FARM INCOME & EXPENSE WORKSHEET 2022-2026

What is the FARM INCOME & EXPENSE WORKSHEET

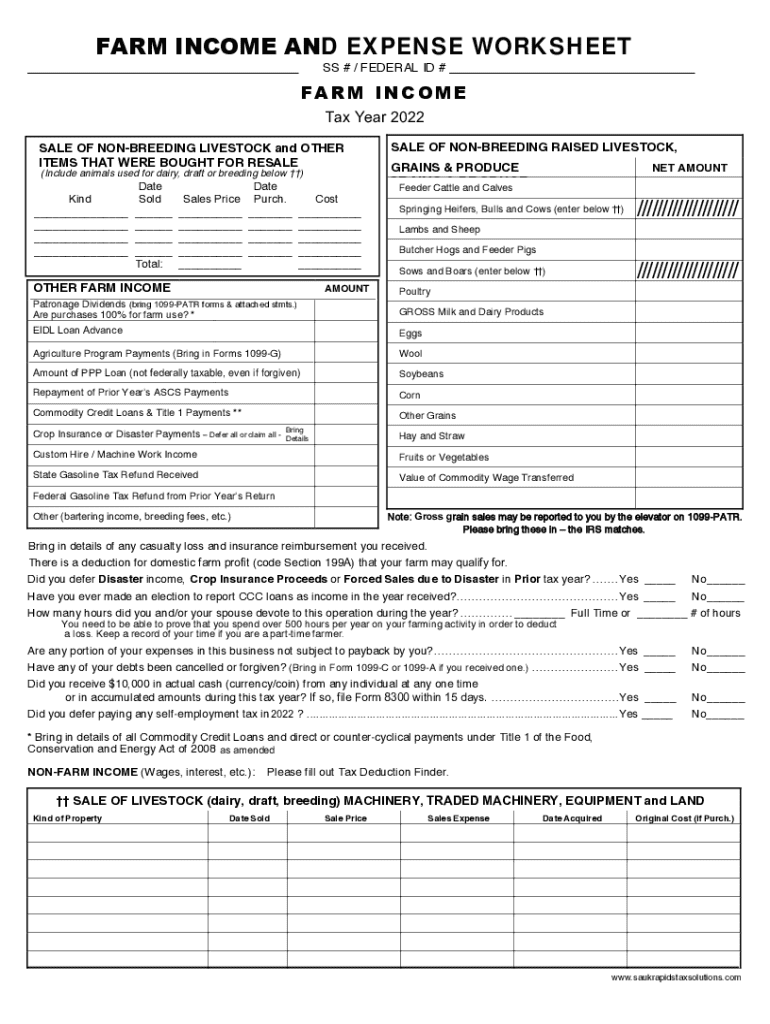

The FARM INCOME & EXPENSE WORKSHEET is a crucial tool for farmers and agricultural businesses to systematically track their income and expenses. This worksheet helps in organizing financial data, which is essential for accurate tax reporting and financial management. It typically includes sections for various types of income, such as sales from crops and livestock, as well as categories for expenses like equipment, labor, and supplies. By using this worksheet, farmers can gain insights into their financial performance and make informed decisions about their operations.

How to use the FARM INCOME & EXPENSE WORKSHEET

Using the FARM INCOME & EXPENSE WORKSHEET involves several straightforward steps. First, gather all relevant financial documents, including receipts, invoices, and bank statements. Next, categorize your income and expenses according to the sections provided in the worksheet. It is important to be thorough and accurate, as this data will be used for tax purposes. Regularly updating the worksheet throughout the year can help maintain accurate records and simplify the tax filing process. Finally, review the completed worksheet to ensure all information is correct before submission.

Steps to complete the FARM INCOME & EXPENSE WORKSHEET

Completing the FARM INCOME & EXPENSE WORKSHEET can be broken down into several key steps:

- Collect all financial documents related to your farming activities.

- Fill in the income section with details of sales and other revenue sources.

- Document all expenses, categorizing them into fixed and variable costs.

- Calculate net income by subtracting total expenses from total income.

- Review the worksheet for accuracy and completeness.

Key elements of the FARM INCOME & EXPENSE WORKSHEET

The FARM INCOME & EXPENSE WORKSHEET consists of several key elements that facilitate effective financial tracking. These elements typically include:

- Income Section: This part captures all sources of revenue, including crop sales, livestock sales, and government payments.

- Expense Categories: Expenses are divided into categories such as operational costs, labor, equipment maintenance, and supplies.

- Net Income Calculation: This section automatically calculates the difference between total income and total expenses, providing a clear picture of profitability.

- Year-End Summary: A summary section that compiles financial data for review and reporting purposes.

IRS Guidelines

The IRS provides specific guidelines for reporting farm income and expenses. Farmers must adhere to these guidelines to ensure compliance with tax laws. The IRS requires accurate reporting of all income generated from farming activities, as well as a detailed account of expenses incurred. This includes maintaining records for at least three years, as the IRS may audit tax returns. Familiarizing oneself with IRS publications related to farming can help ensure that all necessary information is included in the FARM INCOME & EXPENSE WORKSHEET.

Filing Deadlines / Important Dates

Understanding filing deadlines is essential for farmers to avoid penalties. Generally, the deadline for filing tax returns for individuals, including farmers, is April 15. However, if additional time is needed, farmers may file for an extension, which typically grants an additional six months. It is crucial to keep track of any changes in tax law that may affect these dates. Being aware of these deadlines helps ensure timely submission of the FARM INCOME & EXPENSE WORKSHEET and associated tax forms.

Create this form in 5 minutes or less

Find and fill out the correct farm income amp expense worksheet

Create this form in 5 minutes!

How to create an eSignature for the farm income amp expense worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a FARM INCOME & EXPENSE WORKSHEET?

A FARM INCOME & EXPENSE WORKSHEET is a tool designed to help farmers track their income and expenses effectively. It provides a structured format for recording financial transactions, which is essential for budgeting and tax preparation. By using this worksheet, farmers can gain insights into their financial performance and make informed decisions.

-

How can airSlate SignNow help with my FARM INCOME & EXPENSE WORKSHEET?

airSlate SignNow streamlines the process of managing your FARM INCOME & EXPENSE WORKSHEET by allowing you to easily create, send, and eSign documents. This digital solution ensures that your financial records are organized and accessible from anywhere. Additionally, it enhances collaboration with your accountant or financial advisor.

-

Is there a cost associated with using the FARM INCOME & EXPENSE WORKSHEET on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for managing your FARM INCOME & EXPENSE WORKSHEET. Pricing plans vary based on features and the number of users, ensuring that you can find an option that fits your budget. Investing in this tool can save you time and improve your financial management.

-

What features does airSlate SignNow offer for the FARM INCOME & EXPENSE WORKSHEET?

airSlate SignNow offers several features for the FARM INCOME & EXPENSE WORKSHEET, including customizable templates, electronic signatures, and secure document storage. These features make it easy to create and manage your financial documents efficiently. Additionally, the platform provides tracking and reporting tools to help you analyze your income and expenses.

-

Can I integrate airSlate SignNow with other accounting software for my FARM INCOME & EXPENSE WORKSHEET?

Yes, airSlate SignNow can be integrated with various accounting software solutions to enhance your FARM INCOME & EXPENSE WORKSHEET management. This integration allows for seamless data transfer, reducing the need for manual entry and minimizing errors. By connecting your tools, you can streamline your financial processes and improve accuracy.

-

What are the benefits of using a digital FARM INCOME & EXPENSE WORKSHEET?

Using a digital FARM INCOME & EXPENSE WORKSHEET offers numerous benefits, including increased efficiency, accessibility, and security. Digital worksheets can be easily updated and shared with stakeholders, ensuring everyone has the latest information. Additionally, they reduce the risk of losing important documents and help maintain organized records.

-

How secure is my data when using airSlate SignNow for my FARM INCOME & EXPENSE WORKSHEET?

airSlate SignNow prioritizes the security of your data, implementing advanced encryption and security protocols to protect your FARM INCOME & EXPENSE WORKSHEET. Your documents are stored securely in the cloud, ensuring that only authorized users have access. This commitment to security helps you manage your financial information with confidence.

Get more for FARM INCOME & EXPENSE WORKSHEET

- Blanket certificate of exemption lafayette parish school system form

- Notification of settlement section 112 form

- Foreign government information fgi briefing tri sac

- Form 40 idaho

- Network patient activity report qirn3 qirn3 form

- Global health checklist the partners center of expertise in partners form

- Vmp mortgage forms

- 30 day payment terms letter agreement template form

Find out other FARM INCOME & EXPENSE WORKSHEET

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document