WV 2848 West Virginia State Tax Department Authorization of Form

What is the WV 2848 West Virginia State Tax Department Authorization Of

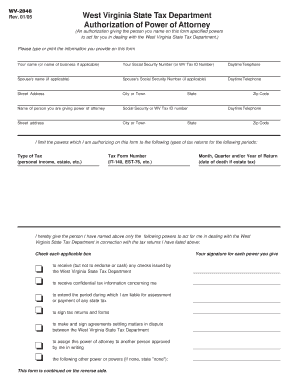

The WV 2848, officially known as the West Virginia State Tax Department Authorization of, is a power of attorney form that allows taxpayers to designate an individual or entity to represent them before the West Virginia Department of Revenue. This form is particularly important for individuals who may need assistance in managing their tax matters, such as filing returns, communicating with tax officials, or handling disputes. By completing this form, taxpayers can ensure that their chosen representative has the authority to act on their behalf in all tax-related matters.

How to use the WV 2848 West Virginia State Tax Department Authorization Of

Using the WV 2848 involves several key steps. First, the taxpayer must accurately fill out the form, providing necessary details such as their name, address, and Social Security number. Next, the taxpayer should specify the representative's information, including their name and contact details. It is crucial to sign and date the form to validate it. Once completed, the taxpayer should submit the form to the West Virginia Department of Revenue, ensuring that their representative is officially recognized for tax purposes. This process simplifies communication and allows for efficient handling of tax matters.

Steps to complete the WV 2848 West Virginia State Tax Department Authorization Of

Completing the WV 2848 is a straightforward process. Follow these steps:

- Obtain the WV 2848 form from the West Virginia Department of Revenue website or other official sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the representative's details, including their name, address, and contact information.

- Clearly indicate the scope of authority you are granting to your representative.

- Sign and date the form to authenticate it.

- Submit the completed form to the West Virginia Department of Revenue via mail or in person.

Legal use of the WV 2848 West Virginia State Tax Department Authorization Of

The legal use of the WV 2848 is grounded in its compliance with state regulations governing power of attorney forms. This document grants the designated representative the authority to act on behalf of the taxpayer in various tax-related matters. It is essential to ensure that the form is filled out correctly and submitted to the appropriate authorities to maintain its legal validity. The use of this form can help taxpayers navigate complex tax situations while ensuring that their rights and interests are protected under West Virginia law.

Key elements of the WV 2848 West Virginia State Tax Department Authorization Of

Several key elements define the WV 2848 and its functionality:

- Taxpayer Information: The form requires the taxpayer's full name, address, and Social Security number for identification purposes.

- Representative Information: Details about the appointed representative, including their name and contact information, must be provided.

- Scope of Authority: The form allows taxpayers to specify the extent of the authority granted to their representative, ensuring clarity in responsibilities.

- Signature: A valid signature from the taxpayer is necessary to authenticate the form, confirming their consent.

Examples of using the WV 2848 West Virginia State Tax Department Authorization Of

The WV 2848 can be utilized in various scenarios, such as:

- A taxpayer who is unable to attend a tax meeting due to personal reasons may authorize a tax professional to represent them.

- An individual seeking assistance with tax disputes can use the form to allow a lawyer to handle negotiations with the tax department.

- Business owners may designate an accountant to manage their company's tax filings and communications with the state.

Quick guide on how to complete wv 2848 west virginia state tax department authorization of

Complete WV 2848 West Virginia State Tax Department Authorization Of effortlessly on any gadget

Web-based document management has become favored among companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage WV 2848 West Virginia State Tax Department Authorization Of on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to edit and eSign WV 2848 West Virginia State Tax Department Authorization Of without hassle

- Find WV 2848 West Virginia State Tax Department Authorization Of and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to store your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Modify and eSign WV 2848 West Virginia State Tax Department Authorization Of and ensure excellent communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv 2848 west virginia state tax department authorization of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WV 2848 West Virginia State Tax Department Authorization Of?

The WV 2848 is a form provided by the West Virginia State Tax Department that allows individuals to authorize someone else to act on their behalf concerning their state tax matters. This authorization can simplify the process of managing tax-related issues, ensuring that your representative can access relevant information efficiently.

-

How can airSlate SignNow help with the WV 2848 West Virginia State Tax Department Authorization Of?

AirSlate SignNow offers a user-friendly platform that allows you to fill out, sign, and send the WV 2848 West Virginia State Tax Department Authorization Of securely. By using our e-signature solution, you can expedite the authorization process while ensuring compliance with state regulations.

-

What are the costs associated with using airSlate SignNow for the WV 2848 West Virginia State Tax Department Authorization Of?

AirSlate SignNow provides various pricing plans to accommodate different needs. Each plan offers features tailored to help you manage and e-sign documents like the WV 2848 West Virginia State Tax Department Authorization Of without breaking the bank. A cost-effective solution, our service aims to provide maximum value for your investment.

-

Is airSlate SignNow compliant with the requirements for the WV 2848 West Virginia State Tax Department Authorization Of?

Yes, airSlate SignNow is designed to comply with legal requirements for e-signatures in West Virginia. This means you can confidently use our platform to manage your WV 2848 West Virginia State Tax Department Authorization Of while ensuring that all documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other software for managing the WV 2848 West Virginia State Tax Department Authorization Of?

Absolutely! AirSlate SignNow offers seamless integrations with various software tools, allowing you to manage your WV 2848 West Virginia State Tax Department Authorization Of alongside your existing systems. This helps streamline your workflow and makes document management more efficient.

-

What features does airSlate SignNow offer for the WV 2848 West Virginia State Tax Department Authorization Of?

AirSlate SignNow provides features such as customizable templates, audit trails, and user-friendly document editing, all specifically designed to help you manage the WV 2848 West Virginia State Tax Department Authorization Of easily. These features enhance collaboration and ensure that your documents are processed quickly and accurately.

-

What are the benefits of using airSlate SignNow for the WV 2848 West Virginia State Tax Department Authorization Of?

Using airSlate SignNow to manage the WV 2848 West Virginia State Tax Department Authorization Of offers numerous benefits, including faster processing times, improved accuracy, and enhanced document security. Our platform empowers you to streamline your tax authorization process while reducing paperwork and physical handling of documents.

Get more for WV 2848 West Virginia State Tax Department Authorization Of

Find out other WV 2848 West Virginia State Tax Department Authorization Of

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free