Form Nr302 2010-2026

What is the Form Nr302

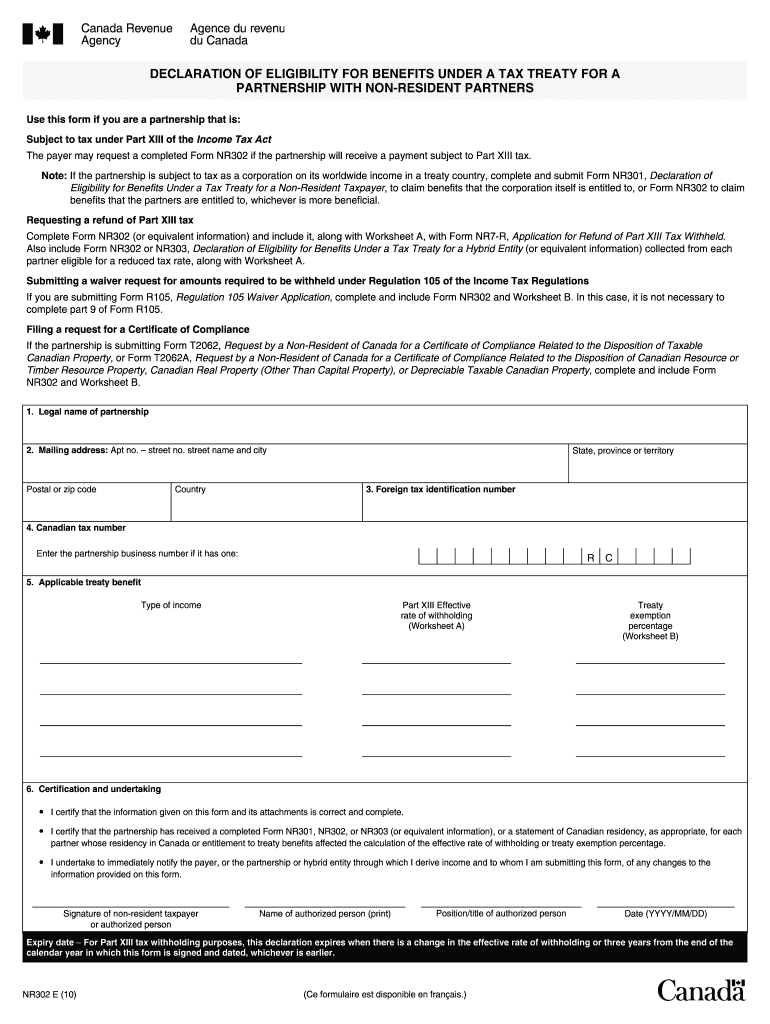

The Form Nr302 is a document used primarily in Canada for tax purposes. It serves as a declaration for certain types of income and is essential for individuals and businesses to report their earnings accurately. This form is particularly relevant for those who may have income sourced from outside Canada, ensuring compliance with both Canadian tax laws and any applicable international agreements.

How to use the Form Nr302

To effectively use the Form Nr302, individuals must first gather all necessary information regarding their income sources. This includes details about any foreign income, deductions, and credits applicable to their situation. Once the information is compiled, the form can be completed by entering the relevant details in the designated fields. It is crucial to review the completed form for accuracy before submission to avoid potential delays or issues with the tax authorities.

Steps to complete the Form Nr302

Completing the Form Nr302 involves several key steps:

- Gather all relevant financial documents, including income statements and receipts.

- Fill in personal information, such as your name, address, and Social Security number.

- Report all income sources, ensuring to include any foreign income.

- Calculate any applicable deductions and credits.

- Review the form for accuracy and completeness.

- Submit the form according to the guidelines provided by the tax authorities.

Legal use of the Form Nr302

The legal use of the Form Nr302 is governed by tax laws that require accurate reporting of income. Failing to submit this form correctly can lead to penalties or legal consequences. It is essential to ensure that all information provided is truthful and complete, as discrepancies may trigger audits or investigations by tax authorities. Utilizing a reliable electronic signature solution can further enhance the legitimacy of the submitted form.

Key elements of the Form Nr302

Key elements of the Form Nr302 include:

- Personal Information: This section requires the taxpayer's identifying details.

- Income Reporting: Accurate reporting of all income sources is critical.

- Deductions and Credits: Taxpayers can claim eligible deductions to reduce taxable income.

- Signature: A signature is required to validate the form, which can be completed electronically for convenience.

Form Submission Methods

The Form Nr302 can be submitted through various methods, including:

- Online Submission: Many tax authorities allow for electronic submission through secure portals.

- Mail: The form can be printed and sent via postal service to the appropriate tax office.

- In-Person: Taxpayers may also choose to deliver the form directly to their local tax office.

Quick guide on how to complete form nr302

Effortlessly prepare Form Nr302 on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed files, as you can directly access the right forms and securely save them online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Handle Form Nr302 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Form Nr302 with ease

- Find Form Nr302 and click on Get Form to begin.

- Make use of the available tools to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes merely seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Nr302 and ensure excellent communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form nr302

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nr302 feature in airSlate SignNow?

The nr302 feature in airSlate SignNow allows users to seamlessly prepare, send, and eSign documents electronically. This feature enhances workflow efficiency and ensures that all necessary parties can easily access and sign documents, streamlining your business processes.

-

How much does airSlate SignNow cost with the nr302 feature?

The cost of airSlate SignNow with the nr302 feature varies based on the chosen plan. Our pricing tiers are designed to accommodate businesses of all sizes, ensuring you get the most cost-effective solution for document management and eSigning.

-

What are the main benefits of using nr302 in airSlate SignNow?

The nr302 feature in airSlate SignNow offers several benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. By utilizing nr302, businesses can track document status and ensure compliance, ultimately saving time and resources.

-

Can I integrate nr302 with other applications?

Yes, airSlate SignNow's nr302 feature integrates seamlessly with various applications, enhancing your existing workflows. With numerous API options and popular application integrations, you can easily connect nr302 to your existing systems to streamline processes further.

-

Is the nr302 feature secure for sensitive documents?

Absolutely! The nr302 feature in airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage. This ensures that your sensitive documents are protected throughout the signing process, giving you peace of mind.

-

How can nr302 help my business save time?

Utilizing the nr302 feature in airSlate SignNow signNowly reduces the time spent on document handling. Automated reminders and streamlined signing processes allow your team to focus on more critical tasks, resulting in improved productivity and faster turnaround times.

-

What types of documents can I send using nr302?

With the nr302 feature in airSlate SignNow, you can send a variety of document types for eSigning, including contracts, NDAs, and more. This versatility means you can handle all your document needs within a single platform.

Get more for Form Nr302

- Po box 6010 cypress ca 90630 form

- Pce form 21708405

- Assignment extension request form

- California v scott peterson defense motion for new trial form

- Casa paloma green valley az form

- Grade forgiveness request form university of south florida

- Application for fall connorsstate form

- The title of washington state university extension master cru cahe wsu form

Find out other Form Nr302

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free