Iafba Form

What is the IAFBA?

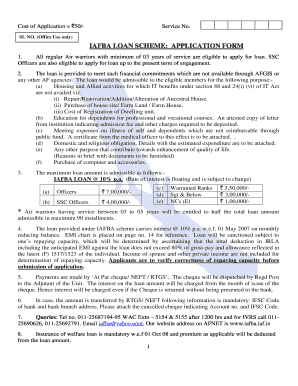

The IAFBA, or Indian Air Force Benevolent Association, is an organization dedicated to providing welfare and financial assistance to its members and their families. It aims to support personnel in the Indian Air Force through various programs, including the IAFBA loan, which offers financial aid for various needs. This assistance can be critical for members seeking to manage personal expenses, education, or emergencies.

How to Obtain the IAFBA Loan

To obtain the IAFBA loan, members must follow a structured application process. This typically involves filling out the IAFBA loan form, which requires personal and financial information. Applicants should ensure they meet the eligibility criteria, which may include being an active or retired member of the Indian Air Force. Once the form is completed, it can be submitted online or through designated channels, depending on the specific guidelines set by the IAFBA.

Steps to Complete the IAFBA Loan Application

Completing the IAFBA loan application involves several key steps:

- Gather Required Documents: Collect necessary documentation, such as identification, proof of income, and any other relevant financial information.

- Fill Out the Loan Form: Accurately complete the IAFBA loan form, ensuring all information is correct and up to date.

- Submit the Application: Submit the completed form through the appropriate method, either online or by mail.

- Await Approval: After submission, applicants should monitor their loan status and be prepared to provide additional information if requested.

Legal Use of the IAFBA Loan

The IAFBA loan is governed by specific legal requirements to ensure compliance and protection for both the lender and the borrower. It is essential for members to understand the terms and conditions associated with the loan, including repayment obligations and interest rates. Utilizing a reliable platform, like SignNow, can help ensure that all documentation is legally binding and compliant with applicable laws.

Eligibility Criteria for the IAFBA Loan

Eligibility for the IAFBA loan typically includes the following criteria:

- Must be an active or retired member of the Indian Air Force.

- Must have a valid identification and proof of service.

- Must demonstrate a need for financial assistance, supported by relevant documentation.

Meeting these criteria is crucial for a successful application and to ensure that members receive the support they need.

Form Submission Methods

Members can submit the IAFBA loan form through various methods, depending on the guidelines provided by the association. Common submission methods include:

- Online Submission: Many members prefer to complete and submit their applications electronically for convenience.

- Mail Submission: For those who prefer traditional methods, submitting the form via postal mail is also an option.

- In-Person Submission: Some members may choose to submit their applications in person at designated IAFBA offices.

Each method has its own advantages, and members should choose the one that best suits their needs.

Quick guide on how to complete iafba

Effortlessly prepare Iafba on any device

Online document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Iafba on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Iafba with ease

- Locate Iafba and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that need new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Iafba and ensure smooth communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iafba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IAFBA loan and how does it work?

An IAFBA loan is a financing option designed for members of the International Association of Federal Business Association. It offers flexible terms and competitive rates, helping individuals and businesses access the capital they need. By leveraging the IAFBA's resources, applicants can streamline the loan process and potentially secure funding faster.

-

What are the benefits of choosing an IAFBA loan?

Choosing an IAFBA loan provides numerous benefits, including lower interest rates and flexible repayment options. Members can also access exclusive resources and support that can aid in the overall loan experience. Additionally, these loans are tailored to meet the unique needs of business professionals, making it easier to manage finances.

-

Are there any fees associated with applying for an IAFBA loan?

While applying for an IAFBA loan typically doesn't incur application fees, there may be associated costs such as closing fees or origination fees depending on the lender. It’s essential to review all potential costs upfront to avoid surprises. Make sure to clarify any fees with your chosen lender during the application process.

-

How long does it take to get approved for an IAFBA loan?

The approval time for an IAFBA loan can vary based on the lender and the specific loan amount requested. Generally, applicants can expect a decision within a few days to a couple of weeks. Providing complete documentation and a clear financial history can help expedite the approval process.

-

Can I use an IAFBA loan for business expansion?

Yes, an IAFBA loan can be used for various business purposes, including expansion, purchasing equipment, or increasing working capital. This flexibility allows business owners to invest in their growth strategically. When applying, it's beneficial to articulate how the loan will be used to enhance your business's future.

-

What documents do I need to apply for an IAFBA loan?

To apply for an IAFBA loan, you typically need to provide financial statements, business plans, and proof of income. Additional documentation may be required depending on the loan amount and purpose. It's crucial to gather all relevant materials early to streamline your application process.

-

Does an IAFBA loan require collateral?

Whether an IAFBA loan requires collateral largely depends on the lender and the size of the loan you are requesting. Some lenders may offer unsecured loans, while others might require collateral to mitigate risk. Always check the specifics with your lender when exploring your options.

Get more for Iafba

Find out other Iafba

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template