Form 8329

What is the Form 8329

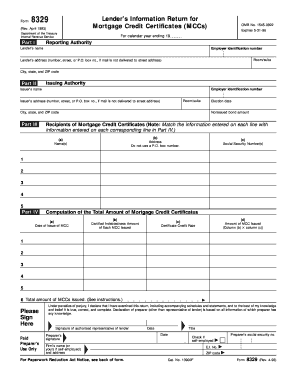

The IRS Form 8329 is a tax form used by individuals and businesses to report the sale of certain types of property, particularly those that qualify for special tax treatment. This form is crucial for taxpayers who need to disclose gains or losses from the sale of assets, such as real estate or investments. Understanding the purpose and requirements of Form 8329 is essential for accurate tax reporting and compliance with IRS regulations.

How to use the Form 8329

Using the IRS Form 8329 involves several steps to ensure proper completion. Taxpayers must gather relevant information about the property sold, including purchase price, sale price, and any associated costs. Once this information is compiled, it can be entered into the form accurately. It is important to follow the IRS guidelines closely to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Form 8329

Completing the IRS Form 8329 requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary documentation related to the property sale, including purchase and sale agreements.

- Fill out the personal information section, including your name, address, and taxpayer identification number.

- Detail the property sold, including description, date of acquisition, and date of sale.

- Calculate the gain or loss from the sale, ensuring to include any adjustments for improvements or depreciation.

- Review the completed form for accuracy before submission.

Legal use of the Form 8329

The legal use of IRS Form 8329 hinges on its compliance with federal tax laws. When filled out correctly, the form serves as a valid document for reporting taxable events related to property sales. It is essential to ensure that all information is truthful and complete to avoid potential legal issues or penalties from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 8329 are typically aligned with the annual tax return deadlines. Taxpayers should be aware of the specific date for submission, which usually falls on April 15 of the following year after the tax year ends. If additional time is needed, taxpayers may file for an extension, but it is crucial to check for any updates or changes to deadlines each tax year.

Required Documents

To successfully complete and file IRS Form 8329, several documents are required. These include:

- Purchase and sale agreements for the property.

- Records of any improvements made to the property.

- Documentation of any depreciation claimed on the property.

- Taxpayer identification numbers for all parties involved in the transaction.

Form Submission Methods

IRS Form 8329 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system, which is often the quickest method.

- Mailing a paper copy of the form to the appropriate IRS address, as indicated in the form instructions.

- In-person submission at designated IRS offices, which may be suitable for those needing assistance.

Quick guide on how to complete form 8329

Complete Form 8329 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8329 on any platform using airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

How to modify and electronically sign Form 8329 effortlessly

- Find Form 8329 and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your chosen device. Edit and electronically sign Form 8329 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8329

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8329 and why is it important?

IRS Form 8329 is used to report the Qualified Plug-in Electric Drive Motor Vehicle Credit. Understanding this form is essential for businesses claiming tax credits related to electric vehicles, helping them maximize their financial benefits and comply with tax regulations.

-

How can airSlate SignNow assist with IRS Form 8329?

AirSlate SignNow provides a streamlined process to send and eSign IRS Form 8329 efficiently. By using our platform, you can ensure timely submissions and maintain accurate records, making tax season less stressful and more organized.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8329?

AirSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for handling IRS Form 8329. Our plans include features such as unlimited eSignatures and document storage, ensuring you get value for your investment.

-

Can I integrate other tools with airSlate SignNow when handling IRS Form 8329?

Yes, airSlate SignNow integrates seamlessly with a variety of tools and software, enhancing your workflow for managing IRS Form 8329. This allows you to connect with CRMs, cloud storage solutions, and more, ensuring a comprehensive document management process.

-

What features does airSlate SignNow offer for managing IRS documents?

AirSlate SignNow offers features like secure eSigning, document tracking, and templates specifically designed for IRS Form 8329. These tools simplify the document management process while ensuring compliance and security for sensitive tax information.

-

Is airSlate SignNow secure for sending IRS Form 8329?

Absolutely! AirSlate SignNow employs advanced encryption and security protocols to protect the integrity and confidentiality of IRS Form 8329 and other documents. Your data is safe, allowing you to focus on your business without worrying about security bsignNowes.

-

Can airSlate SignNow help audit IRS Form 8329 submissions?

Yes, airSlate SignNow provides features that help you keep a detailed log of all actions taken on IRS Form 8329, which is essential for audits. Our platform tracks every signature and modification, ensuring you can present clear records during an audit process.

Get more for Form 8329

- Keeping a diary is the first step to taming the stress in your life form

- Umsl affidavit of support form

- Entertainment firearms permit form

- Dementia support services program consumer intake form alz

- Core tn gove form

- Interpreting expressions worksheet pdf form

- Form 5489 request for immediate 90 day interlock restricted dor mo

- Dos bcco art of incorpation for profit form

Find out other Form 8329

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy