Church Exemption 2022

What is the Church Exemption

The Church Exemption refers to a legal provision that allows qualifying religious organizations to be exempt from certain taxes and regulations. This exemption is primarily focused on federal income tax, but it may also extend to state and local taxes, depending on jurisdiction. To qualify, a church or religious organization must meet specific criteria established by the Internal Revenue Service (IRS) and relevant state laws.

How to obtain the Church Exemption

To obtain the Church Exemption, a religious organization must apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This involves completing IRS Form 1023, which requires detailed information about the organization’s structure, purpose, and activities. Additionally, organizations must demonstrate that they operate exclusively for religious purposes and are not engaged in substantial non-religious activities.

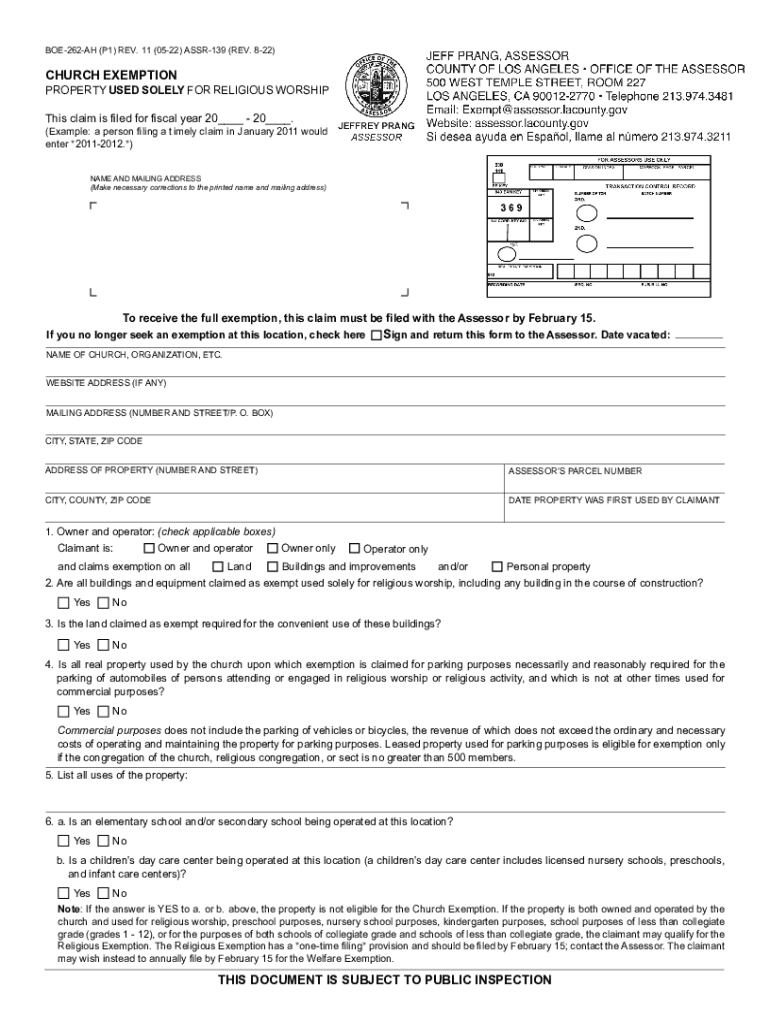

Steps to complete the Church Exemption

Completing the Church Exemption process involves several key steps:

- Gather necessary documentation, including articles of incorporation, bylaws, and financial statements.

- Complete IRS Form 1023 accurately, providing all required information about the organization.

- Submit the completed form along with the appropriate filing fee to the IRS.

- Respond promptly to any requests for additional information from the IRS during the review process.

Legal use of the Church Exemption

The legal use of the Church Exemption is governed by specific IRS guidelines. Organizations must ensure they adhere to the requirements for maintaining tax-exempt status, which includes not engaging in political campaigning or substantial lobbying activities. Additionally, churches must keep accurate records of their income and expenditures to support their tax-exempt status.

Eligibility Criteria

Eligibility for the Church Exemption requires that the organization be a church or a religious organization as defined by the IRS. Key criteria include:

- The organization must be organized and operated exclusively for religious purposes.

- It must have a recognized creed and form of worship.

- The organization must have a distinct religious history and a regular congregation.

Required Documents

When applying for the Church Exemption, certain documents are essential to support the application. These documents typically include:

- Articles of incorporation or a statement of organization.

- Bylaws outlining the governance of the organization.

- Financial statements, including budgets and income sources.

- Detailed descriptions of the organization’s religious activities.

Create this form in 5 minutes or less

Find and fill out the correct church exemption

Create this form in 5 minutes!

How to create an eSignature for the church exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Church Exemption and how does it apply to eSigning documents?

A Church Exemption refers to the legal status that allows religious organizations to operate without certain tax obligations. When using airSlate SignNow, churches can easily eSign documents while ensuring compliance with their exemption status, streamlining administrative processes.

-

How can airSlate SignNow help churches manage their Church Exemption documentation?

airSlate SignNow provides a user-friendly platform for churches to manage their Church Exemption documentation efficiently. With features like templates and secure storage, churches can ensure that all necessary documents are signed and stored in compliance with their exemption requirements.

-

What are the pricing options for airSlate SignNow for churches seeking a Church Exemption?

airSlate SignNow offers flexible pricing plans tailored for organizations, including churches. These plans are designed to be cost-effective, ensuring that churches can access essential eSigning features without exceeding their budget while maintaining their Church Exemption status.

-

What features does airSlate SignNow offer that benefit churches with Church Exemption?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features are particularly beneficial for churches managing Church Exemption documents, allowing for efficient workflows and compliance.

-

Can airSlate SignNow integrate with other tools used by churches for Church Exemption management?

Yes, airSlate SignNow offers integrations with various tools commonly used by churches, such as CRM systems and accounting software. This allows for seamless management of Church Exemption documents alongside other organizational processes.

-

How does airSlate SignNow ensure the security of documents related to Church Exemption?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and secure access controls to protect documents related to Church Exemption, ensuring that sensitive information remains confidential and compliant with legal standards.

-

Is there customer support available for churches using airSlate SignNow for Church Exemption?

Absolutely! airSlate SignNow provides dedicated customer support to assist churches with any questions or issues related to their Church Exemption documentation. Our support team is available to ensure that users can maximize the benefits of the platform.

Get more for Church Exemption

Find out other Church Exemption

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy