignNow include customizable templates for tax documents, automated reminders for tax deadlines, and secure eSigning capabilities. These features help businesses effectively manage their documentation related to 400 mn taxation and maintain compliance with regulatory requirements.

-

Can airSlate SignNow integrate with accounting software used for 400 mn taxation?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier for businesses to manage their financial data and documents related to 400 mn taxation. This integration enhances workflow efficiency and ensures accurate financial reporting.

-

What are the security measures in place for documents related to 400 mn taxation?

airSlate SignNow employs robust security measures, including encryption, secure data storage, and access controls, to protect documents related to 400 mn taxation. Businesses can confidently manage sensitive tax information, knowing that their data is safeguarded against unauthorized access.

-

How can airSlate SignNow benefit businesses in terms of time management for 400 mn taxation?

By automating document processes, airSlate SignNow signNowly reduces the time spent on tasks associated with 400 mn taxation. This allows businesses to focus on strategic decision-making and compliance rather than being bogged down by administrative paperwork.

Get more for Ct 400 Mn

Find out other Ct 400 Mn

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien