Schedule Se Form

What is the Schedule SE?

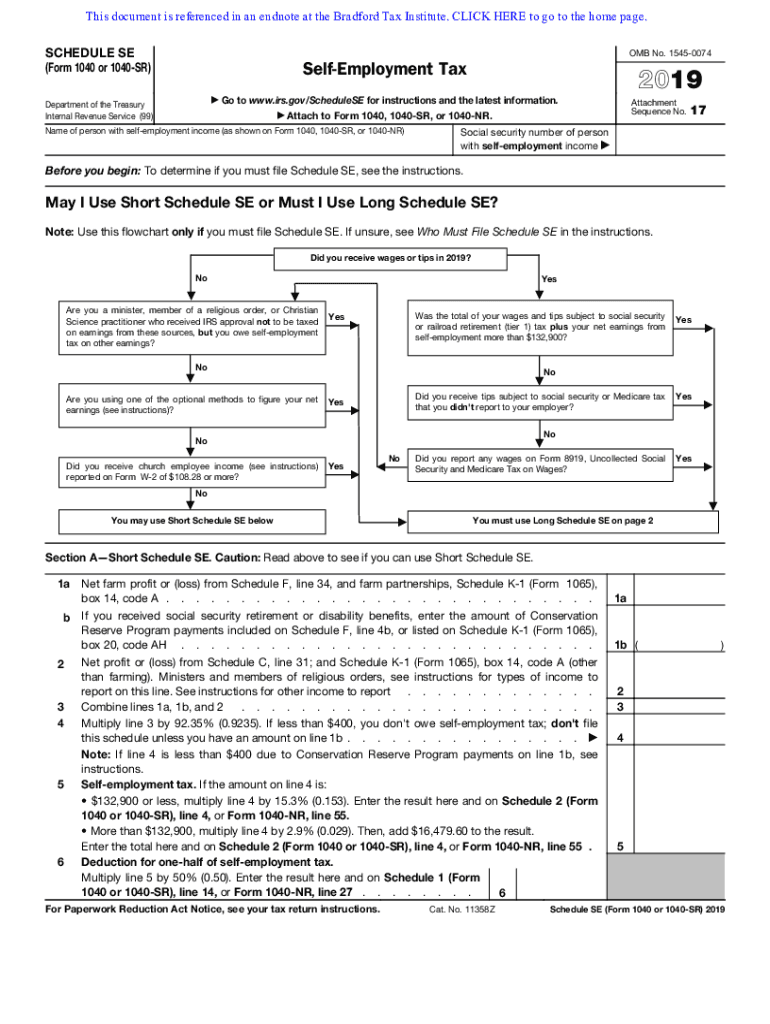

The Schedule SE is a tax form used by self-employed individuals to calculate their self-employment tax. This tax is essential for funding Social Security and Medicare. The form is typically filed alongside the IRS Form 1040. It is crucial for individuals who earn income from self-employment, including freelancers, independent contractors, and small business owners. Understanding the Schedule SE is vital for ensuring accurate tax reporting and compliance with IRS regulations.

Steps to complete the Schedule SE

Completing the Schedule SE involves several key steps:

- Gather your income information: Collect all relevant income documents, including 1099 forms and any records of business income.

- Determine your net earnings: Calculate your net earnings from self-employment by subtracting your business expenses from your total income.

- Fill out the form: Complete the Schedule SE by entering your net earnings and following the instructions provided on the form.

- Calculate your self-employment tax: Use the form to compute the amount of self-employment tax owed based on your net earnings.

- Transfer the tax amount: Finally, transfer the calculated self-employment tax amount to your Form 1040.

How to obtain the Schedule SE

The Schedule SE can be obtained directly from the IRS website. It is available as a downloadable PDF file, which can be printed and filled out manually. Additionally, tax preparation software often includes the Schedule SE as part of the filing process, allowing for easier completion and submission. It is important to ensure that you are using the correct version of the form for the applicable tax year.

Legal use of the Schedule SE

The Schedule SE is legally binding when completed accurately and submitted in accordance with IRS guidelines. It is essential to ensure that all reported income is legitimate and that the calculations are correct. Submitting a false or inaccurate Schedule SE can lead to penalties and interest on unpaid taxes. Using reliable eSignature solutions can help ensure that your completed forms are submitted securely and in compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE coincide with the due date for the Form 1040. Typically, this is April 15 of the following year. If you are unable to file by this date, you can request an extension, which usually extends the deadline by six months. However, it is important to note that any taxes owed must still be paid by the original due date to avoid penalties and interest.

Examples of using the Schedule SE

Common scenarios for using the Schedule SE include:

- Freelancers reporting income from various clients.

- Small business owners calculating taxes on profits from their business activities.

- Independent contractors who receive 1099 forms for their work.

In each case, the Schedule SE helps ensure that self-employment taxes are calculated and reported correctly, fulfilling legal responsibilities while supporting social programs.

Quick guide on how to complete schedule se 535579439

Effortlessly Prepare Schedule Se on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle Schedule Se on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and eSign Schedule Se with Ease

- Find Schedule Se and click on Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Adjust and eSign Schedule Se while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule se 535579439

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015 schedule se and how can it benefit my business?

The 2015 schedule se is a tax form used by self-employed individuals to report their earnings and calculate their self-employment tax. Using airSlate SignNow enables you to easily send, sign, and manage documents related to your 2015 schedule se efficiently. This streamlines your paperwork and ensures you meet important deadlines.

-

How does airSlate SignNow integrate with the 2015 schedule se process?

airSlate SignNow integrates seamlessly with your workflow for the 2015 schedule se by allowing you to send necessary documents for eSignature directly from the platform. You can automate document routing and reminders, ensuring you capture essential signatures without delays, thereby simplifying your tax process.

-

What features does airSlate SignNow offer for managing the 2015 schedule se?

AirSlate SignNow offers features like document templates, customizable workflows, and secure cloud storage specifically tailored for managing your 2015 schedule se documents. These features save you time and help maintain organization, giving you easy access when you need to file your taxes.

-

Is airSlate SignNow cost-effective for handling multiple 2015 schedule se submissions?

Yes, airSlate SignNow is a cost-effective solution for handling multiple 2015 schedule se submissions. With its competitive pricing, you can send and sign an unlimited number of documents without incurring additional costs, making it ideal for self-employed professionals and businesses.

-

Can I track the progress of my 2015 schedule se documents in airSlate SignNow?

Absolutely! airSlate SignNow provides robust tracking features that allow you to monitor the status of your 2015 schedule se documents in real-time. You can see when documents are viewed, signed, and finalized, offering transparency and peace of mind.

-

What benefits does eSigning offer for the 2015 schedule se?

eSigning with airSlate SignNow provides signNow benefits for your 2015 schedule se, such as faster turnaround times and enhanced document security. By utilizing digital signatures, you can expedite the signing process, ensuring timely submissions with reduced risk of loss or delays.

-

Are there any integrations with accounting software for 2015 schedule se submissions?

Yes, airSlate SignNow integrates with various accounting software that supports your 2015 schedule se submissions. This ensures that your documents and financial data sync seamlessly, allowing for efficient management of your tax filings and finances without the hassle of manual entries.

Get more for Schedule Se

- Fdoe ese complaint form

- Power of attorney poa idaho state tax commission idaho gov tax idaho form

- Authorization letter to claim toga form

- U s air force form af860a download

- To do list form

- Part 1 pre application questionnaire form

- List of grantee board of directors and officers dos ny form

- Educational expense reimbursement application and refund requisition form

Find out other Schedule Se

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word