Irs W 9 Form

What is the IRS W-9 Form

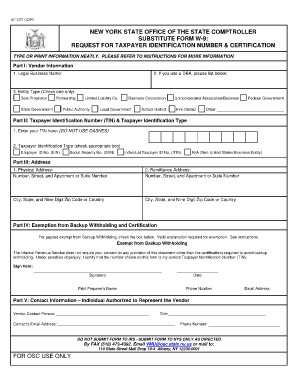

The IRS W-9 form is a tax document used in the United States by individuals and businesses to provide their taxpayer identification information. This form is primarily utilized by freelancers, contractors, and vendors who need to report income received from clients. The W-9 form collects essential details, including the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be a Social Security number (SSN) or Employer Identification Number (EIN).

How to Use the IRS W-9 Form

Using the IRS W-9 form is straightforward. Individuals or businesses complete the form to provide their information to clients or organizations that will pay them. Once filled out, the form should be submitted to the requester, not to the IRS. The requester uses the information to prepare tax documents such as the 1099 form at the end of the tax year. It is important to ensure that the information provided is accurate to avoid any tax issues.

Steps to Complete the IRS W-9 Form

Completing the IRS W-9 form involves several key steps:

- Download the Form: Obtain the latest version of the W-9 form from the IRS website or a trusted source.

- Fill in Your Information: Enter your name, business name (if applicable), and address in the designated fields.

- Provide Your TIN: Include your Social Security number or Employer Identification Number in the appropriate section.

- Sign and Date: Sign the form to certify that the information provided is correct and date it accordingly.

- Submit the Form: Send the completed W-9 to the requester, ensuring it is not sent to the IRS.

Legal Use of the IRS W-9 Form

The IRS W-9 form is legally binding once signed, meaning that the information provided must be accurate. Misrepresentation or failure to provide the correct TIN can lead to penalties, including backup withholding on payments. It is essential to use the form in compliance with IRS guidelines to ensure that all tax obligations are met. The form serves as a declaration of your tax status, and any discrepancies can result in legal consequences.

Key Elements of the IRS W-9 Form

Several key elements are essential when filling out the IRS W-9 form:

- Name: The legal name of the individual or business.

- Business Name: If applicable, the trade name or DBA (doing business as).

- Address: The complete mailing address where you can be reached.

- TIN: Your Social Security number or Employer Identification Number.

- Certification: A signature certifying the accuracy of the information provided.

Form Submission Methods

The IRS W-9 form can be submitted in various ways, depending on the requester's preferences:

- Online Submission: Some organizations may allow electronic submission of the W-9 form through secure portals.

- Email: The completed form can be sent via email as a PDF attachment, ensuring it is sent securely.

- Mail: You can print and mail the form to the requester, ensuring it reaches them in a timely manner.

- In-Person: If required, the form can be delivered in person to the requesting party.

Quick guide on how to complete irs w 9 form

Complete Irs W 9 Form effortlessly on any device

Web-based document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without unnecessary waits. Manage Irs W 9 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Irs W 9 Form without any hassle

- Obtain Irs W 9 Form and click Get Form to begin.

- Make use of the features we offer to complete your form.

- Emphasize important sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tiring form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Irs W 9 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs w 9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are W 9 forms and why are they important?

W 9 forms are tax documents used in the United States by individuals and businesses to provide their Taxpayer Identification Number (TIN) to another party. This information is essential for reporting income to the IRS and ensuring correct tax withholding. Using airSlate SignNow makes it easy to complete and eSign W 9 forms securely.

-

How can airSlate SignNow help with W 9 forms?

airSlate SignNow offers a simple way to create, send, and eSign W 9 forms electronically. With our user-friendly interface, you can manage multiple forms effortlessly, reducing the hassle of paperwork. Our platform ensures compliance and allows for easy storage of completed W 9 forms in one secure location.

-

What is the pricing structure for using airSlate SignNow for W 9 forms?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes. Whether you need a basic plan for occasional use of W 9 forms or an advanced plan for frequent transactions, we have options tailored to your needs. Check our website for detailed pricing information and choose a plan that works for you.

-

Is airSlate SignNow secure for handling W 9 forms?

Yes, airSlate SignNow prioritizes security and compliance when handling W 9 forms. Our platform employs advanced encryption technology to protect your data, ensuring that sensitive information remains confidential. You can trust us to securely manage your W 9 forms and other important documents.

-

Can I track the status of W 9 forms sent through airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of W 9 forms in real-time. You will receive notifications when the form is viewed, signed, or completed, giving you peace of mind and streamlining your workflow.

-

Does airSlate SignNow integrate with other tools for W 9 forms?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools and software, enhancing your workflow when managing W 9 forms. This includes popular platforms like Google Drive, Salesforce, and Microsoft Teams. Our integrations help you maintain efficiency across various applications.

-

What features does airSlate SignNow offer for managing W 9 forms?

airSlate SignNow includes features such as customizable templates, electronic signatures, and automated workflows, all designed for efficient W 9 forms management. You can easily upload existing forms or create them from scratch, simplify your signing process, and ensure a smooth experience for everyone involved.

Get more for Irs W 9 Form

- Direct debit mandate pdf form

- Swimming rubrics form

- Mv 5211 form

- Usborne books educational development corporation form

- Cally conform to the language adopted by pollard ampamp sag 1987 which is inspired by situation

- Advances and challenges at the national hurricane center form

- Medgivande att migrationsverket fr utfrda frmlingspass fr barn under 18 r form

- Sale for car agreement template form

Find out other Irs W 9 Form

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT