AT1 Schedule 9 Alberta Treasury Board and Finance Finance Alberta 2012-2026

What is the AT1 Schedule 9 Alberta Treasury Board And Finance Finance Alberta

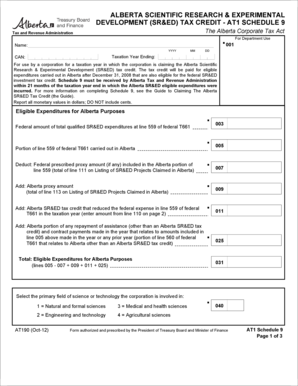

The AT1 Schedule 9 is a specific form issued by the Alberta Treasury Board and Finance. It is primarily used for tax reporting purposes in Alberta, Canada. This form helps individuals and businesses disclose information related to their financial activities, ensuring compliance with provincial tax regulations. It is essential for accurate record-keeping and fulfilling legal obligations regarding taxation.

How to use the AT1 Schedule 9 Alberta Treasury Board And Finance Finance Alberta

Using the AT1 Schedule 9 involves several steps. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors or omissions. Finally, submit the AT1 Schedule 9 to the appropriate tax authority, either online or via mail, depending on your preference and the specific instructions provided by the Alberta Treasury Board and Finance.

Steps to complete the AT1 Schedule 9 Alberta Treasury Board And Finance Finance Alberta

Completing the AT1 Schedule 9 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Obtain the latest version of the AT1 Schedule 9 form.

- Fill in your personal and business information as required.

- Provide detailed financial information, including income and deductions.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

- Submit the form according to the specified submission methods.

Key elements of the AT1 Schedule 9 Alberta Treasury Board And Finance Finance Alberta

The AT1 Schedule 9 contains several key elements that are crucial for proper completion. These include:

- Personal Information: Name, address, and contact details of the taxpayer.

- Financial Data: Comprehensive details regarding income sources and amounts.

- Deductions: A list of eligible deductions that can reduce taxable income.

- Signature: A declaration that the information provided is accurate and complete.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the AT1 Schedule 9. Typically, the deadline for submission aligns with provincial tax deadlines, which may vary based on the taxpayer's situation. Ensure that you check the current year's specific dates to avoid any penalties for late submission. Mark these dates on your calendar to stay organized and compliant.

Required Documents

When preparing to complete the AT1 Schedule 9, certain documents are essential. These may include:

- Income statements from all sources.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any correspondence from the Alberta Treasury Board and Finance regarding tax matters.

Create this form in 5 minutes or less

Find and fill out the correct at1 schedule 9 alberta treasury board and finance finance alberta

Create this form in 5 minutes!

How to create an eSignature for the at1 schedule 9 alberta treasury board and finance finance alberta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is AT1 Schedule 9 and how does it relate to Alberta Treasury Board and Finance?

AT1 Schedule 9 is a financial document required by the Alberta Treasury Board and Finance that outlines specific financial reporting requirements. It is essential for businesses operating in Alberta to comply with these regulations to ensure transparency and accountability in their financial practices.

-

How can airSlate SignNow help with AT1 Schedule 9 submissions?

airSlate SignNow provides a streamlined platform for businesses to prepare, send, and eSign AT1 Schedule 9 documents efficiently. With its user-friendly interface, companies can ensure that their submissions to the Alberta Treasury Board and Finance are accurate and timely.

-

What are the pricing options for using airSlate SignNow for AT1 Schedule 9?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By choosing the right plan, organizations can access features specifically designed to facilitate the completion and submission of AT1 Schedule 9 documents to the Alberta Treasury Board and Finance.

-

What features does airSlate SignNow offer for managing AT1 Schedule 9 documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing AT1 Schedule 9 documents. These tools help ensure that all necessary information is included and that the documents are signed and submitted correctly.

-

What are the benefits of using airSlate SignNow for AT1 Schedule 9 compliance?

Using airSlate SignNow for AT1 Schedule 9 compliance offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can save time and resources while ensuring compliance with the Alberta Treasury Board and Finance requirements.

-

Can airSlate SignNow integrate with other software for AT1 Schedule 9 processing?

Yes, airSlate SignNow can integrate with various software solutions, making it easier to manage AT1 Schedule 9 processing. This integration capability allows businesses to streamline their workflows and ensure that all relevant data is captured and utilized effectively.

-

Is airSlate SignNow secure for handling AT1 Schedule 9 documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all AT1 Schedule 9 documents are handled with the utmost care. The platform employs advanced encryption and security measures to protect sensitive financial information required by the Alberta Treasury Board and Finance.

Get more for AT1 Schedule 9 Alberta Treasury Board And Finance Finance Alberta

Find out other AT1 Schedule 9 Alberta Treasury Board And Finance Finance Alberta

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself