Schedule M Other Additions and Subtractions for EFile Form

What is the Schedule M Other Additions And Subtractions For EFile

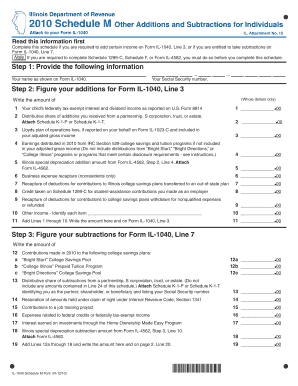

The Schedule M Other Additions and Subtractions for EFile is a tax form used by individuals and businesses in the United States to report specific additions and subtractions to their income. This form helps to adjust the federal adjusted gross income (AGI) for state tax purposes, ensuring that taxpayers accurately reflect their financial situation. It is particularly relevant for those who may have unique income sources or deductions that differ from standard reporting requirements.

Steps to complete the Schedule M Other Additions And Subtractions For EFile

Completing the Schedule M involves several key steps:

- Gather necessary financial documents, including W-2s, 1099s, and any other income statements.

- Identify the specific additions and subtractions applicable to your situation, such as tax-exempt interest or non-deductible IRA contributions.

- Fill out the form accurately, ensuring that each addition and subtraction is clearly documented.

- Review the completed form for accuracy and completeness before submission.

- Submit the Schedule M along with your state tax return, either electronically or by mail.

Key elements of the Schedule M Other Additions And Subtractions For EFile

Several key elements are essential when filling out the Schedule M:

- Additions: This section includes items that increase your taxable income, such as certain types of interest income and other specific adjustments.

- Subtractions: This part allows for deductions that decrease your taxable income, including contributions to retirement accounts and certain state tax refunds.

- Documentation: It is crucial to maintain records supporting each addition and subtraction, as these may be requested by tax authorities.

- Filing Requirements: Ensure that you meet all state-specific filing requirements, as these can vary significantly.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule M, which are essential for compliance. These guidelines outline the types of income and deductions that can be reported, as well as instructions for calculating totals. Familiarizing yourself with these guidelines can help ensure that you do not overlook any critical information that could affect your tax liability.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Schedule M. Generally, state tax returns, including the Schedule M, are due on April fifteenth of each year. However, if you require additional time, you may request an extension, which typically extends the deadline by six months. Be mindful of any state-specific deadlines that may differ from federal timelines.

Examples of using the Schedule M Other Additions And Subtractions For EFile

Examples of situations where the Schedule M may be used include:

- A taxpayer who received tax-exempt interest from municipal bonds would report this as an addition to their income.

- A self-employed individual who made contributions to a retirement plan may subtract these contributions from their taxable income.

- Individuals who received a state tax refund in the previous year may need to report this as an addition if they previously claimed a deduction for state taxes paid.

Quick guide on how to complete schedule m other additions and subtractions for efile

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M Other Additions And Subtractions For EFile

Create this form in 5 minutes!

How to create an eSignature for the schedule m other additions and subtractions for efile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule M Other Additions And Subtractions For EFile?

Schedule M Other Additions And Subtractions For EFile is a tax form used to report specific additions and subtractions to income for e-filing purposes. It helps taxpayers accurately calculate their taxable income by detailing various adjustments. Understanding this form is crucial for ensuring compliance and optimizing tax returns.

-

How can airSlate SignNow assist with Schedule M Other Additions And Subtractions For EFile?

airSlate SignNow provides a streamlined platform for managing and eSigning documents related to Schedule M Other Additions And Subtractions For EFile. Our solution simplifies the process of preparing and submitting necessary forms, ensuring that all adjustments are accurately documented. This efficiency can save time and reduce errors in your tax filings.

-

What are the pricing options for using airSlate SignNow for Schedule M Other Additions And Subtractions For EFile?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the preparation and eSigning of documents related to Schedule M Other Additions And Subtractions For EFile. You can choose a plan that fits your budget while ensuring you have the tools needed for efficient tax management.

-

Are there any integrations available for Schedule M Other Additions And Subtractions For EFile?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software to facilitate the handling of Schedule M Other Additions And Subtractions For EFile. These integrations allow for easy data transfer and document management, enhancing your overall workflow. This connectivity ensures that you can efficiently manage your tax documents without switching between multiple platforms.

-

What features does airSlate SignNow offer for managing Schedule M Other Additions And Subtractions For EFile?

airSlate SignNow includes features such as document templates, eSigning, and secure storage specifically designed for managing Schedule M Other Additions And Subtractions For EFile. These tools help streamline the preparation and submission process, making it easier to handle tax-related documents. Additionally, our user-friendly interface ensures that you can navigate the platform with ease.

-

How does airSlate SignNow ensure the security of documents related to Schedule M Other Additions And Subtractions For EFile?

Security is a top priority at airSlate SignNow. We implement advanced encryption and secure access protocols to protect documents related to Schedule M Other Additions And Subtractions For EFile. This ensures that your sensitive tax information remains confidential and secure throughout the eSigning process.

-

Can I access airSlate SignNow on mobile devices for Schedule M Other Additions And Subtractions For EFile?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage Schedule M Other Additions And Subtractions For EFile on the go. Our mobile-friendly platform ensures that you can prepare, eSign, and send documents from anywhere, making it convenient for busy professionals.

Get more for Schedule M Other Additions And Subtractions For EFile

- Npdes permit modification request section 301g form

- Form a2 to be completed by the reserve bank of india

- Birthdatechildsgendermalefemale form

- Hdfc bank deposit slip v we understand your worl form

- Instructions this log will be maintained for each refrigerator and zer both walk in and reach in units in form

- Anf 2a application form for issuemodification in

- Un police division electronic application for seconded police non contracted selection and recruitment of seconded unpol form

- As in any essay the first paragraph of your argumentative essay should contain a form

Find out other Schedule M Other Additions And Subtractions For EFile

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now