Credit Authorization Form Mortgage

What is the Credit Authorization Form Mortgage

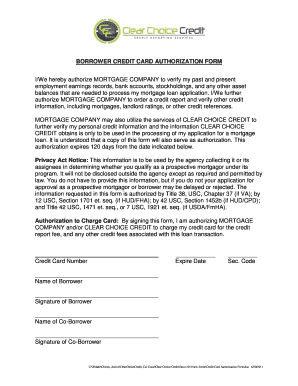

The credit authorization form mortgage is a crucial document used in the mortgage application process. It allows lenders to obtain necessary information about a borrower's credit history and financial background. This form typically includes personal identification details, social security numbers, and consent for the lender to access credit reports. By signing this form, borrowers grant permission for lenders to evaluate their creditworthiness, which is essential for determining loan eligibility and terms.

How to use the Credit Authorization Form Mortgage

Using the credit authorization form mortgage involves several key steps. First, borrowers need to fill out the form with accurate personal information, including their full name, address, and social security number. Next, it is important to read the terms carefully to understand what information will be accessed and how it will be used. After completing the form, borrowers must sign it to provide consent. This signed document can then be submitted electronically or in paper form to the lender as part of the mortgage application process.

Steps to complete the Credit Authorization Form Mortgage

Completing the credit authorization form mortgage requires attention to detail. Here are the steps to follow:

- Gather necessary personal information, including identification and financial details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign the form to authorize the lender to access your credit information.

- Submit the completed form as directed by your lender, either online or via mail.

Legal use of the Credit Authorization Form Mortgage

The legal use of the credit authorization form mortgage is governed by various laws and regulations. Under the Fair Credit Reporting Act (FCRA), lenders must obtain explicit consent from borrowers before accessing their credit reports. This form serves as that consent, ensuring compliance with legal standards. Additionally, the use of electronic signatures is recognized under the ESIGN Act and UETA, making e-signatures on this form legally binding as long as specific requirements are met.

Key elements of the Credit Authorization Form Mortgage

Key elements of the credit authorization form mortgage include:

- Borrower Information: Personal details such as name, address, and social security number.

- Consent Statement: A clear statement indicating the borrower's permission for the lender to access credit information.

- Signature Line: A designated area for the borrower to sign and date the form.

- Disclosure of Rights: Information about the borrower's rights regarding their credit report and how the information will be used.

Examples of using the Credit Authorization Form Mortgage

Examples of situations where the credit authorization form mortgage is used include:

- Applying for a new mortgage loan when purchasing a home.

- Refinancing an existing mortgage to secure better terms.

- Seeking a home equity line of credit (HELOC) based on the equity in a property.

Quick guide on how to complete credit authorization form mortgage

Complete Credit Authorization Form Mortgage effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents promptly without delays. Manage Credit Authorization Form Mortgage on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The optimal method to edit and eSign Credit Authorization Form Mortgage effortlessly

- Obtain Credit Authorization Form Mortgage and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your demands in document management with just a few clicks from any device of your preference. Edit and eSign Credit Authorization Form Mortgage and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit authorization form mortgage

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit authorization form mortgage?

A credit authorization form mortgage is a document that grants permission for lenders to access a borrower's credit report. This form is essential for assessing your eligibility for a mortgage loan. Understanding this document can help streamline the mortgage approval process.

-

How does airSlate SignNow simplify the credit authorization form mortgage process?

airSlate SignNow simplifies the credit authorization form mortgage process by providing an intuitive platform to create, send, and eSign this form digitally. This eliminates the need for physical paperwork, making the overall process faster and more efficient. Users can complete and submit forms securely from any device.

-

What are the pricing options for using airSlate SignNow for mortgage documents?

airSlate SignNow offers various pricing plans to accommodate different business needs, including features tailored for handling documents like the credit authorization form mortgage. These plans are designed to be cost-effective, ensuring that even small businesses can leverage professional eSigning capabilities without breaking the bank.

-

What features does airSlate SignNow offer for mortgage applications?

airSlate SignNow includes features that enhance the mortgage application process, such as customizable templates, automated reminders, and secure storage. These features help users manage the credit authorization form mortgage and other related documents more efficiently. The simplicity of the platform allows for easy tracking and management of all eSigned documents.

-

Can airSlate SignNow integrate with other software for mortgage management?

Yes, airSlate SignNow offers seamless integrations with various customer relationship management (CRM) systems and mortgage software. This allows for smooth data transfer and management of documents, including the credit authorization form mortgage. Enhanced integration capabilities help streamline overall operations.

-

What are the benefits of using airSlate SignNow for the credit authorization form mortgage?

The benefits of using airSlate SignNow for the credit authorization form mortgage include increased speed of processing, reduced paperwork, and enhanced security. Users can expect fast turnaround times with eSignatures compared to traditional methods. Additionally, airSlate SignNow ensures compliance with legal standards, providing peace of mind.

-

How secure is the credit authorization form mortgage when using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially with sensitive documents like the credit authorization form mortgage. The platform uses top-tier encryption and compliance protocols to protect your data. This ensures that all uploaded documents and eSignatures are kept secure and confidential.

Get more for Credit Authorization Form Mortgage

Find out other Credit Authorization Form Mortgage

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed