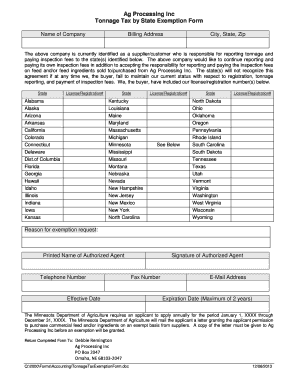

Tonnage Tax by State Exemption Form

What is the tonnage tax by state exemption form

The tonnage tax by state exemption form is a specific document that allows businesses to apply for exemptions from state tonnage taxes. These taxes are typically levied on vessels based on their tonnage, which can significantly impact operational costs for shipping companies. By completing this form, eligible entities can potentially reduce their tax liabilities, ensuring compliance with state regulations while maximizing financial efficiency.

How to use the tonnage tax by state exemption form

To effectively use the tonnage tax by state exemption form, individuals or businesses must first determine their eligibility based on state-specific criteria. Once eligibility is confirmed, the form should be filled out accurately, providing all required information, such as business details and vessel specifications. After completing the form, it must be submitted to the appropriate state tax authority for review. Utilizing electronic signature solutions can streamline this process, ensuring timely submission and compliance.

Steps to complete the tonnage tax by state exemption form

Completing the tonnage tax by state exemption form involves several key steps:

- Gather necessary information, including business identification details and vessel specifications.

- Review the eligibility criteria for your state to ensure compliance.

- Fill out the form accurately, ensuring all sections are completed.

- Sign the document electronically or manually, depending on submission requirements.

- Submit the completed form to the relevant state tax authority, either online or by mail.

Key elements of the tonnage tax by state exemption form

The tonnage tax by state exemption form includes several critical elements that must be accurately completed. Key components typically include:

- Business Information: Name, address, and tax identification number.

- Vessel Details: Type, size, and registration information of the vessel.

- Exemption Justification: A statement explaining the basis for the exemption request.

- Signature: An authorized signature confirming the accuracy of the information provided.

Eligibility criteria

Eligibility for the tonnage tax by state exemption form varies by state but generally includes criteria such as:

- The type of vessel being operated (e.g., commercial, fishing).

- The intended use of the vessel (e.g., for trade, transport).

- Compliance with state regulations and tax requirements.

Form submission methods

The tonnage tax by state exemption form can typically be submitted through various methods, depending on state regulations. Common submission options include:

- Online: Many states offer electronic submission through their tax authority websites.

- Mail: Physical copies can be sent to the designated state tax office.

- In-Person: Some states allow for in-person submissions at local tax offices.

Quick guide on how to complete tonnage tax by state exemption form

Accomplish Tonnage Tax By State Exemption Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary forms and securely archive them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Tonnage Tax By State Exemption Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Tonnage Tax By State Exemption Form without hassle

- Find Tonnage Tax By State Exemption Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Tonnage Tax By State Exemption Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tonnage tax by state exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tonnage tax by state exemption form?

The tonnage tax by state exemption form is a document used by businesses to claim exemptions from state tonnage taxes. This form allows businesses operating in specific states to avoid hefty tax liabilities by providing required information. Understanding how to properly fill out this form can save companies signNow amounts of money.

-

How do I obtain the tonnage tax by state exemption form?

You can easily obtain the tonnage tax by state exemption form from your state’s tax authority website or through relevant financial regulatory agencies. Make sure to download the latest version of the form to ensure compliance. If you need assistance, consider consulting with a tax professional.

-

What are the benefits of using the tonnage tax by state exemption form?

Using the tonnage tax by state exemption form allows businesses to legally reduce their tax burden, leading to greater savings. This can enhance cash flow, allowing businesses to invest more in growth and operations. Additionally, it helps ensure compliance with state tax laws, reducing the risk of penalties.

-

Are there any fees associated with filing the tonnage tax by state exemption form?

Typically, there are no fees for filing the tonnage tax by state exemption form itself; however, consult your local tax authority for any associated costs. It’s important to be aware of potential filing fees or charges from tax consultants if you seek professional assistance. Budgeting for these potential costs is advisable.

-

How long does it take to process the tonnage tax by state exemption form?

Processing times for the tonnage tax by state exemption form can vary signNowly based on the state and the volume of submissions. Generally, it may take anywhere from a few weeks to a couple of months. It’s recommended to submit the form well in advance of any applicable deadlines.

-

Can I eSign the tonnage tax by state exemption form?

Yes, you can eSign the tonnage tax by state exemption form if your state allows electronic signatures. Utilizing eSignature tools, like airSlate SignNow, simplifies the signing process and speeds up submission. Ensure that the eSignature platform you use complies with state regulations to avoid any issues.

-

What features should I look for in a platform to manage the tonnage tax by state exemption form?

When managing the tonnage tax by state exemption form, look for features that support document tracking, secure eSigning, and integration with your accounting software. A user-friendly interface and robust customer support are also essential to ensure a smooth filing process. airSlate SignNow offers many of these features for efficient document management.

Get more for Tonnage Tax By State Exemption Form

- Shamrock foundation cats form

- Janata personal accident proposal form

- Fripp island arb form

- Friendly sportspdf super teacher worksheets goethecharterschool form

- Afps form 9 commutation options afps15 afps05

- Discretionary housing payment application form

- Event safety plan template form

- Bus pass application form for people aged 60 or over

Find out other Tonnage Tax By State Exemption Form

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself