Form 8841

What is the Form 8841

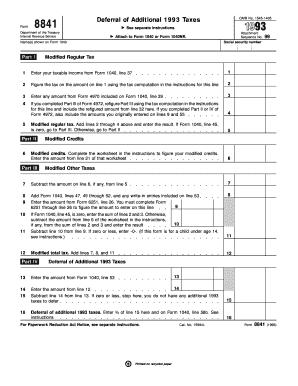

The IRS Form 8841, also known as the "Qualified Electric Vehicle Credit," is a tax form used by taxpayers to claim a credit for qualified electric vehicles. This form is particularly relevant for individuals and businesses that have purchased eligible electric vehicles during the tax year. By completing this form, taxpayers can reduce their overall tax liability, making electric vehicle ownership more financially accessible. Understanding the specifics of this form is essential for ensuring compliance and maximizing potential tax benefits.

How to use the Form 8841

Using the IRS Form 8841 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary information regarding their electric vehicle, including the make, model, and year of manufacture. Next, they should review the eligibility criteria to confirm that their vehicle qualifies for the credit. After filling out the form, it is crucial to double-check all entries for accuracy before submission. This process helps avoid delays and potential issues with the IRS.

Steps to complete the Form 8841

Completing the IRS Form 8841 requires a systematic approach to ensure all information is accurately reported. The following steps outline the process:

- Gather documentation related to the electric vehicle purchase, including the purchase invoice and vehicle identification number (VIN).

- Review the eligibility criteria to confirm that the vehicle qualifies for the credit.

- Fill out the form, providing accurate details about the vehicle and the taxpayer's information.

- Calculate the credit amount based on the vehicle's specifications and the IRS guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form along with the tax return for the applicable tax year.

Legal use of the Form 8841

The legal use of IRS Form 8841 is governed by specific guidelines set forth by the IRS. To ensure that the form is legally valid, taxpayers must adhere to the following requirements:

- The vehicle must meet the criteria outlined by the IRS for electric vehicles.

- All information provided on the form must be truthful and accurate.

- The form must be submitted within the designated filing period to be considered for the tax credit.

Failure to comply with these legal requirements may result in penalties or denial of the claimed credit.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8841 align with the general tax filing deadlines for individuals and businesses. Typically, the deadline for submitting tax returns is April 15 of the following year. However, if a taxpayer requires additional time, they may file for an extension, which generally provides an additional six months. It is essential to stay informed about any changes to these dates, as they can vary from year to year.

Required Documents

To successfully complete and file the IRS Form 8841, taxpayers must gather several key documents:

- Purchase invoice of the electric vehicle, which includes the date of purchase and VIN.

- Proof of eligibility, such as manufacturer certifications or specifications that confirm the vehicle meets IRS criteria.

- Previous tax returns, if applicable, to provide context for the current filing.

Having these documents ready can streamline the process and reduce the likelihood of errors.

Quick guide on how to complete form 8841

Effortlessly Prepare Form 8841 on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it digitally. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without delays. Handle Form 8841 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form 8841 with Ease

- Find Form 8841 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8841 to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8841

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8841 and why is it important?

Form 8841 is a tax form used by certain foreign students and scholars to claim a refund of excess Social Security and Medicare taxes withheld. It's important because it helps eligible individuals recover taxes that were incorrectly deducted, ensuring compliance with U.S. tax laws.

-

How can airSlate SignNow help me with form 8841?

With airSlate SignNow, you can easily fill out, sign, and send form 8841 electronically. Our user-friendly platform ensures that your document is securely managed, giving you peace of mind while you complete your tax requirements.

-

Is there a cost associated with using airSlate SignNow for form 8841?

AirSlate SignNow offers various pricing plans to accommodate your needs, including options for free trials. The costs are competitive, and using our platform for form 8841 can save you both time and money on document management.

-

What features does airSlate SignNow offer for managing form 8841?

AirSlate SignNow provides features like template creation, bulk sending, real-time tracking, and secure storage, which makes managing form 8841 efficient. These tools help streamline the eSigning process and enhance communication during tax preparation.

-

Can I integrate airSlate SignNow with other software for processing form 8841?

Yes, airSlate SignNow offers a range of integrations with popular software that you may use for tax filings and document management. This allows you to seamlessly incorporate form 8841 into your existing workflow for increased efficiency.

-

How secure is my data when using airSlate SignNow to complete form 8841?

AirSlate SignNow prioritizes your data security by implementing advanced encryption protocols and compliance with data protection regulations. When completing form 8841, you can trust that your sensitive information is safe and secure.

-

Are there customer support options available for using airSlate SignNow with form 8841?

Absolutely, airSlate SignNow offers comprehensive customer support through various channels, including live chat and email. If you have questions about completing form 8841 or using our platform, our dedicated team is always ready to assist you.

Get more for Form 8841

Find out other Form 8841

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe